Global trade, despite having trillions of dollars in volume, still operates through fragmented systems, manual processes, and intermediary-dependent financing models. Companies are forced to run disconnected operations between contracts, invoices, shipping documents, and payments. This situation both slows down cash flow and makes access to financing more difficult. Nexity Network (NXT) positions itself as an on-chain trade operating system that aims to fundamentally transform this structure.

Nexity Network tokenizes trade contracts, invoices, and trade assets, not only digitizing them but also making them instantly usable, transferable, and financeable. The goal is to reduce friction in global trade, accelerate payments, and optimize capital flow through a programmable infrastructure.

What Does Nexity Network (NXT) Offer?

Nexity Network offers an on-chain trade infrastructure that aims to eliminate the fragmented structure in global trade and make transactions programmable, verifiable, and instant. By unifying the entire lifecycle from contract to final payment on a single protocol, it targets accelerating capital flow and reducing operational costs.

This approach, which redefines the way trade is conducted with software logic, aims to establish a new standard especially in the areas of access to finance, transparency, and automation.

On-Chain Trade with Nexity Network (NXT)

Nexity Network defines itself as an operating system for “on-chain trade.” It enables orders, contracts, payments, and liquidity to be coordinated on a single programmable layer. Thus, the trade process is executed from a single verifiable source instead of being scattered across email chains, ERP systems, and separate portals.

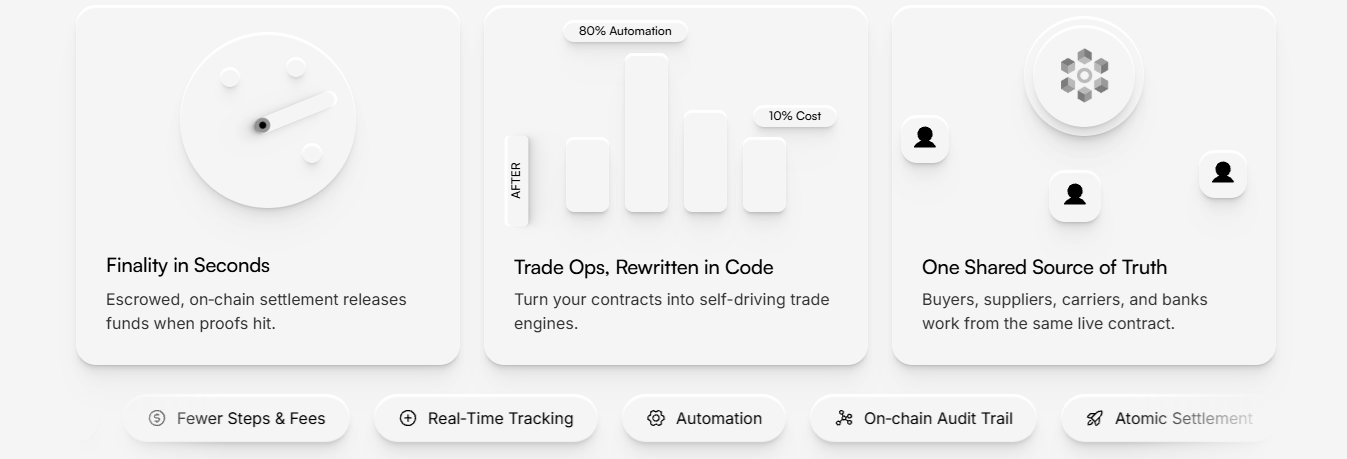

The platform’s core approach is to turn commercial operations into code. Contracts cease to be mere text documents and transform into “smart trade engines” containing milestones, obligations, and payment triggers. When specified proofs (e.g., delivery verification) are recorded on-chain, funds can be automatically released. This structure claims to provide finality in seconds.

Core Components: Full-Stack Trade Infrastructure

Nexity Network provides an end-to-end infrastructure for on-chain trade:

Contracts Structured, milestone-based agreements including identity verification, dates, amounts, and enforcement mechanisms. Verifiable and standardized contracts are created instead of free-text complexity.

Orders Orders are held on-chain along with all their terms. Negotiations, changes, and updates are recorded within a single verifiable state machine. This reduces versioning errors and fraud risk.

Payments Conditional settlement is possible through both fiat and cryptocurrency. Escrow mechanisms, partial payments, and split transfers are natively supported. Payment is automatically executed upon delivery proof.

