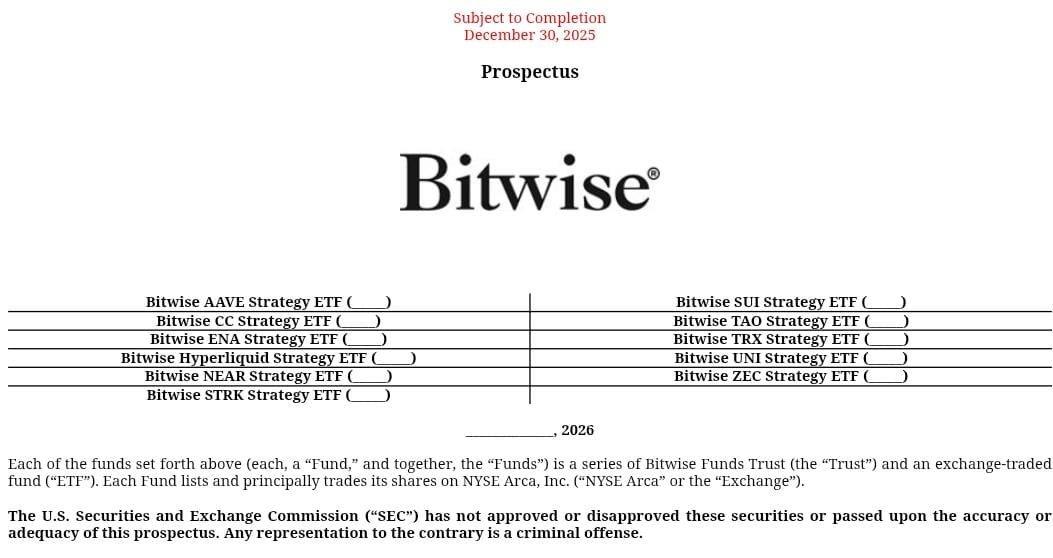

As institutional interest in digital assets continues to expand, asset management firm Bitwise has taken a notable step that could reshape the altcoin investment landscape. The company has officially submitted spot ETFs applications for 11 different altcoins, signaling a broader institutional focus beyond Bitcoin and Ethereum. This move is widely seen as another milestone in the ongoing convergence of crypto markets and traditional finance.

Which Altcoins Are Included?

The list of assets covered in Bitwise’s ETF filings reflects a diverse cross-section of the crypto ecosystem. Rather than concentrating on a single narrative, the selection spans decentralized finance, Layer-1 infrastructure, privacy-focused networks, and emerging blockchain technologies.

The altcoins included in the applications are:

-

Aave (AAVE)

-

Uniswap (UNI)

-

Zcash (ZEC)

-

Canton (CC)

-

Ethena (ENA)

-

Hyperliquid (HYPE)

-

Near (NEAR)

-

Starknet (STRK)

-

Sui (SUI)

-

Bittensor (TAO)

-

Tron (TRX)

This broad asset mix highlights Bitwise’s intention to capture multiple growth segments within the digital asset market rather than betting on a single category.

Why Spot Altcoin ETFs Matter

Spot ETFs allow investors to gain exposure to crypto assets through regulated financial products without the need to directly hold or custody tokens. For institutional investors, family offices, and traditional funds, this structure reduces operational complexity while aligning with existing compliance frameworks.

By extending ETF applications to altcoins, Bitwise is effectively acknowledging that institutional demand is evolving. The market is no longer limited to flagship assets, and alternative blockchain networks are increasingly viewed as investable instruments within a diversified portfolio.

Potential Market Impact

If approved, these ETFs could contribute to increased liquidity and broader market participation for the underlying assets. Easier access through traditional investment channels may also support more efficient price discovery over time.

In addition, Bitwise’s initiative could encourage other asset managers to pursue similar products, accelerating competition and innovation in crypto-based financial instruments.

A New Phase of Institutional Adoption

This development points to a new stage in institutional crypto adoption—one where altcoins are no longer peripheral but actively considered within structured investment products. As ETF offerings expand and diversify, digital assets may continue to solidify their position within global financial markets.

While regulatory outcomes remain uncertain, Bitwise’s move is a clear signal that the long-term potential of the altcoin market is gaining serious institutional recognition.

This content does not constitute investment advice. Cryptocurrency markets involve significant risk, and investors should conduct their own research before making any financial decisions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.