As the blockchain and digital asset ecosystem matures, structures that go beyond platforms merely offering buying and selling services, placing regulatory compliance at the center and developing institutional solutions, have begun to stand out. HashKey (HSK) positions itself as one of the strongest Asia-based representatives of this transformation. With its broad service range, licensed operations, and long-term vision for Web3 infrastructure, HashKey offers not just a crypto platform but an integrated digital asset finance ecosystem.

At the center of this ecosystem is HashKey’s platform token, HSK.

What Does HashKey (HSK) Aim For?

HashKey is a comprehensive digital asset platform providing blockchain and cryptocurrency-focused financial services. Its areas of activity are not limited to crypto trading alone. HashKey operates in many fields, including licensed crypto exchange operations, asset management, brokerage services, over-the-counter (OTC) trading, institutional client solutions, venture capital investments, cloud-based Web3 infrastructure, and asset tokenization.

The platform aims to deliver all these services within a high regulatory compliance framework. Security and transparency are priority issues in critical processes such as the storage, management, and transfer of digital assets. HashKey also develops infrastructure products and blockchain solutions that contribute to the development of the Web3 ecosystem.

A Strong Asia-Centered Global Structure

HashKey Group is a digital asset company operating Asia-centered since 2018 and expanding globally. The group conducts its operations in key financial centers such as Hong Kong, Singapore, Japan, and Bermuda, with the goal of creating a regulatory-compliant Web3 ecosystem.

Under the HashKey Group umbrella, there are multiple structures focused on different areas of expertise:

- HashKey Exchange: Stands out as one of the largest licensed virtual asset exchanges in Hong Kong.

- HashKey Global: The main digital asset exchange targeting global users.

- HashKey Capital: A global asset manager investing solely in blockchain technologies and digital assets.

- HashKey OTC: Offers regulatory-compliant over-the-counter (OTC) trading services.

- HashKey Cloud: A technology unit providing global-scale Web3 infrastructure solutions.

- HashKey Tokenisation: Provides consulting and implementation services for the tokenization of real-world assets.

Thanks to this structure, HashKey has become one of the rare platforms capable of offering end-to-end digital asset solutions to individual and institutional investors.

HashKey’s On-Chain Ecosystem and HashKey Chain

HashKey Group has developed a strong on-chain ecosystem, not limiting itself to centralized platforms. In this context, HashKey Chain, built on Ethereum, draws attention as a Layer-2 solution.

HashKey Chain is developed with targets of scalability, low transaction costs, and high transaction efficiency. It also provides an infrastructure that allows regulatory-compliant applications to run on-chain. The native platform token of this chain is HSK.

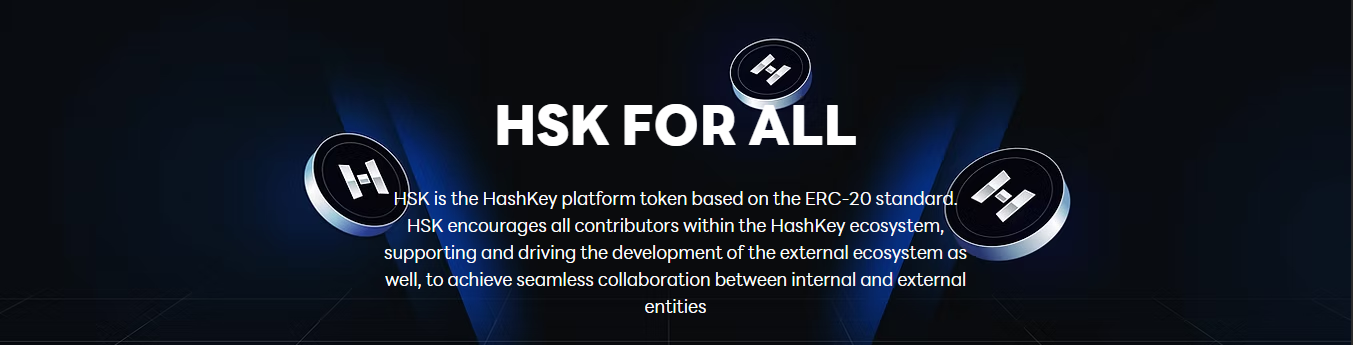

What is HashKey (HSK) Token?

