Ethereum is currently displaying a notable divergence between price action and on-chain behavior. While Ethereum (ETH) has struggled to establish a clear directional trend in recent weeks, a key supply-side metric is flashing an important signal: the amount of ETH held on centralized exchanges continues to fall sharply. This trend suggests that investors are increasingly favoring staking over short-term selling.

Exchange Balances Drop to Six-Month Lows

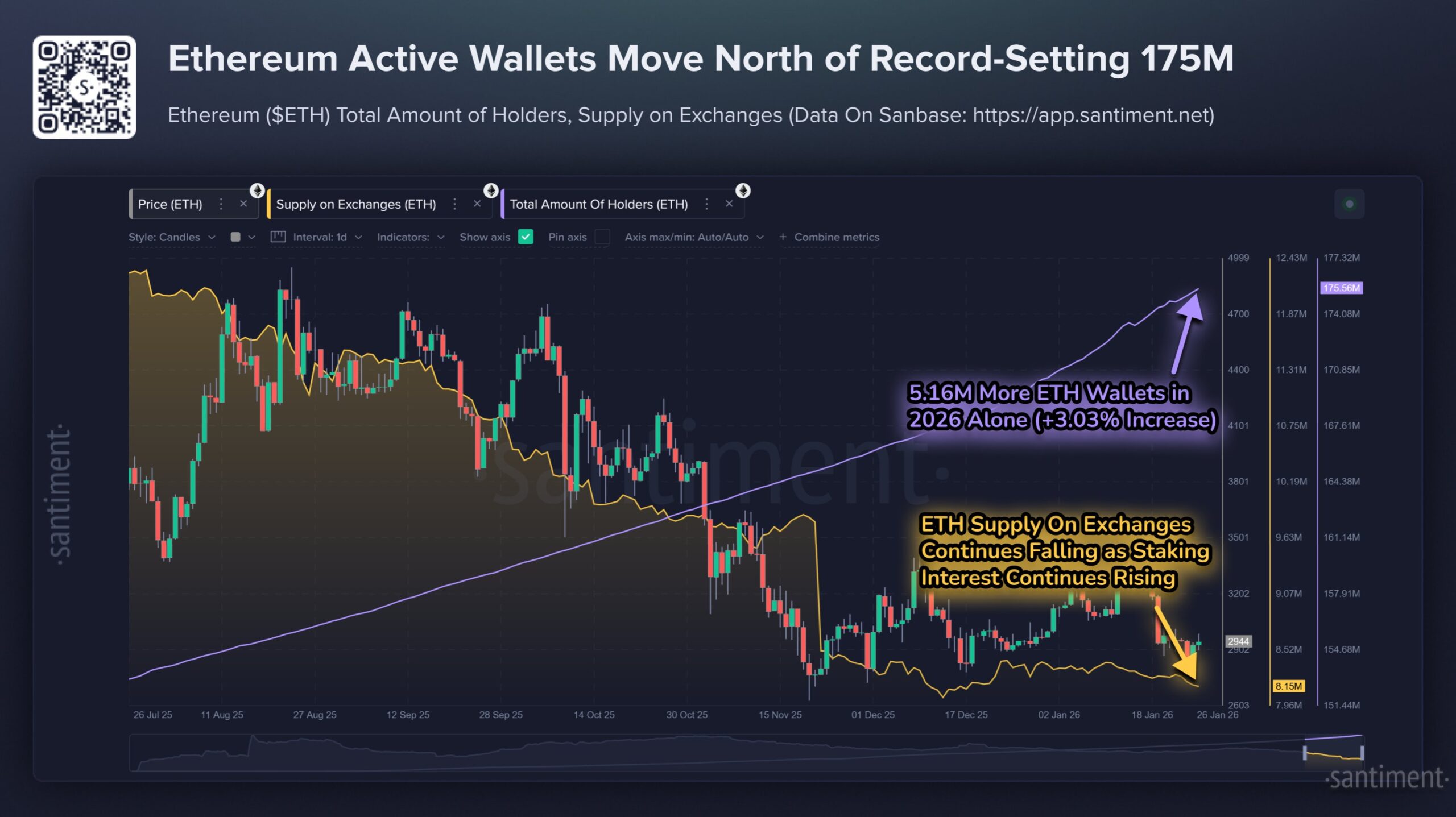

On-chain data shows a steady decline in Ethereum reserves on crypto exchanges over the past six months. After peaking at 12.31 million ETH in July, exchange-held supply has fallen to approximately 8.15 million ETH. Crucially, this drawdown occurred during a period when ETH prices remained largely range-bound, indicating that coins are being withdrawn rather than sold.

Over the past seven days, Ethereum has traded within a relatively tight band between $2,801 and $3,034. In this sideways market environment, staking has emerged as an increasingly attractive option for holders seeking yield while waiting for a clearer market catalyst.

Staking Demand Pushes Validator Queue to Capacity

The growing appetite for staking is now visibly straining Ethereum’s validator onboarding process. Roughly 3.6 million ETH is currently queued for staking, with an estimated wait time of around 63 days for new validators to enter the network.

In contrast, the exit side of the queue remains comparatively light. Only about 44,448 ETH is waiting to be unstaked, with an estimated processing time of just 18 hours. This imbalance reflects Ethereum’s built-in limits on validator entries and exits per epoch, which are designed to preserve network stability.

Nearly One-Third of ETH Supply Is Now Staked

Total staked Ether has climbed above 36 million ETH, accounting for roughly 29% of the circulating supply. Just a few months ago, this figure stood closer to 35 million ETH. In a proof-of-stake system, increasing staking participation is often interpreted as a long-term confidence signal, as it requires assets to be locked rather than kept liquid for potential sale.

Institutional and Whale Activity Reinforces the Trend

Large holders appear to be reinforcing this dynamic. Treasury-focused firm BitMine recently staked an additional 250,912 ETH, bringing its total staked balance above 2.5 million ETH—around 61% of its overall holdings. Meanwhile, several major staking wallets have collectively withdrawn more than 26,000 ETH from Binance, pointing toward further accumulation.

Shrinking Liquidity Meets Falling Volume

While daily ETH trading volume has slipped from over $27 billion to roughly $23.54 billion, the ongoing reduction in exchange supply suggests a tightening liquidity environment.

Taken together, Ethereum’s price may look stagnant on the surface, but underlying on-chain indicators point to strengthening long-term conviction. If demand rebounds, this tightening supply dynamic could become a critical factor in Ethereum’s next major move.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.