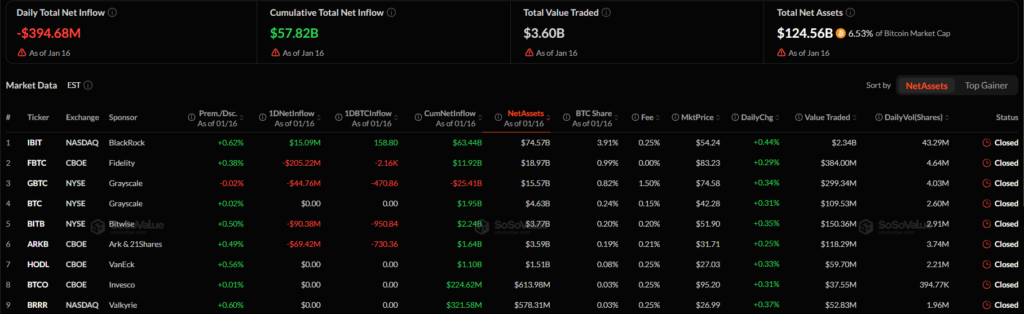

Bitcoin latest pullback is no longer confined to price charts alone. Renewed trade tensions centered on Greenland have triggered a sharp wave of capital outflows from US spot Bitcoin ETF, altering short-term risk perception across the market. On Monday alone, total net outflows reached $394.68 million, marking a decisive shift in institutional positioning.

This development suggests that the geopolitical sell-off that began over the weekend has now extended into the institutional layer of the market. The scale of ETF redemptions points to a broader portfolio adjustment rather than purely speculative selling pressure.

ETF Flows Reverse Course

According to data from SoSoValue, US-listed spot Bitcoin ETF recorded net outflows of $394.68 million on Monday. With this move, the four-day inflow streak that had brought more than $1.8 billion into the market came to a clear end.

Fidelity’s FBTC led the outflows, shedding $205.22 million in a single session. Grayscale’s GBTC, Bitwise’s BITB, and Ark & 21Shares’ ARKB also posted notable redemptions. BlackRock’s IBIT stood out as the exception, registering a modest $15 million net inflow.

Just days earlier, strong ETF inflows had coincided with Bitcoin rally above $95,800. However, the resurgence of geopolitical risk quickly reversed that momentum.

Greenland Tensions Disrupt Risk Appetite

The sudden shift in ETF flows reflects growing concerns over a potential trade conflict between the United States and the European Union. Over the weekend, former President Donald Trump warned that tariffs could be raised on imports from eight NATO allies if Denmark refuses to sell Greenland.

In response, European officials signaled possible countermeasures, including restrictions on US services, new taxes on American companies, or limits on investment activity within the EU. These escalating signals injected fresh uncertainty into global markets, pressuring risk assets across the board.

Following the initial headlines, Bitcoin slid from around $95,000 to near $92,500. Selling pressure persisted, with BTC trading near $90,979 at the time of writing.

“A Layer of Uncertainty Markets Can’t Absorb”

BTC Markets analyst Rachael Lucas argues that the prospect of a trade war adds a level of geopolitical uncertainty markets are ill-equipped to handle. She notes that sentiment had already weakened after delays in US crypto market structure discussions last week.

According to Lucas, if macro pressure persists, Bitcoin could revisit the $67,000–$74,000 range in the coming period.

Mixed Signals Across Other Crypto ETFs

While Bitcoin ETF experienced heavy redemptions, flows across other crypto funds remained more contained. Spot Ethereum ETFs posted $4.6 million in net inflows on Monday, while XRP products recorded $1.1 million in inflows. Solana ETFs, however, saw $2.2 million in net outflows, marking their first daily outflow since December 3.

Presto Research associate analyst Min Jung cautions that it is still too early to draw firm conclusions, as trade policy details remain unclear. However, she expects geopolitical uncertainty to keep crypto markets volatile in the near term.

With ETF flows and geopolitical risk converging, Bitcoin now faces heightened pressure during a critical phase of consolidation. Institutional capital appears to be shifting into a defensive posture. Whether this proves temporary or signals a deeper trend shift will largely depend on Bitcoin’s ability to hold above the $90,000 level in the days ahead.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.