The concept of a digital dollar has been at the center of the crypto ecosystem since the first stablecoins appeared. However, many dollar-pegged stablecoins launched to date have either remained in gray areas regarding regulation or raised questions about reserve transparency and institutional trust. World Liberty Financial USD (USD1) positions itself as a next-generation fiat-backed stablecoin designed to fill this gap.

Launched in April 2025 by World Liberty Financial (WLFI), USD1 is a 1:1 USD-pegged, fully reserved, and regulation-focused digital dollar solution. The project’s core goal is to create a stablecoin infrastructure that meets institutional standards and can be used both on-chain and in the real world.

What is USD1?

USD1 is a fiat-backed stablecoin pegged 1:1 to the US dollar. Each USD1 token is backed by an equivalent amount of US dollars and high-liquidity cash-like assets in circulation.

One of the most fundamental features of USD1 is that it is structured directly within the framework of US regulations. While the issuance and reserve management of the stablecoin are handled by BitGo Trust Company, World Liberty Financial owns the USD1 brand and acts as the ecosystem developer.

Thanks to this structure, USD1 aims to differentiate itself from classic stablecoins in areas such as:

- Transparent reserve model

- Institutional compliance

- DeFi and traditional finance integration

How Does USD1 Work?

Technically, USD1 is an ERC-20 token operating on the Ethereum network. This enables it to work seamlessly with DeFi protocols in the Ethereum ecosystem, as well as centralized and decentralized exchanges.

Minting and redemption processes are managed by BitGo. Authorized and eligible users can mint USD1 directly in exchange for US dollars at a 1:1 ratio or redeem their USD1 back to dollars at the same ratio.

In these processes:

- No transaction fees are charged for minting and redemption

- Reserve assets are held off-chain but reported regularly

- On-chain verification tools ensure reserve transparency

Multichain Structure and Accessibility

USD1 does not aim to remain limited to a single network. Starting as an ERC-20 token on Ethereum, the structure is designed to expand to different blockchain networks over time.

Thanks to the multichain approach:

- Liquidity can be provided across different ecosystems

- Cross-chain transfers and integrations become easier

- Users can conveniently use USD1 depending on the network they are on

USD1 offers on-chain settlement in seconds and enables 24/7 global transfers.

Reserve Structure and Assurance Mechanism

The foundation of its stability lies in a fully cash and cash-equivalent reserve model. Every USD1 in circulation is backed 1:1 by reserves held by BitGo.

Reserve components include:

- US Treasury bills

- US government-backed money market funds

- US dollar deposits

- Other high-liquidity cash equivalents

Reserves are:

- Held by BitGo Trust Company

- Periodically audited by independent third parties

- Publicly disclosed through monthly reserve reports

Additionally, mechanisms such as Chainlink Proof of Reserves provide continuous balance verification between circulating USD1 supply and reserve assets on-chain.

Regulation and Institutional Compliance

One of the most distinctive aspects of USD1 is that regulation is placed at the center of the project design. The stablecoin is issued under a licensed and regulated structure in the United States.

In this context:

- The coin is issued by BitGo Trust Company

- KYC and AML processes are integrated from the beginning

- It targets institutional users and regulated platforms

This approach makes USD1 more suitable for:

- Institutional capital

- Financial institutions

- Regulated DeFi protocols

Where Can USD1 Be Used?

USD1 aims for active financial use cases beyond merely being a “store of value.”

Cross-Border Payments

With USD1:

- International transfers can be executed without bank intermediaries

- At low cost

- With instant settlement

Global Digital Dollar Access

The project offers a secure digital dollar alternative in regions with limited access to banking infrastructure.

DeFi and Capital Markets

It is integrated into the WLFI ecosystem to be used in DeFi applications such as:

- Lending

- Borrowing

- Liquidity provision

- Digital asset trading

Real-World Usage

Long-term goals of USD1 include:

- Retail payments

- Real-world trade integrations

- Institutional payment solutions

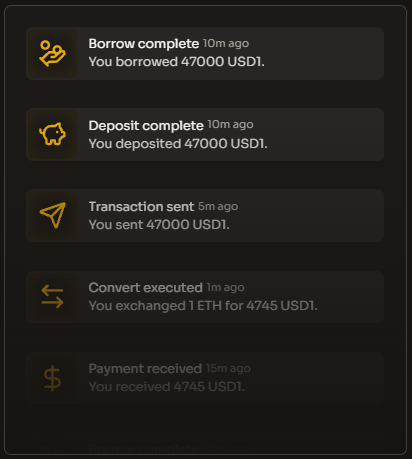

How to Convert USD1?

