Crypto Google search volume has fallen to its lowest levels of the year as 2025 approaches its end, both globally and in the United States. Online search behavior suggests that retail investors have largely stepped away from the crypto market after strong interest earlier in the year. The fading digital attention highlights how confidence in the market has yet to recover.

Global Search Data Signals Weakening Interest

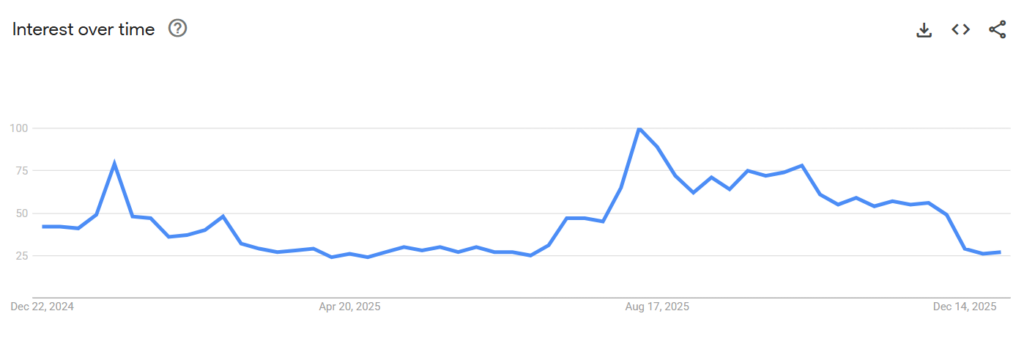

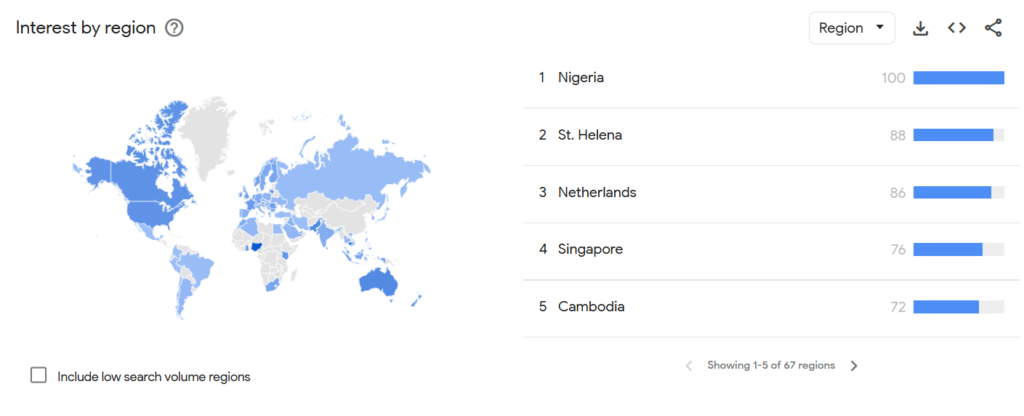

According to Google Trends data, global search interest for the term “crypto” is currently hovering around the 26 level. This reading sits just above the lowest point recorded over the past twelve months. On a scale where 100 represents peak interest, the current level indicates historically subdued public attention toward crypto assets.

Notably, this decline did not occur overnight. Search activity dropped sharply following the market turbulence in April and has struggled to regain momentum since then. Reduced global risk appetite and ongoing macroeconomic uncertainty continue to weigh on investor curiosity toward digital assets.

US Search Trends Confirm Retail Pullback

Search behavior in the United States mirrors the global picture. Google search volume for “crypto” has slipped to 26, marking a one-year low. This trend reinforces the view that retail investors have distanced themselves from the market.

Market commentator Mario Nawfal notes that retail engagement has almost disappeared. He points to recent memecoin collapses as a key factor behind the erosion of trust. Tokens associated with the Trump family have lost more than 90% of their value from peak levels, dealing a heavy blow to individual investor confidence. As a result, crypto has largely vanished from everyday conversations and casual market interest.

Google New Move in Crypto! Investment in Bitcoin Mining

Why It Matters: Search Volume Reflects Behavioral Breakdown

Low crypto Google search volume offers a critical behavioral signal independent of price movements. Search data suggests that investors remain hesitant to re-engage with the market. This reluctance can be traced back to the major sell-off that unfolded in October.

During that period, nearly $20 billion worth of leveraged positions were liquidated. Several altcoins experienced near-total losses within a single day. Bitcoin dropped from an all-time high above $125,000 to around $80,000 and has since traded in a tight $80,000–$90,000 range.

The psychological impact of that crash remains visible. The Crypto Fear and Greed Index fell to a yearly low of 10 in November, signaling extreme fear among investors. While the index has since recovered modestly to around 28, sentiment remains firmly in fear territory.

Persistently weak search activity suggests that fresh retail participation may arrive slowly. Even if prices stabilize or rebound, broader engagement could lag, limiting the strength of any near-term recovery.

Digital attention remains a leading indicator of retail confidence, and current search trends suggest that trust is rebuilding far more slowly than prices.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.