Zoth (ZOTH) is an innovative financial ecosystem that aims to bridge traditional finance (TradFi) with on-chain finance. Its primary goal is to combine real-world assets (Real World Assets – RWA) with blockchain-based liquidity to create a more efficient, transparent, and accessible financial infrastructure for both individuals and institutions.

Zoth’s most prominent product, ZOTH – Fixed Income (ZOTH-FI), is an institutional-grade fixed-income instrument marketplace. Through this platform, real-world assets such as cross-border trade finance, treasury bills, and government bonds are tokenized and traded. This enables investors to access fixed-income products that have limited accessibility in traditional markets via on-chain infrastructure.

What is Zoth Aiming For?

Zoth (ZOTH) is a comprehensive project that aims to create a next-generation financial infrastructure by integrating real-world assets with on-chain finance. With its RWA marketplace, USDZe liquid yield asset, global payment solutions, and governance-based token structure, it targets both individual users and institutional actors.

In an era where the boundaries between traditional finance and blockchain technology are becoming increasingly blurred, the integrated and institutional-grade structure offered by Zoth presents a remarkable model—particularly for the Global South and cross-border transactions.

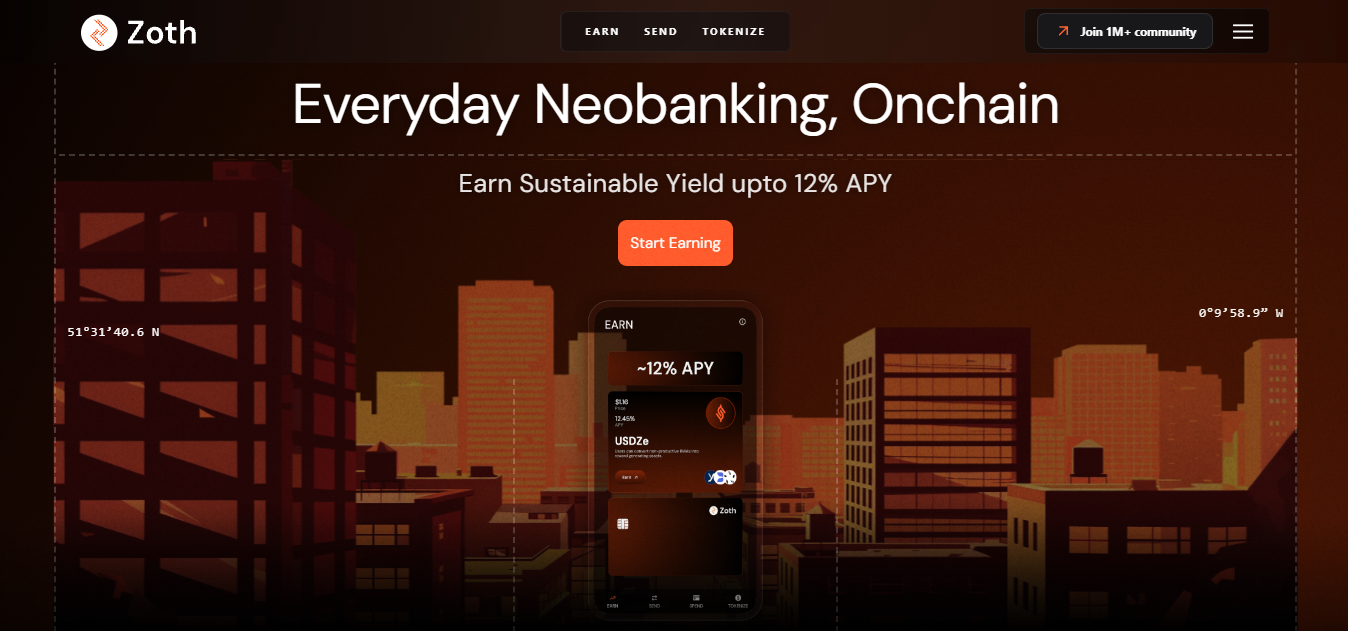

Zoth (ZOTH) Ecosystem: Privacy-Focused Neobank

Zoth is not merely an RWA platform; it is also positioned as a privacy-focused stablecoin neobank targeting the Global South and the emerging “agentic economy.” This vision aims to facilitate access to dollar-based assets for billions of people, accelerate cross-border payments, and make financial services more inclusive.

The ecosystem integrates yield, payments, card solutions, liquidity management, compliance, and security infrastructure into a single cohesive structure. This holistic approach provides an institutional-grade financial layer for individuals, businesses, and autonomous systems.

