CAP (rCAP) is a decentralized stablecoin protocol developed on the Ethereum network, designed to protect principal capital while offering collateralized yield. Cap’s core objective is to free stablecoin users from fragmented liquidity structures and unsustainable yield models by creating a monetary and yield infrastructure backed by verifiable financial guarantees.

The protocol revolves around two main products: the dollar-based cUSD and the yield-generating stcUSD. This structure enables Cap to provide both a secure digital dollar standard and a savings product with clearly defined risks and downside protection.

Core Vision of the CAP (rCAP) Protocol

Cap focuses on two long-standing fundamental problems in the stablecoin ecosystem: fragmentation and the lack of reliable yield.

Today’s stablecoin market presents a scattered picture with different issuers, incompatible reserve structures, and closed systems. Cap aims to position itself as a neutral and open aggregation layer built on top of this complex structure. Through smart contracts and market mechanisms, it delivers a financial infrastructure where trust is verified by code.

The protocol is built on two main principles:

- Open protocols: Open-source, autonomous systems provide transparency and resilience. Financial guarantees should be based on verifiable code, not human promises.

- Market-driven design: Reward and penalty mechanisms are structured to minimize human intervention.

What is cUSD?

cUSD is a 1:1 redeemable digital dollar issued on Ethereum and usable across different networks. The reserve of cUSD consists of “blue-chip” stablecoins from regulated and transparently audited institutions. These include assets such as USDC, USDT, pyUSD, BUIDL, and BENJI.

The key difference of cUSD is that it is not tied to a single issuer. Users can redeem cUSD 1:1 for any asset in the reserve. The entire process operates on-chain, and no reserve asset is given preferential treatment.

This structure aims to rebuild the principle of “singleness of money” in the stablecoin world. Just as the dollar represents the same value regardless of which bank holds it in interbank systems, cUSD aggregates different stablecoins under a single liquid and interoperable standard.

What is stcUSD?

stcUSD is a yield-generating savings product obtained by staking cUSD. However, what distinguishes stcUSD from similar products is that its yield is fully collateralized and protected against downside risk.

Today, many yield-bearing stablecoin products rely on strategies managed by centralized teams. This creates serious issues in terms of both scalability and security. stcUSD reverses this model.

In Cap, yield generation is performed by an open network of operators. Operators generate yield through advanced strategies such as arbitrage, MEV, RWAs, and similar methods. However, the risk of this yield is borne by delegators through restaked ETH or staked assets.

As a result, users:

- Are not directly exposed to the risk of yield generation

- Can verify the protection of their principal on-chain

- Gain access to competitive yields independent of market conditions

How Does the Cap Ecosystem Work?

Cap is designed as a three-sided marketplace:

- Users: Mint cUSD or stake into stcUSD

- Operators: Implement institutional-grade yield strategies

- Delegators: Provide collateral to secure the system

This structure operates through Cap’s “Shared Security Network” approach. Operators must post collateral to participate in the system. Failed or risky behavior is prevented through automatic penalty (slashing) mechanisms.

Cap Protocol Modules

The Cap infrastructure consists of six main modules:

- Vault: Holds reserve assets and performs cUSD minting

- Lender: Manages borrowing, repayment, liquidation, and interest calculations

- Fee Auction: Converts generated yield into cUSD via Dutch auction

- Delegation: Manages collateral, rewards, and slashing processes

- Oracles: Provides the oracle layer for asset prices and interest rates

- Access Controls: Implements detailed permissioning across the protocol

The system uses Chainlink oracles for price accuracy.

What is the CAP (rCAP) Token?

CAP (rCAP) is the governance and ecosystem token of the Cap protocol.

Use Cases

-

Governance:

- Protocol parameters

- Collateral management

- Operator admission processes

- Fee structures

-

Protocol Integration (planned):

- Staking mechanisms for operators, delegators, and users

CAP (rCAP) Tokenomics

- Ecosystem development: 46.72%

- Team: up to 20%

- Investors: up to 20%

- Community ICO: 10%

- Echo community sale: 3.28%

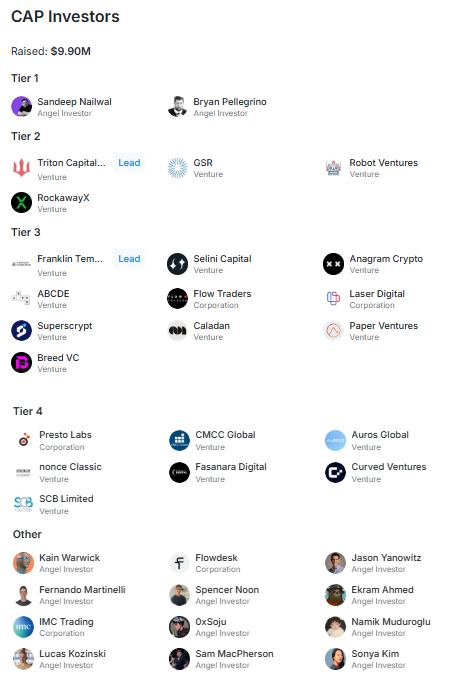

CAP (rCAP) Investors

Cap has raised a total of $9.90 million to date. The project has received support from leading names in the crypto industry as well as institutional actors with traditional finance backgrounds.

- Tier 1: Sandeep Nailwal, Bryan Pellegrino

- Tier 2: Triton Capital (formerly Kraken Ventures), GSR, Robot Ventures, RockawayX

- Tier 3: Franklin Templeton Investments, Selini Capital, Anagram Crypto, ABCDE, Flow Traders, Laser Digital, Superscrypt, Caladan, Paper Ventures, Breed VC

- Tier 4: Presto Labs, CMCC Global, Auros Global, nonce Classic, Fasanara Digital, Curved Ventures, SCB Limited

- Others: Kain Warwick, Flowdesk, Jason Yanowitz, Fernando Martinelli, Spencer Noon, Ekram Ahmed, IMC Trading, 0xSoju, Namik Muduroglu, Lucas Kozinski, Sam MacPherson, Sonya Kim

CAP (rCAP) Team

The core team of Cap consists of experienced individuals in DeFi and infrastructure development:

- Benjamin – Founder

- Weso – CTO and Founding Member

- DeFi Dave – Head of Growth

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.