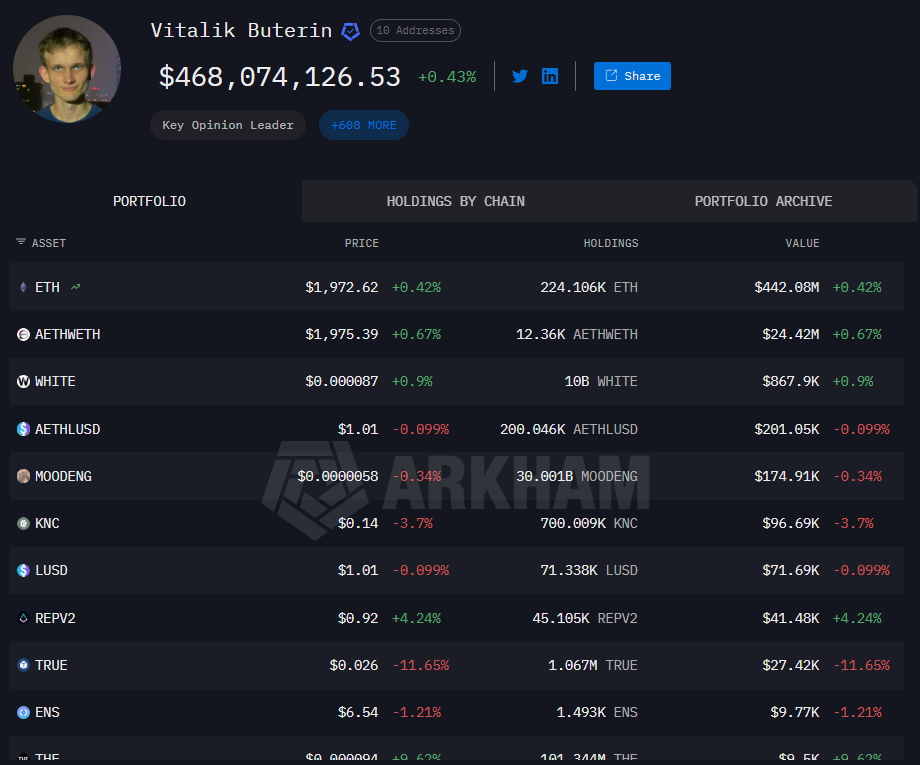

Ethereum co-founder Vitalik Buterin’s wealth has been a topic of curiosity for years. On-chain data now clarifies the picture: the known wallets controlled by Buterin hold over 240,000 ETH. The current value of this amount is around $467 million. Almost the entirety of this wealth is directly tied to Ethereum’s price. In other words, rather than a diversified portfolio, it is heavily concentrated in a single asset.

Blockchain analytics platform Arkham’s on-chain investigation confirms that Buterin remains one of the largest accessible individual ETH holders. However, in the overall ranking, exchanges, ETF custodians, and staking contracts are far ahead. This distinction is important because individual control and institutional custody are not the same.

Why Vitalik Buterin’s ETH Share Has Decreased Over the Years

Although Buterin’s Ethereum balance is still massive, his share of the total supply has declined significantly over time.

At the end of 2015, Buterin held around 662,810 ETH, accounting for about 0.91% of total supply. Today, his 240,010 ETH represents only 0.20% of the circulating supply.

Several factors explain this decline:

-

Buterin gradually sold ETH over the years

-

Ethereum’s total supply increased over time

-

Large donations and funding transfers occurred

-

Direct funding for ecosystem development

From the outside, this could appear as “selling pressure,” but most on-chain transactions point to donations and infrastructure funding rather than personal profit.

Recent Transactions: $43 Million ETH Move

At the end of January 2026, 16,384 ETH (about $43 million) was withdrawn from Buterin’s wallet. This move was interpreted as funding for Ethereum open-source infrastructure.

Immediately after, in early February, around 2,961 ETH (about $6.6 million) was sold in small pieces via CoW Protocol. This method is usually chosen to avoid sudden market pressure. Instead of a single large order, transactions are split. This indicates careful liquidity management.

During the same period, Ethereum Foundation announced a “mild austerity” phase. Buterin personally funding certain projects aligns with this move.

Buterin’s Wealth is Almost Entirely ETH-Dependent

Buterin’s wealth structure differs from classic tech billionaires. Rather than stock, company shares, or a broad investment portfolio, most of his wealth is concentrated in a single asset.

In 2021, when ETH crossed $3,000, Buterin became a billionaire. In November of that year, during ETH’s peak, his net worth reached $2.09 billion.

However, the crypto bear market is harsh. In 2022, his wealth fell by approximately 75%. In 2025, as ETH prices approached $5,000 again, his net worth briefly surpassed $1 billion. Today, it stands at roughly $467 million.

This volatility is a direct result of the limited diversification of his portfolio.

Source of Wealth: 2014 Ethereum Pre-Sale

Buterin’s current wealth stems from Ethereum’s 2014 pre-sale. At that time, 16.53% of the total supply was allocated to the founding team.

This early distribution has turned into hundreds of millions of dollars today. Buterin also left university thanks to a $100,000 Thiel Fellowship grant, allowing him to focus full-time on Ethereum. This decision is considered one of the critical turning points in crypto history.

Who Holds the Most Ethereum?

The largest ETH balance in the network does not belong to a single individual. At the top is the ETH2 staking contract, holding millions of ETH locked by validators, naturally leading the list. Institutional players such as Binance, BlackRock, and Coinbase are also prominent, usually holding user assets and ETF funds.

Among individual holders, Vitalik Buterin stands out. Early investor Rain Lohmus holds roughly 250,000 ETH but lost access to the wallet’s private keys. Therefore, Buterin remains one of the largest accessible individual ETH holders.

Wealth Mirrors Ethereum’s Performance

Vitalik Buterin’s financial situation mirrors Ethereum itself. When ETH rises, his wealth grows rapidly; when ETH falls, it declines just as fast.

While limited diversification may seem risky, it also signals strong alignment with the network’s success. This distinguishes Buterin from classic tech founders, as his wealth depends directly on a protocol’s future rather than a company’s shares.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.