Courtyard.io (COURTYARD) is an innovative platform that brings physical collectible items together with blockchain technology, adapting the concept of collecting to the requirements of the digital age. Courtyard enables users to buy, hold, and trade collectible cards, comic books, and similar physical assets through digital tokens represented on the blockchain. This structure significantly reduces the biggest problems of the traditional collectibles market: lack of liquidity, trust issues, and operational difficulties.

At the core of the platform are NFTs that represent a 1:1 counterpart of physical assets. The Courtyard system guarantees that each NFT corresponds to a unique physical item securely stored in vaults. Users can buy and sell these NFTs on Courtyard’s own marketplace, request physical delivery at any time, or choose to keep the asset in storage indefinitely.

How Does Courtyard.io (COURTYARD) Work?

Courtyard operates on a custodial tokenization model. When a user joins the platform, the physical collectible item is shipped to Courtyard’s high-security vaults located in the United States. Once the item is verified, a corresponding ERC-721 standard NFT is created and added to the user’s digital wallet.

From this point onward, the user can:

- Instantly buy or sell the NFT on the global marketplace

- Request and receive the physical item

- Continue keeping the asset in storage

- Transfer the NFT to another user

All of these operations occur without the need to move the physical asset, resulting in significant savings in time, cost, and operational risk in the collectibles market.

What Does Courtyard.io (COURTYARD) Offer?

Courtyard.io provides a comprehensive infrastructure that not only digitizes collecting but also addresses liquidity, transparency, and security issues. Representing physical assets on the blockchain makes the collectibles market more accessible and global while minimizing traditional risks.

In these respects, Courtyard stands out as one of the leading projects in the tokenization of real-world assets (RWA).

Solution to Liquidity Problems in Physical Collectibles

In traditional collectibles markets, the sales process involves multiple stages such as listing, finding a buyer, packaging, shipping, and fraud risks. Thanks to Courtyard’s tokenization model, these processes are eliminated. Once the asset is placed in storage, transactions conducted via NFT provide instant liquidity.

The platform also further enhances liquidity by offering users an instant buyback option at approximately 90% of the market value.

Transparency and Provenance (Ownership History Tracking)

One of the most important advantages Courtyard offers is that the entire transaction history is recorded on-chain. The previous owners of a collectible item, transfer prices, and transaction history can be transparently tracked. This makes the concept of provenance—highly important in the collectibles world—far more reliable.

Each physical asset is paired with a human-readable description and a unique identifier number. This information is cryptographically hashed and added to the NFT metadata.

What is Proof of Integrity?

Courtyard secures the link between the NFT and the physical asset with a system called “Proof of Integrity.” This system clearly demonstrates if any tampering has occurred with the NFT’s identity.

For each asset:

- Physical photograph

- 3D render

- Unique identifier

- On-chain hash

are created. This structure proves that the NFT truly belongs to a unique physical item held in storage.

Storage, Insurance, and Security

Courtyard does not charge users any storage or insurance fees. All collectible items are stored in high-security vaults in the United States and are insured at market value.

In the event of loss or damage, the insured value is compensated to the user. In this regard, Courtyard offers a more institutional security standard compared to traditional collectible storage methods.

Technical Architecture of Courtyard.io

The Courtyard architecture consists of three main components:

- Smart contracts: Manage ERC-721 NFTs

- Web interface: Provides user interaction

- Centralized backend: Handles inventory management and mint authorization

Mint operations are performed with signed approvals generated by the Courtyard backend. This structure guarantees that every NFT has 100% physical backing.

Physical Delivery and NFT Burning Process

When a user wants to receive the physical item, the corresponding NFT is burned (burned) through the system. Physical delivery is not made without burning the NFT. This prevents the same asset from circulating both digitally and physically at the same time.

In the delivery process:

- KYC verification is performed

- Shipping and taxes are covered by the user

- International shipments are supported

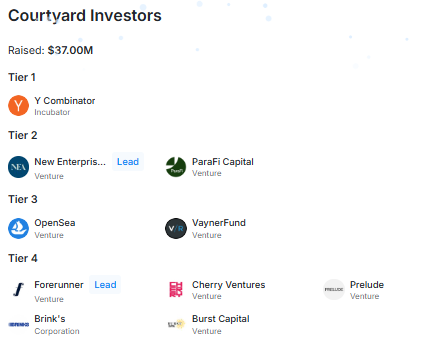

Courtyard.io (COURTYARD) Investors

Courtyard.io has raised a total of $37 million and has gained the support of strong investors from both the Web3 and traditional finance worlds. The investor profile supports the platform’s technological and institutional vision.

Investors:

- Y Combinator

- New Enterprise Associates (NEA)

- ParaFi Capital

- OpenSea

- VaynerFund

- Forerunner

- Cherry Ventures

- Prelude

- Brink’s

- Burst Capital

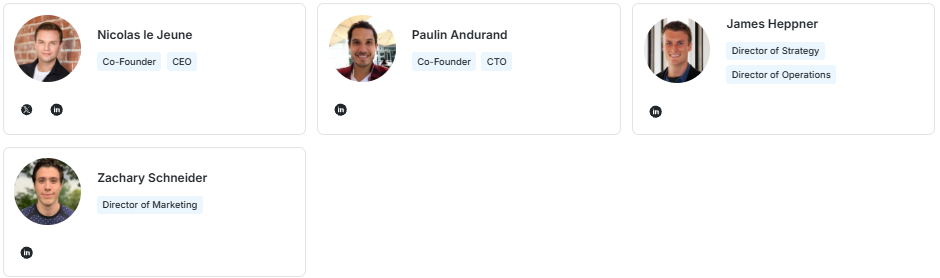

Courtyard.io (COURTYARD) Team

The Courtyard team consists of experienced individuals in technology, strategy, and operations. The team aims to build a scalable infrastructure that combines collecting with blockchain.

Team members:

- Nicolas le Jeune (Co-Founder & CEO)

- Paulin Andurand (Co-Founder & CTO)

- James Heppner (Head of Strategy & Operations)

- Zachary Schneider (Head of Marketing)

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.