The amount of Bitcoin that can still be purchased on the open market is steadily shrinking. On-chain data shows that exchange reserves continue to decline as institutional investors and long-term holders move coins into cold storage, effectively removing them from liquid circulation.

Liquid Supply Is Much Lower Than Total Circulating Supply

This trend matters because not all Bitcoin in existence is actually available for purchase. While over 19 million coins have already been mined, a large portion is held by long-term investors who rarely sell. As a result, the true liquid supply the Bitcoin actively available on exchanges is significantly lower than the total circulating supply.

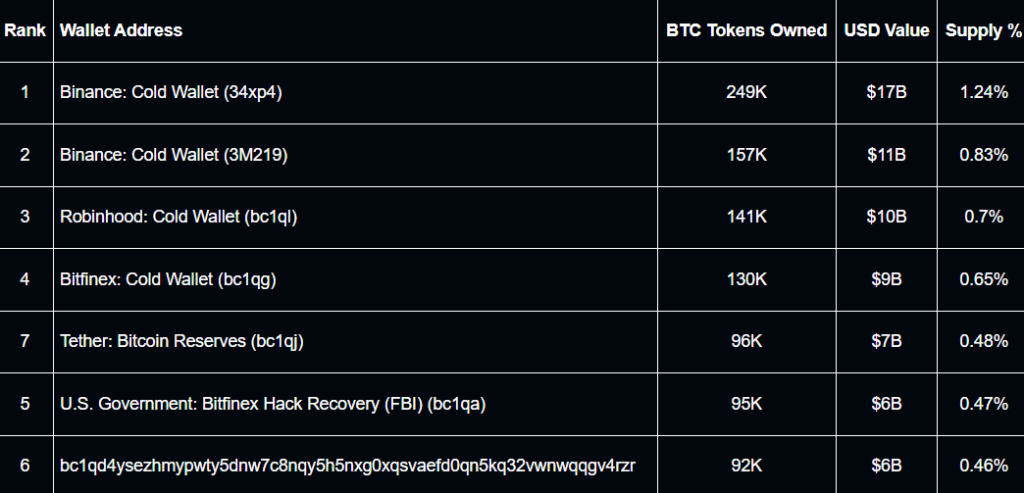

Exchange reserve data provides one of the clearest signals. Over the past few years, Bitcoin balances held on centralized exchanges have consistently declined. This indicates that investors are withdrawing coins into private wallets rather than keeping them available for trading. Historically, such behavior has often preceded major supply squeezes.

Institutional Accumulation Is Removing Coins From Circulation

Institutional accumulation has played a major role in this shift. Large entities, including funds and corporate investors, tend to acquire Bitcoin and hold it for extended periods. Unlike short-term traders, these buyers reduce the available float, tightening overall market liquidity.

Long-term holders, often referred to as “strong hands,” have also contributed to the shrinking liquid supply. On-chain metrics show that a growing percentage of Bitcoin has not moved for months or even years. These dormant coins effectively reduce the number of coins that can respond to immediate market demand.

Supply and Demand Imbalance Is Becoming Structurally Stronger

This dynamic creates a structural imbalance. When demand increases while liquid supply remains constrained, price volatility can intensify. Even modest inflows of new capital can have a disproportionate impact because fewer coins are available for purchase.

Another important factor is Bitcoin’s fixed maximum supply of 21 million coins. Unlike traditional assets, Bitcoin’s issuance is predetermined and decreases over time due to halving events. This predictable scarcity reinforces the long-term supply tightening narrative.

Exchange Reserve Declines Signal Increasing Scarcity

Current on-chain indicators suggest that the market may be entering another phase where available supply becomes increasingly limited. Exchange reserve declines, long-term holder accumulation, and institutional demand are converging into a single signal: the amount of Bitcoin readily available to buy is becoming more constrained.

This does not mean Bitcoin will immediately rise in price, but historically, sustained reductions in liquid supply have increased the probability of stronger price movements over time. Market participants closely monitor these metrics because supply availability ultimately plays a critical role in price discovery.

As liquid supply continues to shrink, the balance between buyers and sellers becomes more fragile. In such an environment, shifts in demand can have amplified effects, reinforcing Bitcoin’s underlying scarcity narrative and its position as a structurally limited digital asset.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.