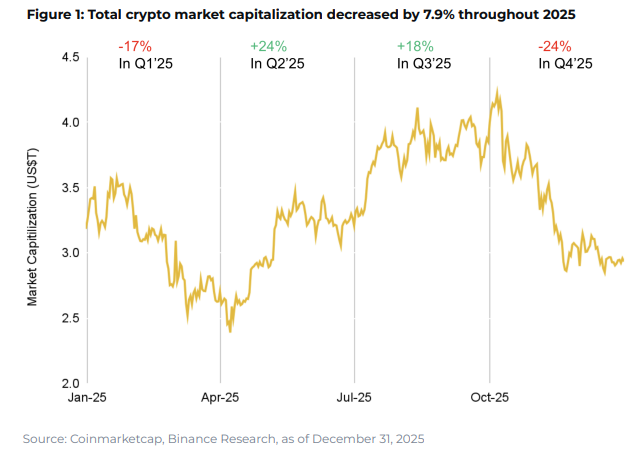

Binance latest annual outlook frames 2025 as one of the most contradictory years in crypto market history. The industry reached unprecedented scale, yet struggled to translate those milestones into sustained performance. Total crypto market capitalization briefly surpassed the $4 trillion mark, Bitcoin printed new all-time highs, and institutional participation expanded across ETFs, stablecoins, and tokenized assets. Despite these achievements, persistent macroeconomic pressure and regulatory friction ultimately capped market momentum.

By year-end, it became clear that digital assets were no longer driven primarily by internal adoption cycles. Instead, global liquidity conditions, fiscal uncertainty, and traditional financial dynamics played the dominant role in price formation—signaling a structural evolution in how crypto is valued.

A Market Shaped by Macroeconomic Noise

From a broader economic perspective, 2025 unfolded under what Binance characterizes as a period of limited visibility. A new U.S. administration, uncertainty around trade policies, fiscal debates, and geopolitical tensions repeatedly pushed investors toward defensive positioning.

While enthusiasm around artificial intelligence and potential fiscal stimulus lifted Bitcoin during the second half of the year, regulatory delays prevented crypto markets from fully participating in the recovery seen in traditional risk assets. As a result, total market value fluctuated within an unusually wide range, reinforcing crypto’s growing sensitivity to global liquidity cycles rather than purely sector-specific narratives.

Bitcoin’s Institutional Strength Versus On-Chain Weakness

Bitcoin remained the market’s primary macro benchmark throughout 2025. Although it reached new price highs, BTC underperformed both gold and major equity indices on a full-year basis. Even so, its market capitalization stayed near $1.8 trillion, with dominance holding in the 58–60% range.

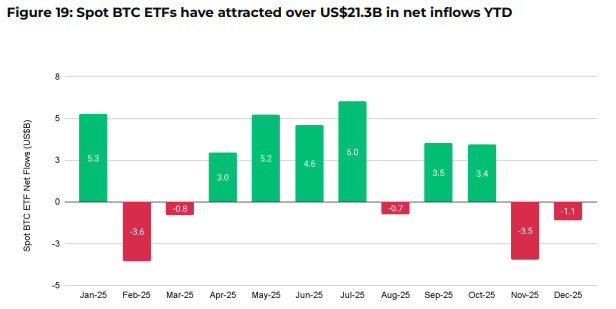

Institutional demand intensified beneath the surface. U.S. spot Bitcoin ETFs recorded more than $21 billion in net inflows, while corporate treasuries accumulated over 1.1 million BTC—approximately 5.5% of total supply. Network security also improved, with hash rate surpassing the 1 zettahash-per-second threshold.

In contrast, base-layer activity weakened. Active addresses declined, transaction volumes failed to match previous cycle peaks, and speculative on-chain behavior became more sporadic. This divergence highlights Bitcoin’s transition toward a macro-financial asset, where price discovery increasingly occurs through regulated, off-chain channels rather than direct network usage.

Layer-1 Competition and the Importance of Revenue

For Layer-1 ecosystems, 2025 underscored a critical lesson: transaction volume alone does not guarantee economic relevance. Many networks struggled to convert high activity into sustainable fee generation or long-term value capture.