Liquidity Invoices are converted into on-chain assets and matched in real-time with investors. The entire process from financing to closure can be transparently tracked.

Who Is It Designed For?

The NXT infrastructure addresses different trade actors:

- Corporate Companies: Can synchronize purchase orders, compliance processes, logistics, and payments in a single verifiable flow.

- SMEs: Can instantly turn receivables into liquidity and transition to on-chain trade without needing additional operational teams.

- Cross-Border Traders: Can automate customs, currency, tracking, and payment processes with delivery triggers.

- Web3 Ventures: Can combine service trade, access to capital, and compliance integration within a single infrastructure.

Real Use Cases

Example cases executed on the platform demonstrate operational efficiency and cost advantages:

- Mefin: A $250,000 B2B contract was tokenized. An investor purchased the token at a 4.5% discount; the company bridged the 60-day term without using credit.

- Promat: Purchase orders and logistics milestones were coded; event-based payment rate reached 68%, versioning errors dropped to 7%.

- Aqua Flux: Daily delivery routes were connected to a single smart contract; manual escrow transactions fell to 14%, lost document rate dropped to 0%.

Atomic Structure Instead of Fragmented Trade

In the traditional model, workflows are manual, counterparty checks occur in separate systems, and fund releases are delayed. The NXT model provides end-to-end control by offering:

- Verified parties (KYC/KYB)

- Coded obligations

- Proof-based payment release

- Export-ready full transaction history

Nexity Network (NXT) Partners and Integrations

NXT is designed to integrate with existing technology and financial infrastructures. It aims to enable companies to transition to the system without changing tools by being compatible with banks, stablecoin providers, identity verification solutions, and blockchain networks.

- Stripe

- ConsenSys

- Chainlink

- Protocol Labs

- Circle

- Revolut

- Raiffeisen Bank

- ING Bank

- UniCredit

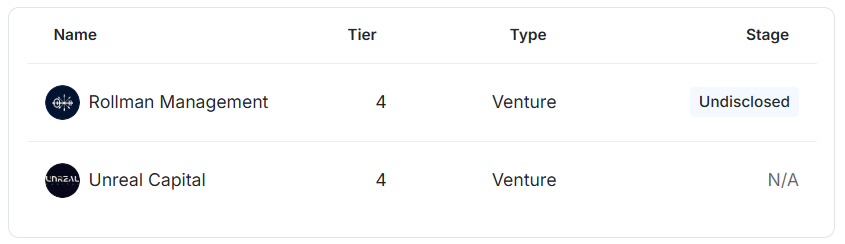

Nexity Network (NXT) Investors

Nexity Network is supported by investors who believe in the vision of moving trade on-chain. The project has received strategic capital support in the early stage.

- Rollman Management

- Unreal Capital

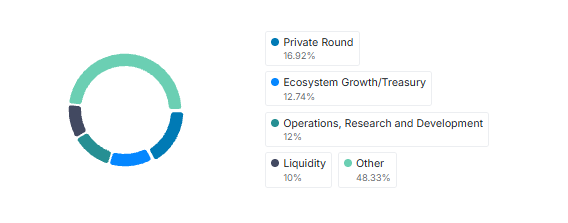

Nexity Network (NXT) Tokenomics

The economic model of the Nexity Network ecosystem is structured around the NXT token. The token plays a core role in the execution of contracts on the on-chain trade infrastructure, access to liquidity, and ecosystem incentive mechanisms. Below are the project’s current supply structure and distribution data.

Distribution:

- Private Round: 16.92%

- Ecosystem Growth / Treasury: 12.74%

- Operations, Research and Development: 12%

- Liquidity: 10%

- Other: 48.33%

Total Supply: 100,000,000 NXT

Nexity Network (NXT) Team

The Nexity Network team consists of experienced names in finance, technology, and business development. The management cadre is shaped around the vision of making global trade processes programmable.

- Catalin Fetean – Co-Founder

- Tiberiu Serbaneci – Co-Founder

- Constantin Sirbu – CDO (Chief Data Officer)

- Mihai Dumitrescu – CTO (Chief Technology Officer)

- Ruslan Kapustin – Head of Research

- Vincent Calianno – CBDO (Chief Business Development Officer)

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.