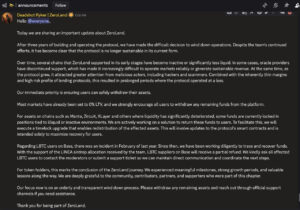

A notable development has occurred in the crypto market. The decentralized finance (DeFi) lending protocol Zerolend announced that it will shut down its platform after nearly three years of operation. The project team cited current market conditions and sustainability concerns as the reasons behind ending operations. Following the closure announcement, Zerolend’s native token ZERO faced sharp selling pressure. Investors reduced their positions due to uncertainty and loss of confidence, causing a rapid price drop. This incident highlights how liquidity fluctuations and user activity in the DeFi sector are increasingly putting pressure on certain projects.

Withdrawal Alert Issued to Users

The Zerolend team advised users to withdraw their funds from the platform as soon as possible. They assured that the withdrawal process would be smooth and that protecting user assets is a top priority. The infrastructure to support secure withdrawals will remain operational, and support will be available to prevent any user losses. The team also revealed a partial compensation plan for users affected by last year’s LBTC attack on the Base chain, offering phased refunds via Linea (LINEA) tokens. This is intended to maintain user trust during the shutdown process.

Why Zerolend is Closing

According to the official statement, the protocol is no longer sustainable in its current form. Key factors influencing the decision include:

- Significant decline in user numbers across supported networks

- Reduced liquidity and low transaction volumes

- Weak revenue model and shrinking profit margins

- Increased cybersecurity risks and operational costs

- Withdrawal of support from certain oracle and price feed providers

The team noted that prolonged operation in low-liquidity networks causes financial losses, making it difficult to maintain a stable DeFi lending environment. Networks like Manta Network (MANTA), Zircuit (ZRC), and X Layer (XLAYER) saw substantial liquidity drops, negatively impacting the protocol’s revenue. The loss of oracle support also posed risks for accurate pricing in lending and collateral operations.

ZERO Price Plummets

Following the closure announcement, Zerolend’s native token ZERO dropped over 30%, reflecting investor loss of confidence and uncertainty about the platform’s future. The sharp decline underscores how critical active user bases and sustainable revenue models are for long-term survival in the DeFi sector.

Assessment

Zerolend’s shutdown highlights the importance of liquidity, active communities, and sustainable financial models for DeFi projects. Low trading volumes, rising security and operational costs, and decreasing infrastructure support pose serious risks for small- and mid-sized projects. The sector is moving toward a more selective and consolidated phase, where only well-structured, financially resilient, and actively supported projects are likely to survive long-term.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.