A striking report has surfaced in the crypto space at a critical moment. According to data shared by Mitchell Amador, CEO of Web3 security platform Immunefi, nearly 80% of crypto projects that suffer a cyberattack never fully recover. More importantly, the core problem often runs deeper than the stolen funds themselves.

Amador’s assessment comes as 2025 has been marked by a surge in high-profile exploits. While markets search for a new trust equilibrium, a lack of operational readiness is leaving many projects permanently weakened.

The First Hours Define a Project’s Fate

According to Amador, the moment an exploit is detected, most protocols effectively freeze. Teams often lack a clear understanding of how exposed they are and rarely have a predefined incident response plan for a large-scale breach.

This uncertainty slows decision-making. Valuable time is lost as teams debate whether to pause contracts or keep systems running. Amador stresses that additional losses frequently occur during these early hours, when improvisation replaces structured response and coordination breaks down.

Silence Doesn’t Repair Trust — It Amplifies Panic

Following a hack, many projects hesitate to pause smart contracts due to reputational concerns. At the same time, communication with users often collapses. According to Amador, this silence does not stabilize the situation — it intensifies fear.

“Nearly 80% of hacked projects never fully recover,” Amador notes, adding that the primary damage stems not from the initial loss of funds, but from operational breakdown and erosion of trust during the response phase. Once lost, that trust is rarely restored.

Fixing the Code Isn’t Enough

A similar warning comes from Alex Katz, CEO of Web3 security firm Kerberus. Katz argues that even technically resolved incidents often mark the beginning of a project’s decline. Users leave, liquidity dries up, and reputational damage becomes permanent.

At the same time, the nature of attacks is shifting. Smart contract vulnerabilities are no longer the dominant threat. Human error has become the weakest link, with users unknowingly approving malicious transactions, interacting with fake interfaces, or exposing private keys.

Losses Hit Record Levels, Risk Turns Structural

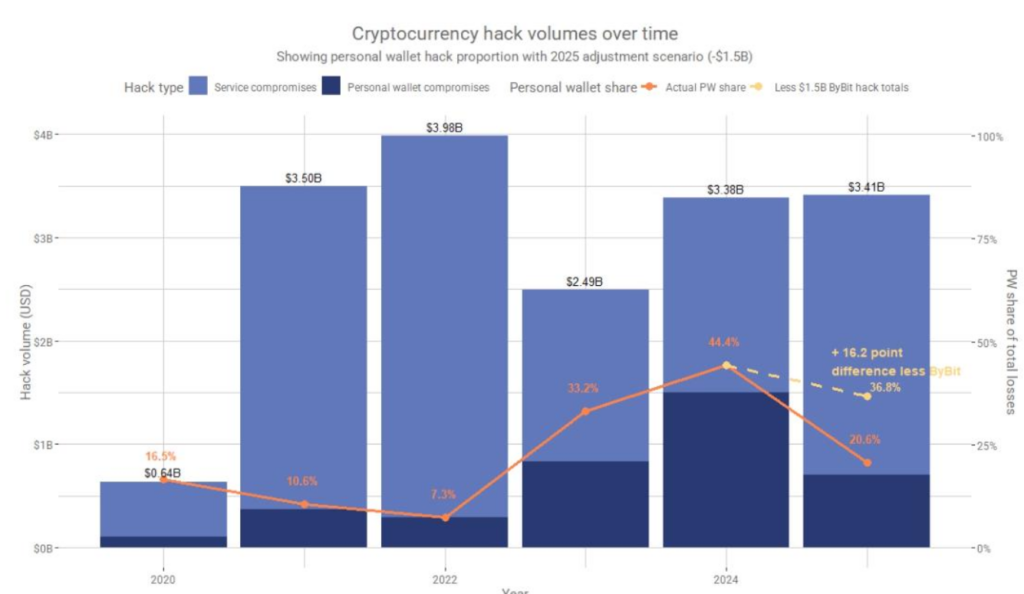

Crypto security challenges intensified sharply in 2025. Total losses reached $3.4 billion, the highest level since 2022. Just three incidents accounted for 69% of all losses, with the $1.4 billion Bybit exploit standing out as a defining example.

Amador warns that AI-powered social engineering is accelerating this trend. Attackers can now deploy thousands of tailored phishing messages daily, pushing security risks far beyond smart contracts and into operational preparedness.

2026 Could Be Stronger — Under One Condition

Despite the grim data, Amador remains cautiously optimistic. He believes smart contract security is improving faster than ever, driven by better development standards, stronger audits, and more mature monitoring tools. In his view, 2026 could become the strongest year yet for smart contract security.

However, one issue remains unresolved: response readiness. Amador emphasizes that teams must act decisively and communicate immediately when incidents occur, even if the full scope is unclear. Early intervention, he argues, causes far less damage than allowing uncertainty to spiral.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.