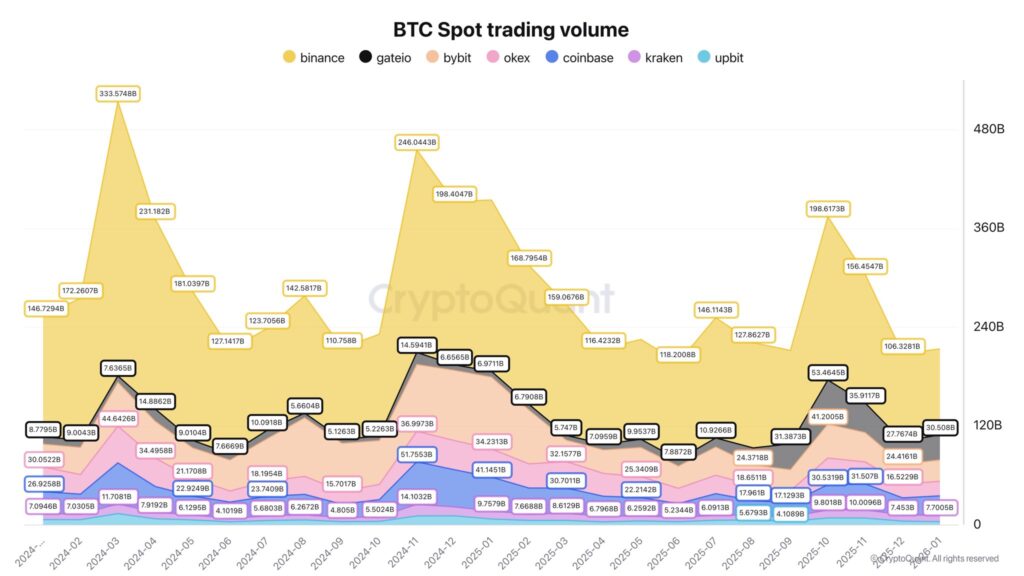

The appetite for crypto trading in the market has cooled off rapidly, and this decline is not due to a single factor. According to CryptoQuant, liquidity on exchanges has largely dried up, with leading exchange Binance seeing Bitcoin volumes drop from $200 billion to $104 billion. Analysts note that spot volumes on major exchanges fell from around $2 trillion in October to $1 trillion by the end of January, emphasizing that “investors have clearly disengaged from the market.”

Bitcoin Liquidity Crisis and Flight from Risk

Bitcoin (BTC) has lost 37.5% since its October peak, falling to $78,733. Liquidity shortages and risk-off behavior have significantly reduced trading volumes.

CryptoQuant analyst Darkfost said, “Spot demand is drying up. This correction has been largely driven by the October 10th liquidation event.”

For instance, Bitcoin spot volumes on Binance fell from $200 billion in October to roughly $104 billion today. By comparison, Gate.io recorded $53 billion, and Bybit $47 billion. According to CryptoQuant, this contraction has brought the market back to levels among the lowest observed since 2024, highlighting weaker investor demand.

Market Liquidity Under Pressure

The drop in volumes is not only due to waning investor interest. Analysts note that stablecoin outflows and roughly $10 billion in stablecoin market cap losses have also put pressure on liquidity.

Justin d’Anethan, head of research at Arctic Digital, stated that Bitcoin’s biggest short-term risk over the coming months is macro-driven:

“Kevin Warsh’s hawkish stance as Fed chair could mean fewer or slower rate cuts, a stronger dollar, and higher real yields, all of which pressure risk assets, including crypto.”

He also noted that Bitcoin’s role as a hedge against inflation and currency debasement remains intact. On the other hand, strong ETF inflows, clearer pro-crypto legislation, or soft economic data prompting the Fed toward easier policy could spark a meaningful rally.

“It may feel like a bitter medicine, but the recent move is ultimately healthy, helping clear leverage, reduce speculation, and make investors reconsider valuations.”

Bitcoin Price Bottom Is Not Close Yet

Joao Wedson, CEO of Alphractal, highlighted two conditions for a Bitcoin price bottom:

-

Short-term holders (STH) need to be underwater, which is currently the case.

-

Long-term holders (LTH) need to start carrying losses, which has not happened yet.

Wedson explained that bear markets only end when the STH realized price falls below the LTH realized price, while bull markets begin when it crosses back above.

Currently, STH realized price remains above LTH. However, a drop below $74,000 could push BTC into bear market territory, signaling a period where investors need to be especially cautious.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.