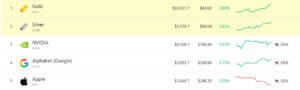

Gold prices have passed a historic turning point in global markets. Spot gold climbed above the $4,900 level, reaching an all-time high. This strong rally signals a growing demand for safe-haven assets among investors, while also bringing renewed comparisons with Bitcoin to the forefront. So, what price would Bitcoin need to reach in order to match gold’s market capitalization?

Spot Gold Surpasses $4,900

Spot gold is experiencing a strong upward trend driven by global economic uncertainty, geopolitical risks, and expectations surrounding central bank monetary policies. Rising safe-haven demand has increased investors’ risk-off behavior, placing gold back at the center of portfolios. In this environment, spot gold breaking above the $4,900 level has been recorded as a historic milestone in the markets. Continued macroeconomic uncertainty and inflation concerns are keeping interest in precious metals alive.

According to current data, gold’s total market capitalization has risen to approximately $34 trillion. In contrast, Bitcoin’s market cap stands at around $1.78 trillion. This large gap clearly highlights the difference in scale and maturity between the two assets. Calculations show that for Bitcoin to reach gold’s current market value, the price of one BTC would need to climb to roughly $1,698,717. While this comparison underscores Bitcoin’s potential size, it also emphasizes gold’s deeply rooted position within the financial system.

Supply Transparency and Inflation Rates

Bitcoin’s total supply and circulating amount can be verified instantly and transparently by anyone thanks to its blockchain structure. In contrast, data on gold’s total supply can vary depending on estimates from different institutions. Factors such as underground reserves, unmined gold, and recycling make it difficult to calculate gold’s total supply precisely. This situation positions Bitcoin as a standout asset in terms of transparency and predictability.

In terms of annual supply growth, Bitcoin has a more limited inflation rate due to its programmed structure. Bitcoin’s annual supply growth is approximately 0.83%, while gold’s is estimated at around 1.72%. Bitcoin’s halving process, which occurs every four years, further reduces the rate of supply growth and strengthens the perception of scarcity over the long term. Gold supply, on the other hand, continues to increase through mining activities, keeping its inflation rate relatively higher.

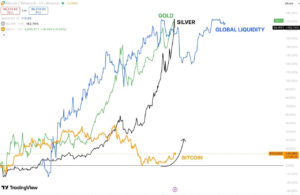

Short- and Long-Term Performance Comparison

In the short term, gold shows a clear advantage. Over the past year, gold has gained approximately 78.8%, while Bitcoin has declined by about 16.2% over the same period. Since the beginning of the year, gold has risen by roughly 13%, whereas Bitcoin’s increase has been limited to 1.7%. In the long term, however, the picture appears more balanced. Over the past five years, Bitcoin has gained approximately 188%, while gold has increased by around 163%.

Evaluation

Gold’s rise above $4,900 to a new all-time high demonstrates just how strong safe-haven demand has become. While Bitcoin has lagged behind gold in the short term, it continues to remain on investors’ radar due to its long-term performance and limited supply structure. In the period ahead, macroeconomic developments will play a key role in shaping the balance between these two assets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.