Ethereum retained its leadership in developer engagement, DeFi liquidity, and aggregate value, but rollup-driven fee compression weighed on ETH’s relative performance versus Bitcoin. Solana distinguished itself by pairing high throughput with meaningful protocol revenue, expanding stablecoin supply and securing U.S. spot ETF approval. BNB Chain capitalized on retail-driven flows, real-world asset deployments, and strong settlement activity, emerging as one of the year’s top-performing major networks.

Across the board, consistent monetization proved to be the key differentiator.

Click here to register on Binance Exchange with a 20% commission discount!

DeFi, Stablecoins, and the Expansion of RWAs

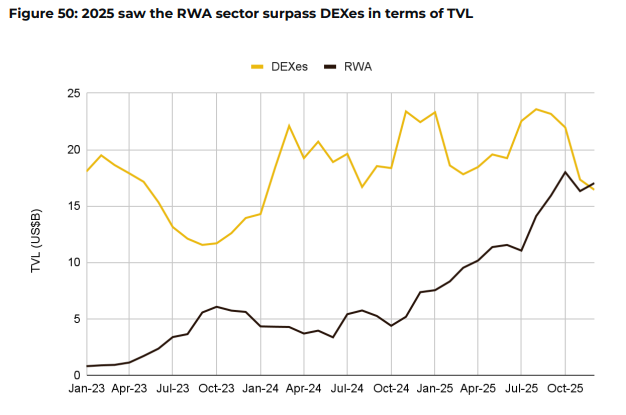

Decentralized finance continued its gradual shift toward institutional maturity. Total value locked stabilized around $124 billion, while capital increasingly concentrated in stablecoins and yield-bearing products. A notable milestone occurred when real-world asset (RWA) TVL surpassed decentralized exchanges, driven by tokenized treasuries and equities.

Stablecoins, meanwhile, evolved into core financial infrastructure. Market capitalization exceeded $305 billion, daily transaction volumes surpassed $3.5 trillion, and regulatory clarity—particularly in the U.S.—accelerated adoption. Several institutional-grade stablecoins crossed the billion-dollar threshold, intensifying competition and expanding real-world use cases.

Looking Ahead: Why 2026 Could Be a Turning Point

Binance’s forward-looking assessment points to 2026 as a potential inflection year. Expectations of synchronized monetary easing, fiscal stimulus, and deregulation could create conditions for a renewed risk cycle. In this environment, market leadership is likely to shift away from retail-driven speculation toward institutional liquidity and utility-focused growth.

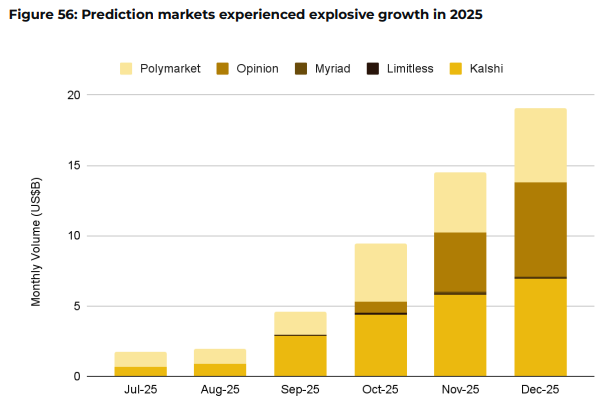

Among emerging narratives, prediction markets stand out. As capital becomes more selective, platforms that aggregate collective intelligence and deliver measurable economic value are gaining attention. Projects such as Opinion illustrate how market sentiment can be transformed into actionable price signals with applications beyond speculation.

Entering Crypto’s Next Phase

The broader takeaway from Binance outlook is that crypto has largely moved beyond its infrastructure-building era. With regulation advancing, institutions embedding digital assets into core workflows, and applications achieving real traction, the next growth phase will be defined by usability, verifiability, and sustainable economics.

As 2026 approaches, the central question is no longer whether crypto will integrate with global finance—but which sectors and platforms are best positioned to lead that integration.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.