Google search behavior in the United States is showing an unusual pattern. The phrase “bitcoin going to zero” reached its highest recorded level in February. This surge coincided with Bitcoin falling toward the $60,000 level after previously trading near $68,000. At first glance, it resembles a classic panic signal. However, global data tells a different story. In fact, it suggests something more nuanced.

This divergence indicates that market psychology is not moving in a single, unified direction.

U.S. Fear Spikes Sharply While Global Interest Declines

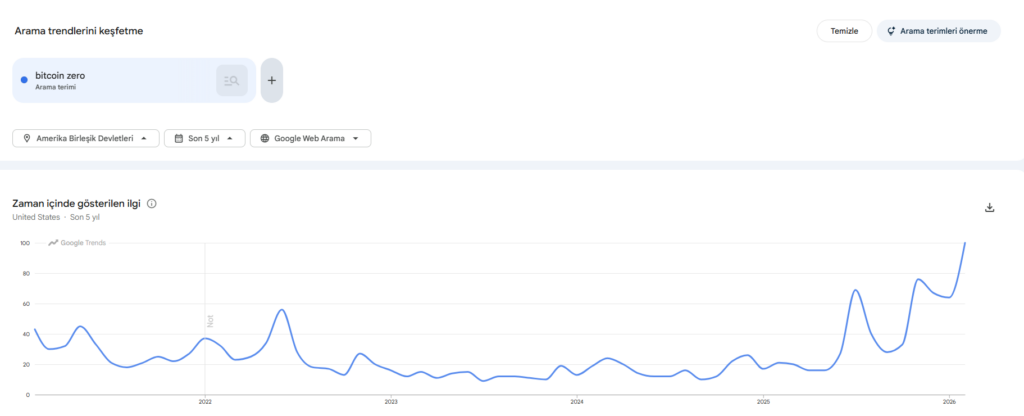

According to Google Trends, searches for “bitcoin zero” in the United States reached the maximum score of 100 in February on the platform’s relative interest scale. This marks the highest level of search intensity within the selected timeframe. Similar spikes were observed in 2021 and 2022, both of which occurred close to local price bottoms for Bitcoin.

Because of this pattern, some analysts interpret extreme search spikes as signs of capitulation — moments when retail investors emotionally surrender to losses. Historically, such periods often align with the late stages of sell-offs.

This time, however, the global data does not confirm the same level of panic.

Worldwide, the same search term peaked at 100 in August. Since then, interest has steadily declined, falling to just 38 this month. Instead of setting new highs, global fear-based searches have been fading for months.

In other words, while fear intensified in the United States, it has been cooling across the rest of the world.

This kind of divergence matters.

Macro Pressure Appears to Be Affecting U.S. Retail Investors More Directly

Recent macro developments have been heavily concentrated in the United States. Escalating tariff rhetoric, geopolitical tensions involving Iran, and broader risk-off sentiment in U.S. equities have all contributed to a more fragile investor environment.

Retail investors tend to react quickly to domestic headlines. In contrast, investors in Asia and Europe may interpret the same price decline through a different macro lens. As a result, Bitcoin — despite being a global asset — can experience regionally uneven fear responses.

That asymmetry is now visible in the data.

Fear is elevated in the U.S., but globally, sentiment appears more stable.

The Hidden Limitation of Google Trends Data

Google Trends does not report absolute search volume. Instead, it assigns scores on a relative scale from 0 to 100. A score of 100 simply represents the highest level of interest within the selected period.

This distinction is important.

BTC user base has expanded significantly since the 2022 bear market. A score of 100 today reflects a surge relative to a much larger baseline audience. It does not necessarily mean more people searched in absolute terms compared to previous cycles.

In other words, the spike signals elevated relative fear, but it must be interpreted within the context of a growing adoption curve.

Bottom Signal Remains Possible, but Confirmation Is Incomplete

Retail panic often emerges near market bottoms. This behavioral pattern has repeated across multiple Bitcoin cycles. However, such signals are rarely reliable in isolation, especially when global data fails to confirm the same trend.

The current structure is more complex. U.S.-based fear has surged sharply, yet global fear indicators have been declining.

This weakens the reliability of a clear capitulation signal.

Panic exists — but it is not universal.

These kinds of fragmented sentiment structures often appear during transitional phases. Sometimes they precede trend reversals. Other times, they reflect temporary emotional stress without marking a definitive bottom.

As Bitcoin stabilizes near the $60,000 region, investor psychology remains unsettled. Search data confirms rising anxiety among U.S. retail participants. However, without broader global confirmation, the signal remains incomplete.

The market, for now, has not fully revealed its direction.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.