Authorized BitGo customers can directly convert USD1 to US dollars. Other users can perform USD1 ↔ USD conversions through:

- Crypto exchanges

- Regulated custody services

- On-chain platforms

that support USD1.

These transactions are subject to the platforms’ own terms and eligibility criteria.

USD1 Tools: Bridge and Convert

The USD1 ecosystem provides additional tools to allow users to use their tokens more flexibly:

Bridge

Enables secure transfer of USD1 between supported networks.

Convert

Allows users to quickly convert different crypto assets to USD1 or USD1 to other crypto assets.

USD1 Partners

World Liberty Financial USD is advancing with a broad network of partnerships to quickly provide liquidity in crypto markets and to build a stablecoin infrastructure that meets institutional standards. These partnerships support the secure, transparent, and scalable use of the project across various exchanges, custody solutions, and blockchain infrastructures, while also aiming to increase USD1’s global reach and adoption speed.

Notable partners of USD1 include:

- Gate, Coinbase, Kraken ,Bithumb, Binance, BitGo, Chainlink, Bitget, Bybit

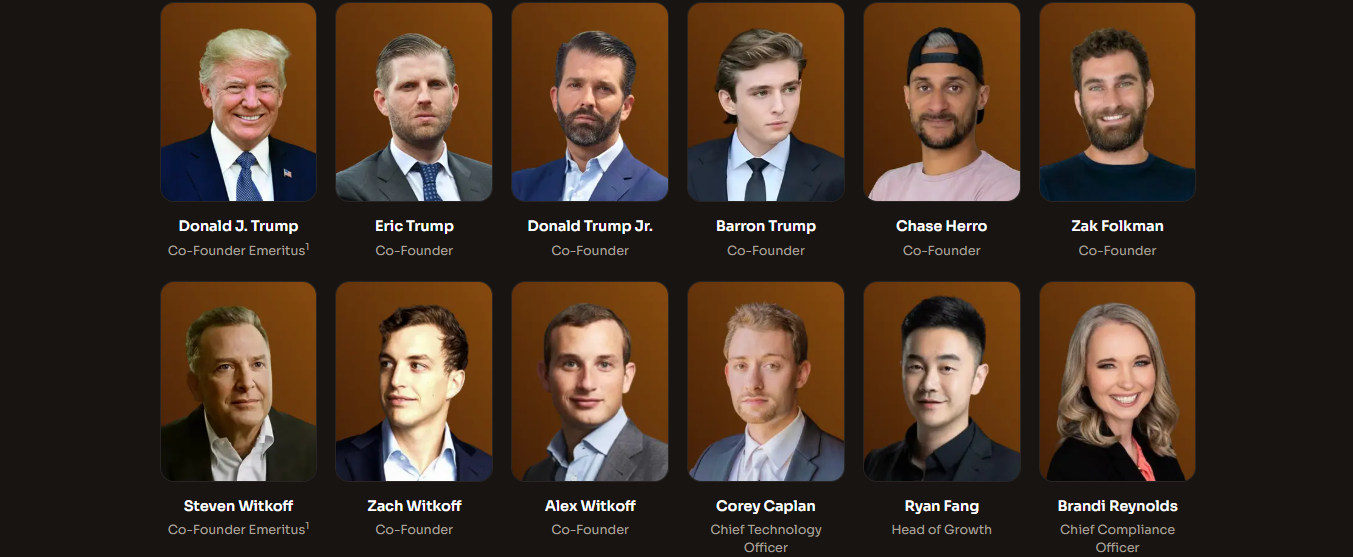

World Liberty Financial USD (USD1) Team

The World Liberty Financial USD1 project is supported by a broad team of experienced individuals in finance, technology, and regulation. The team structure is designed to reflect the project’s institutional and long-term vision.

Founders and Leadership Team

- Donald J. Trump (Co-Founder Emeritus)

- Eric Trump (Co-Founder)

- Donald Trump Jr. (Co-Founder)

- Barron Trump (Co-Founder)

- Chase Herro (Co-Founder)

- Zak Folkman (Co-Founder)

- Steven Witkoff (Co-Founder Emeritus)

- Zach Witkoff (Co-Founder)

- Alex Witkoff (Co-Founder)

Management and Operations Team

- Corey Caplan (Chief Technology Officer)

- Ryan Fang (Head of Growth)

- Brandi Reynolds (Chief Compliance Officer)

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.