USDZe: Liquid Yield Asset

At the center of the Zoth ecosystem is USDZe. USDZe is positioned as a Liquid Yield Asset designed through a combination of RWA and DeFi strategies. Built within a transparent, compliant, and auditable framework, this asset aims to generate sustainable yield.

Key features offered by USDZe:

- Approximately 10% APY potential

- Backed by high-quality real-world assets

- Diversified DeFi strategies

- Programmable capital structure

USDZe is designed not only for individual investors but also for machine-based financial applications and autonomous agents. This allows capital to operate in an integrated manner with smart contracts.

Zoth Payments, Card, and Global Transfer Infrastructure

Zoth combines the neobank experience with blockchain transparency. Through the integrated Zoth Card, users can directly access their USDZe balances. Users can spend their balances both online and in physical stores.

Additionally, the system offers:

- Near-zero-cost global money transfers

- Instant cross-border settlement

- Infrastructure optimized for high-frequency and agent-supported transactions

Users can earn reward points through spending, sending, and saving activities. These points can be converted into on-chain yield boosts or ZOTH token rewards. Real-world benefits such as travel and premium experiences are also integrated into the ecosystem.

Zoth for Institutional Liquidity and Tokenization

The project enables institutions to tokenize their assets through regulated and compliant fund structures, allowing faster access to liquidity. Bringing real-world value on-chain creates a more transparent and efficient process for both investors and issuers.

This structure particularly aims to create alternative financing channels in cross-border trade finance and fixed-income products.

Zoth (ZOTH) Tokenomics

The ZOTH token sits at the center of the ecosystem and has multi-dimensional use cases.

- Governance and Decision Mechanism ZOTH holders have the right to participate in protocol governance. Critical decisions such as fee structures, treasury management, and product integrations are shaped by token holder votes. This structure creates a decentralized and community-driven governance model.

- Enhanced Yield and Incentive Mechanism Users who stake ZOTH can benefit from:

- Higher yield rates on products such as USDZe

- Discounts on transaction fees

- Loyalty program advantages

The token serves as the core element of reward structures that encourage long-term participation.

- Value Capture and Sustainability A portion of the revenue generated from Zoth’s core business lines is directed toward ZOTH token buyback, burn, and reward mechanisms. These business lines include:

- Remittance transactions

- Liquid Yield asset yields

- Tokenization services

This model aims to reward long-term token holders and establish a direct link between operational success and token value.

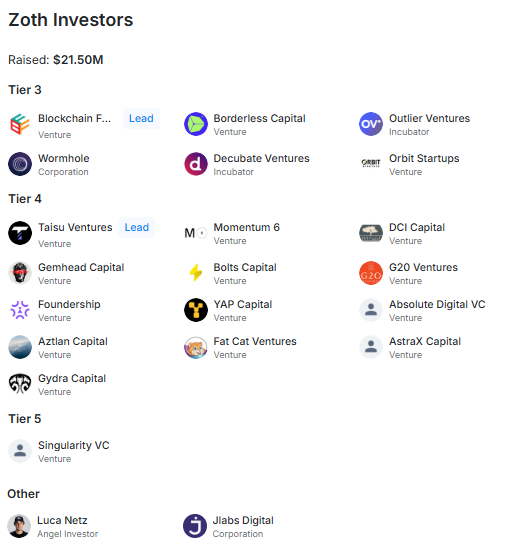

Zoth Investors

The project has raised a total of $21.50 million to date. It is supported by numerous venture capital funds and institutional investors at various levels.

Tier 3 Investors

- Blockchain Founders Fund, Borderless Capital, Outlier Ventures, Wormhole, Decubate Ventures, Orbit Startups

Tier 4 Investors

- Taisu Ventures, Momentum 6, DCI Capital, Gemhead Capital, Bolts Capital, G20 Ventures, Foundership, YAP Capital, Absolute Digital VC, Aztlan Capital, Fat Cat Ventures, AstraX Capital, Gydra Capital

Tier 5 and Others

- Singularity VC, Luca Netz (Angel Investor), Jlabs Digital

This broad investor base demonstrates that the project has received support from both the Web3 and traditional investment ecosystems.

Zoth Team

The project’s founding team consists of experienced individuals in technology and finance. The leadership team is as follows:

- Pritam Dutta – Founder & CEO

- Koushik Bhargav Muthe – Co-Founder & CTO

The team demonstrates a strong vision in technical infrastructure development and product strategy, positioning Zoth in both the RWA and stablecoin-based neobank space.

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.