In the crypto market, options are almost as important as spot prices, and a quiet but powerful signal has emerged in this space. The $40,000 Bitcoin put option, set to expire on February 27, has become the second-largest open position, with approximately $490 million in notional value. These types of positions typically indicate that investors are taking probabilities seriously. It’s not that Bitcoin is expected to necessarily drop to $40,000, but rather that investors are hedging against potential sharp downside risks.

Even though Bitcoin appears relatively strong in the spot market, movements in the derivatives market reflect deeper investor psychology. The options market often signals fear and expectations before price charts do.

A $40,000 put option gives the holder the right—but not the obligation—to sell Bitcoin at $40,000.

For example:

-

Suppose Bitcoin is trading at $66,000

-

You buy a $40,000 put option

-

If Bitcoin plunges to $30,000, you still have the right to sell at $40,000

-

Market price: $30,000

-

Your right: $40,000

-

Difference: $10,000 advantage

Hedging Against Downside Risk

Put options act as insurance against price drops. The $40,000 put option shows that the market has not entirely ignored extreme downside scenarios. The concentration of approximately $490 million at this strike highlights growing demand for protection against deep tail risks. This doesn’t necessarily mean the market expects a crash, but uncertainty is clearly being priced in.

Bitcoin is currently around $66,000, making the $40,000 strike a “tail risk” hedge relative to the spot price. Investors are insuring against this possibility even if they don’t see it as the base scenario. This is typical behavior in transitional phases.

$7.3 Billion in Options Expiring

The focus is not just on a single strike. By the end of the month, roughly $7.3 billion in Bitcoin options will expire. This volume is a critical threshold for short-term market direction.

The $75,000 strike holds about $566 million and represents the “max pain” level—the price at which the most options expire worthless and sellers gain maximum advantage. While the spot remains below this level, option sellers retain their edge, but price dynamics can shift rapidly as expiration approaches.

Option markets are usually more sensitive around such thresholds, with liquidity increasing and volatility widening—sometimes faster than expected.

Bullish Potential Not Gone, But Caution Evident

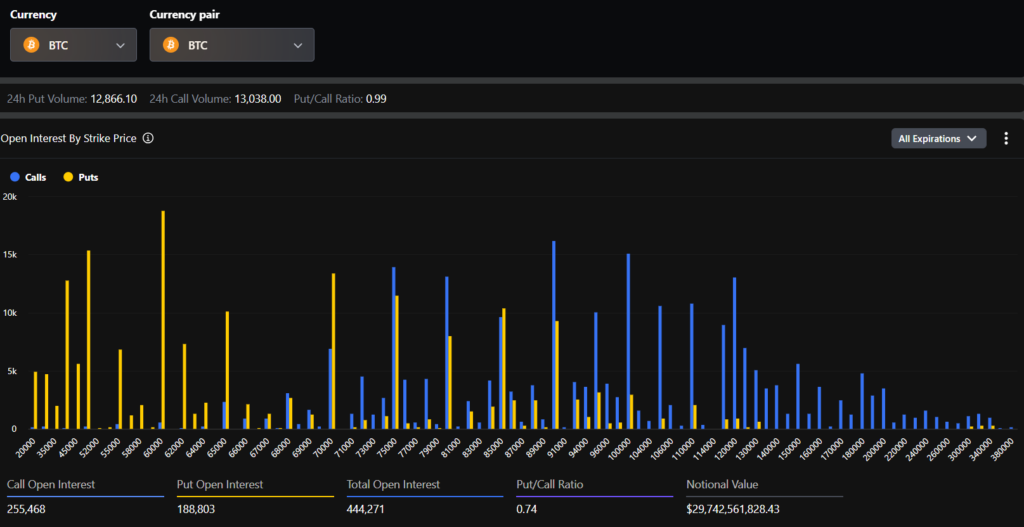

Looking at overall option distribution: 63,547 call contracts vs. 45,914 put contracts. Bullish positioning remains dominant, but the demand for downside protection has clearly risen.

The put/call ratio of 0.72 shows that upward bets are still stronger, yet the concentration of low-strike put positions highlights an increased need for insurance against negative moves. This balanced behavior often appears in uncertain phases—neither full risk appetite nor panic dominates.

Options Data Reflect Changing Market Psychology

This positioning indicates that investors are not strictly one-sided. They prefer flexible, hedged approaches. The market hasn’t entered a decisive trend yet. Large investors tend to avoid aggressive directional bets during such periods, preferring to be prepared for both scenarios.

Currently, the structure shows that while upside potential remains on the table, downside risks are not ignored. The options market often speaks before the spot market in these transitional phases.

Market Approaching a Critical Threshold

With the big option expiry on February 27 approaching, BTC market volatility potential continues to rise. The concentration of large positions makes the price more sensitive and reactive.

Increasing protection at low strike prices signals that investors are taking risk management seriously. This does not mean the market is weak—it simply indicates a more cautious approach. The options market isn’t showing clear fear, but neither is it signaling full confidence.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.