Energy markets are undergoing a fundamental transformation due to increasing global demand, infrastructure inadequacies, and price fluctuations. The proliferation of distributed energy resources (DERs) such as electric vehicles, home batteries, and solar energy systems is making existing grid structures necessitate much more flexible and intelligent operations. Energy Dollar (ENERGY) and the Energy Network centered around it aim to provide a blockchain-based, incentive-driven, and decentralized solution to this transformation.

What is Energy Network?

Energy Network positions itself as a global energy network that unites homes and distributed energy devices under a single coordination layer. Electric vehicle charging units, home batteries, solar panels, and similar devices form the building blocks of this network. The core goal of the network is to balance demand during peak energy consumption periods, thereby reducing pressure on the grid and ensuring stability in energy prices.

In this system, users become active participants by shifting their energy consumption outside peak hours or connecting their DERs to the network. In return for these contributions, they are rewarded with the network’s native utility token, Energy Dollar (ENERGY).

What is Energy Dollar (ENERGY) Used For?

Energy Dollar is designed as a utility token forming the economic backbone of the Energy Network. The main use cases of the ENERGY token can be summarized as follows:

- Rewarding users who contribute to the network

- Incentivizing energy flexibility and grid balancing activities

- Unlocking discounts on products and services within the Fuse ecosystem

- Long-term use as a global energy utility token

Users can burn their earned ENERGY tokens to obtain discounts on items such as electric vehicle charging units, battery installations, solar energy systems, and in later stages, energy bills.

Relationship Between Fuse and Energy Network

The operational power behind Energy Network is provided by Fuse. Fuse operates as a licensed electricity supplier, producer, trader, and installer of distributed energy systems. One of the most notable aspects of the Network is that it is built on an infrastructure with real-world correspondence from day one, rather than being a theoretical structure.

The Fuse team consists entirely of technical experts from leading global institutions in technology and engineering, such as Revolut, SpaceX, Citadel, Jump Trading, CERN, and Tesla. This demonstrates that Energy Network is not just a crypto project but a structure directly integrated into the energy sector.

Distributed Energy Resources and Device-Agnostic Structure

Energy Network is designed with a device-agnostic architecture. This means users are not tied to a specific brand or technology. Anyone living in supported regions can start earning ENERGY by connecting their DERs to the network or manually adjusting their energy consumption behavior.

This approach significantly increases the network’s scalability by enabling the inclusion of millions of already installed energy devices.

Core Principles of Energy Network

- Abundance The network’s core philosophy is that energy abundance is possible with cheap and reliable supply. Shifting energy usage outside peak hours increases market efficiency while lowering prices. At the same time, DERs serve as an asset pool that grid operators can activate on demand.

- Merit Energy Dollar rewards are distributed not randomly but based on real value created. Since energy varies by time and location, flexibility provided in high-priced and volatile regions is met with higher rewards. This ensures contributions are incentivized at the right points according to market needs.

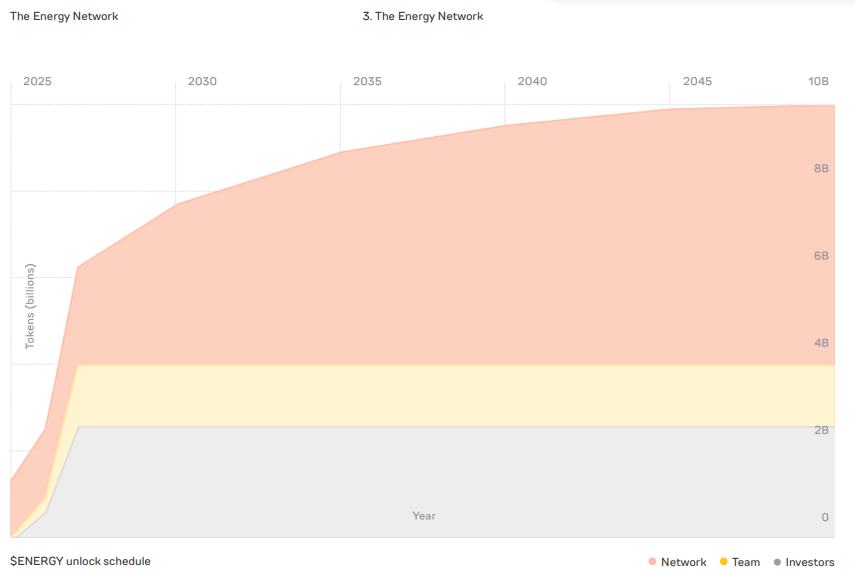

- Urgency ENERGY rewards follow a decreasing, disinflationary distribution model over time. This structure strongly incentivizes early participants while helping the network overcome the cold start problem. Users contributing to grid security in the early period earn disproportionately higher rewards.

