As of January 16, 2026, notable movements were observed in U.S. spot crypto ETFs. While investors took different positions across Bitcoin, Ethereum, XRP, and Solana ETFs, the market experienced clear volatility. These flows reflect not only short-term price movements but also shifts in risk appetite, portfolio preferences, and institutional interest. In particular, inflows and outflows in specific ETFs highlight which assets are gaining demand and which are seeing capital withdrawal. These developments stand out as critical indicators for market participants when evaluating both potential opportunities and short-term risks.

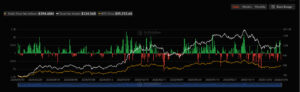

Net Outflows in Bitcoin Spot ETFs

As of January 16, 2026, Bitcoin ETFs recorded total net outflows of $394.68 million. This suggests that investors may be reducing short-term risk exposure or rebalancing their portfolios. However, contrary to the overall outflow trend, BlackRock’s IBIT ETF posted net inflows, standing out among its peers. Analysts note that the general outflows from Bitcoin ETFs are shaped by selective fund preferences and short-term market volatility. Additionally, these withdrawals are expected to have a limited but short-lived impact on Bitcoin’s price, potentially contributing to near-term fluctuations.

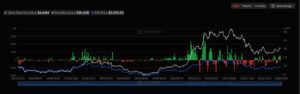

Continued Inflows into Ethereum Spot ETFs

Ethereum ETFs recorded net inflows of $4.64 million as of January 16, 2026. This marked the fifth consecutive day of inflows, signaling sustained investor interest. Experts emphasize that these consistent inflows demonstrate strong confidence and ongoing demand for ETH. The increase in Ethereum ETF inflows reflects positive market expectations and continued institutional participation. Analysts also suggest that this trend could provide short-term price support for ETH, as investors may increase Ethereum’s weight within their portfolios.

Investor Interest in XRP Spot ETFs

XRP ETFs saw net inflows of $1.12 million as of January 16, 2026. This development indicates that institutional investor interest in XRP remains intact. Market observers believe these inflows could support short-term price action, as investors increasingly turn to XRP for portfolio diversification. Moreover, steady inflows and rising liquidity suggest that XRP continues to be viewed as a relatively stable investment option within the ETF market.

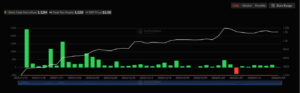

Net Outflows in Solana Spot ETFs

Solana ETFs recorded net outflows of $2.22 million as of January 16, 2026. These withdrawals suggest that some investors are rebalancing their portfolios or opting to reduce short-term risk exposure. Experts warn that outflows from Solana ETFs could lead to short-term volatility in SOL’s price, making close market monitoring essential. In addition, these outflows may temporarily pressure liquidity and influence investors’ risk management strategies.

Overall Assessment

The ETF flows observed as of January 16, 2026 provide important insights into investor behavior and market trends. Bitcoin ETF outflows, Ethereum ETF inflows, XRP’s net gains, and Solana ETF withdrawals collectively reflect diverging investment strategies across the crypto market. While continued inflows into Ethereum and XRP ETFs signal sustained confidence in those assets, outflows from Bitcoin and Solana ETFs point to short-term volatility risks. These data points will remain key indicators for understanding capital rotation and investor positioning in the evolving crypto ETF landscape.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.