Recent weeks have been challenging for the cryptocurrency market, with sharp pullbacks putting significant pressure on investor sentiment. Amid this environment of heightened uncertainty, signals coming from the Bitcoin front continue to attract close attention. One of the most closely watched figures in this space, Michael Saylor, has once again moved into the spotlight with a brief but meaningful social media post.

As the chairman of Strategy, the company holding the largest corporate Bitcoin reserves in the world, Saylor’s words are often scrutinized for potential clues about future moves. His latest message was no exception.

“More Orange”: Bitcoin Buy?

Michael Saylor shared a short statement on social media: “More Orange.” Within the Bitcoin community, the color orange has long been associated with BTC itself, making the phrase widely interpreted as a symbolic reference to additional Bitcoin accumulation.

This is not the first time Saylor has used similar language. In the past, comparable posts were followed by official announcements confirming that Strategy had increased its Bitcoin holdings. As a result, market participants tend to view such messages as subtle previews rather than casual remarks.

Are New Bitcoin Purchases Imminent?

According to market observers, Saylor’s latest post may indicate that Strategy is preparing to announce another BTC purchase in the near term, possibly within days or early next week. Historically, the company has often revealed new acquisitions shortly after these types of indirect signals appeared.

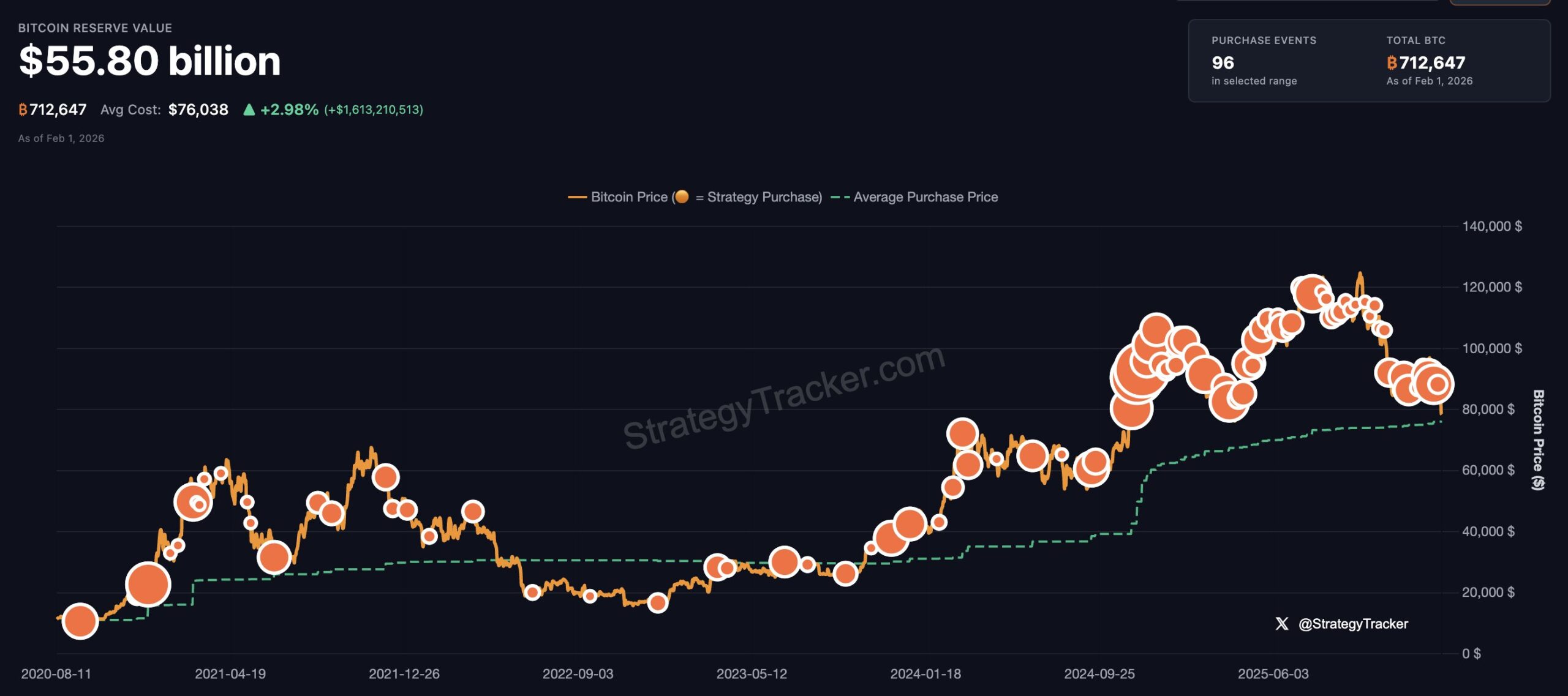

Based on the latest available data, Strategy currently holds 712,647 BTC. The total value of these holdings is estimated at approximately $55.44 billion, with an average acquisition cost of $76,038 per Bitcoin. At current market prices, the company’s Bitcoin position remains modestly profitable, showing a gain of around 2.32%.

Stock Performance and Rising Volatility

Despite this positive positioning on Bitcoin itself, recent price weakness has weighed heavily on Strategy’s stock performance. Since the beginning of the year, BTC has declined by roughly 20.3%, while Strategy shares have suffered a significantly steeper drop of about 55.3%.

Volatility metrics further highlight this divergence. Over the past 30 days, Strategy shares have recorded a volatility rate of 57.7%, placing them at the top of the list. By comparison, Bitcoin ranks third with a volatility level of 36%.

Market on Alert for Bitcoin and MSTR

Saylor’s cryptic message has once again put the market on edge. A potential new BTC purchase by Strategy could influence short-term price dynamics and reinforce long-term institutional confidence. However, given the current volatility, any market reaction is likely to be closely monitored.

This content is for informational purposes only and does not constitute investment advice.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.