HSK is the platform token of the HashKey ecosystem and is built on the ERC-20 standard. The primary purpose of HSK is to bring all stakeholders within the HashKey ecosystem together under a common incentive mechanism and support the sustainable growth of the ecosystem.

HSK is designed not only for use within the HashKey platform but also to support integration with external ecosystems. In this aspect, HSK serves as a bridge enabling value circulation between internal and external stakeholders.

Use Cases and Benefits of HSK

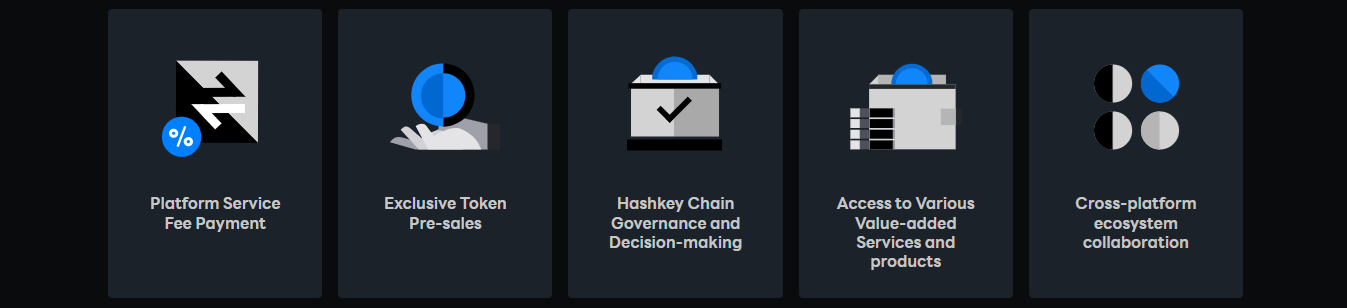

HSK plays a multifaceted role within the HashKey ecosystem. The main use cases of the token can be summarized as follows:

Payment of Platform Service Fees

HSK can be used to pay fees for various services offered on the HashKey platform. This mechanism aims to create continuous demand for the token.

Access to Exclusive Token Pre-Sales

HSK holders can gain participation rights in exclusive token pre-sales offered within the HashKey ecosystem.

HashKey Chain Governance

HSK plays an active role in decisions and governance processes on HashKey Chain. Token holders can participate in decision-making mechanisms regarding the chain’s future.

Access to Value-Added Products and Services

Various additional products and services offered by HashKey can be provided to HSK holders with exclusive advantages.

Cross-Platform Ecosystem Collaboration

HSK offers a structure that supports integration and collaboration between the HashKey ecosystem and other Web3 projects.

HashKey (HSK) Ecosystem and Partnerships

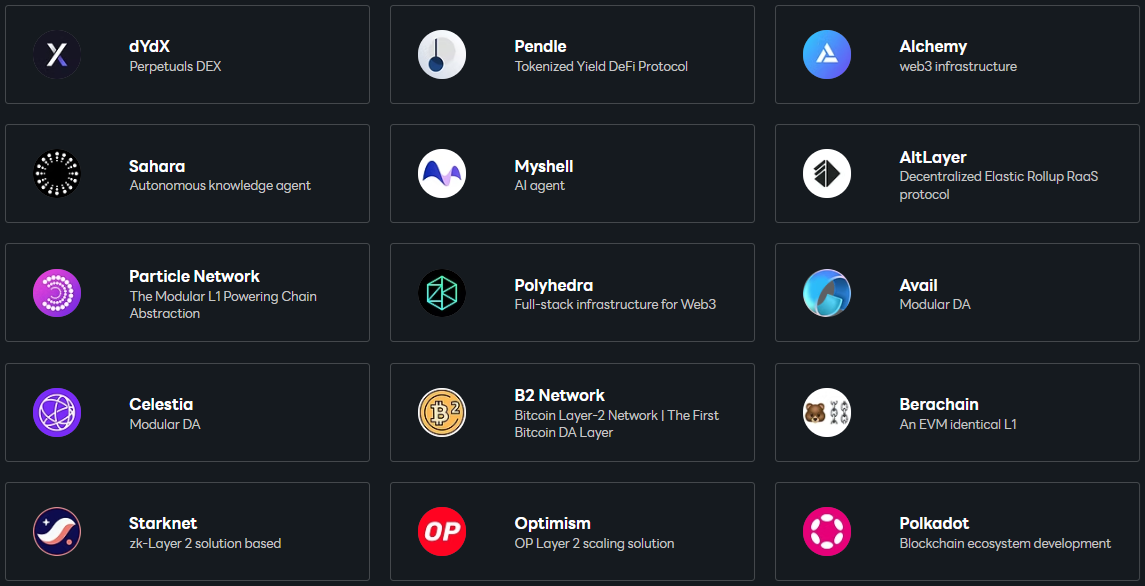

HashKey interacts with many different protocols and infrastructure projects within the broad Web3 ecosystem. Some notable projects in the ecosystem include:

