As volatility continues in the crypto ETF market, the latest data point to strong outflows from Bitcoin and Ethereum ETFs, while XRP ETFs recorded limited but notable inflows. This picture reveals that investors are adopting a more selective and cautious stance across the broader market. In particular, outflows from large-volume ETFs indicate weakening risk appetite and a portfolio rebalancing process, while XRP’s positive divergence shows that interest in certain assets remains intact. This divergence in investor behavior suggests that risk perception in the crypto market is being reshaped and that short-term volatility may increase.

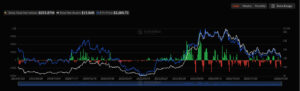

$509.70 Million Outflow From Bitcoin ETFs

According to the latest market data, Bitcoin ETFs recorded a total net outflow of $509.70 million. This figure stands out as one of the largest daily outflows seen in recent weeks. Experts associate this sharp move with investors turning toward short-term profit-taking, growing macroeconomic uncertainties in global markets, and an increasingly cautious approach to risk assets. In addition, expectations around interest rate policies and geopolitical developments are also believed to have intensified selling pressure on Bitcoin ETFs.

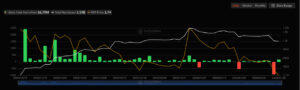

Ethereum ETFs Also Under Pressure

Not only Bitcoin ETFs but also Ethereum ETFs have failed to escape the rising selling pressure recently. A net outflow of $252.87 million on the Ethereum side indicates that risk-off sentiment is strengthening across the market. According to analysts, this development points to a more cautious investor stance toward risky assets and a renewed portfolio rebalancing process. Moreover, weakening short-term expectations for the Ethereum ecosystem and rising market volatility are cited among the factors accelerating ETF outflows.

$16.79 Million Inflow Into XRP ETFs

Despite the overall outflow trend in the market, XRP ETFs managed to show positive divergence. A net inflow of $16.79 million into XRP ETFs indicates that investor interest is beginning to shift toward specific crypto assets. Analysts suggest that these inflows signal strengthening short-term expectations for XRP and highlight that investors are following a more selective strategy. Developments on the regulatory front and expectations surrounding the XRP ecosystem are seen as key factors behind these limited yet meaningful inflows through the ETF channel.

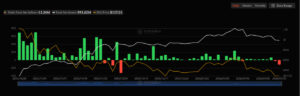

$11.24 Million Outflow From Solana ETFs

Meanwhile, Solana ETFs recorded a net outflow of $11.24 million. Although this outflow remains relatively limited compared to Bitcoin and Ethereum ETFs, it shows that investors are also maintaining a cautious approach toward altcoin ETFs. Analysts note that this reflects investors’ efforts to reduce risk levels amid broad market uncertainty and to hold more controlled positions in highly volatile assets. In this context, movements in Solana ETFs are interpreted as a signal that short-term pressure in the altcoin market is continuing.

Evaluation

The latest ETF data indicate a clear divergence in the market under the themes of Bitcoin ETF outflows, Ethereum ETF outflows, XRP ETF inflows, and Solana ETF outflows. While the significant outflows from Bitcoin and Ethereum signal that short-term volatility may increase, the limited inflows into XRP suggest that selective investor interest remains intact. Investors are advised to closely monitor ETF flows, macroeconomic developments, and overall market liquidity in the period ahead.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.