Energy Dollar Life Cycle

The cycle of Energy Dollar within the network has a clear structure:

- Users connect their DERs to the network or optimize their consumption

- The Network utilizes these contributions in energy and flexibility markets

- ENERGY rewards are distributed according to the defined schedule

- Users burn tokens to obtain discounts and advantages

This cycle creates a deflationary structure that reduces supply over time and keeps value within the network.

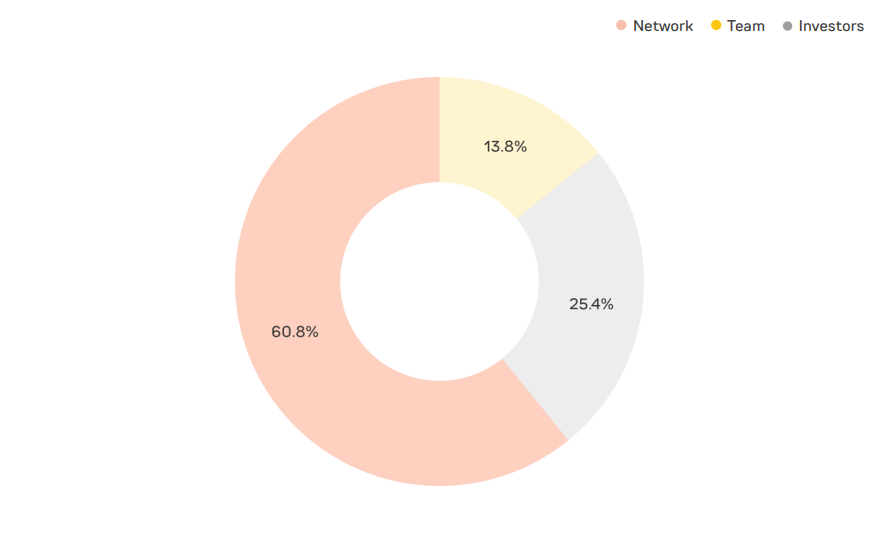

Energy Dollar (ENERGY) Tokenomics

The maximum supply of Energy Dollar is capped at 10 billion tokens. This supply will be minted gradually between 2025–2050. The ultimate goal is to create a self-sustaining and globally operating decentralized energy network.

- Network rewards are spread over a 25-year schedule

- Liquidity, community incentives, and grants are covered from this pool

- Team and investor tokens are locked in the first year

- Subsequently unlocked in 20% increments at months 12, 15, 18, 21, and 24

Under the burn mechanism, a maximum of 5 billion ENERGY can be permanently removed from circulation.

Distribution:

- Network: 60.8%

- Investors: 25.4%

- Team: 13.8%

Vesting:

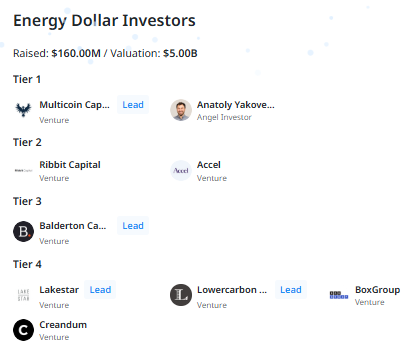

Energy Dollar (ENERGY) Investors

Energy Network has raised $160 million to date with support from high-profile funds and industry leaders, reaching a $5 billion valuation. This investor structure demonstrates a strong foundation of trust in both the energy and finance sides of the project.

Tier 1

- Multicoin Capital (Venture)

- Anatoly Yakovenko (Angel Investor)

Tier 2

- Ribbit Capital (Venture)

- Accel (Venture)

Tier 3

- Balderton Capital (Venture)

Tier 4

- Lakestar (Venture)

- Lowercarbon Capital (Venture)

- BoxGroup (Venture)

- Creandum (Venture)

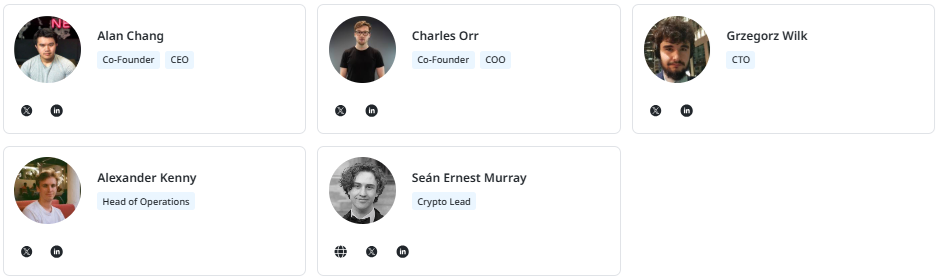

Energy Dollar (ENERGY) Team

The team behind Energy Network consists of a cadre with the technical depth to build both energy and crypto infrastructure together.

- Alan Chang – Co-Founder & CEO

- Charles Orr – Co-Founder & COO

- Grzegorz Wilk – CTO

- Alexander Kenny – Head of Operations

- Seán Ernest Murray – Crypto Lead

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.