- dYdX (Perpetuals DEX)

- Pendle (Tokenized yield DeFi protocol)

- Alchemy (Web3 infrastructure solutions)

- Sahara (Autonomous information agent)

- Myshell (AI agent)

- AltLayer (Decentralized Rollup RaaS protocol)

- Particle Network (Modular Layer-1)

- Polyhedra (Web3 infrastructure solutions)

- Avail and Celestia (Modular data availability layers)

- B2 Network (Bitcoin Layer-2)

- Berachain (EVM-compatible Layer-1)

- Starknet and Optimism (Layer-2 scaling solutions)

- Polkadot (Blockchain ecosystem)

This broad network demonstrates that HashKey is not just a centralized platform but also an active player in the multi-chain Web3 world.

HashKey (HSK) Tokenomics

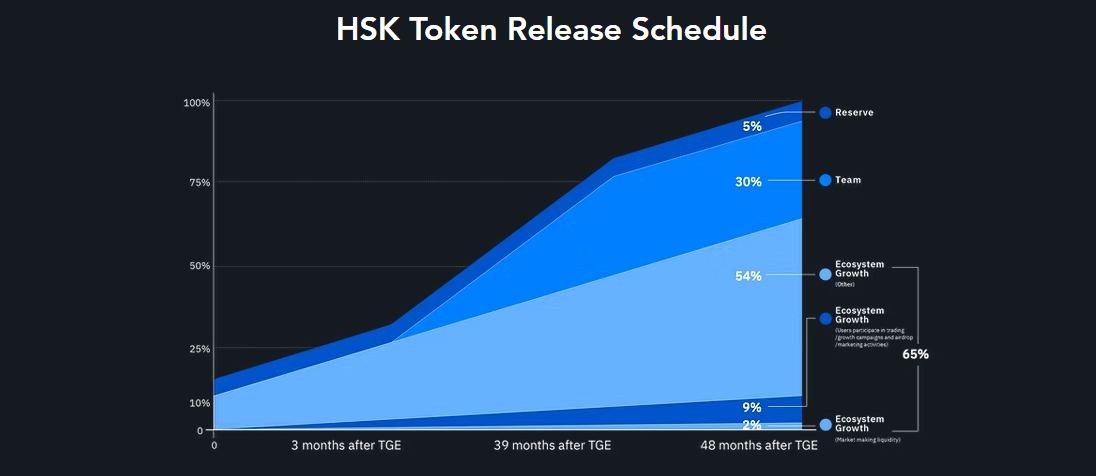

The total supply of the HSK token is capped at 1,000,000,000 tokens.

Supply Distribution

- Ecosystem Growth: 650 million HSK (65%) Released amount: 245 million HSK

- Team: 300 million HSK (30%) Released amount: 83.31 million HSK

- Reserve: 50 million HSK (5%) Not yet released

The absence of more than 5% concentration on a wallet basis indicates a balanced distribution target.

Vesting:

HSK Buyback and Burn Mechanism

HashKey Group has also defined a deflationary mechanism for HSK. Accordingly, 20% of the group’s total quarterly profits will be used for HSK buybacks. Burning the repurchased tokens aims to reduce supply in the long term and support the token economy.

HashKey (HSK) Team

The management team of HashKey Group consists of experienced names in finance, technology, and regulation:

- Xiao Feng – CEO and Chairman

- Eric Zhu – CFO

- Devin Zhang – CTO

- Rain Long – CAO & CHRO

This team structure demonstrates that HashKey has a strong foundation in both technical infrastructure and corporate governance.

Official Links

You can present your own thoughts as comments about the topic. Moreover, you can follow us on Telegram and YouTube channels for this kind of news.