The cryptocurrency market is entering the first month of 2026 with a major supply increase on the agenda. In January, approximately $2 billion worth of token unlocks are expected across 18 different altcoins. This development is closely watched by investors, especially in terms of short-term price movements. Since token unlocks increase circulating supply, they can create selling pressure on the affected crypto assets. The impact on price largely depends on who receives the unlocked tokens, how projects manage the increased supply, and overall market conditions.

ONDO Will See the Largest Token Unlock

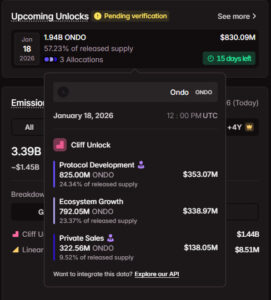

The most notable token unlock in January will occur in Ondo (ONDO). On January 18, a total of 1.94 billion ONDO tokens will be unlocked. This amount corresponds to a striking 57.23% of the circulating supply. In dollar terms, the unlock is valued at approximately $830 million at current prices, making ONDO the dominant contributor to January’s total token unlock volume.

Projects With Token Unlocks Exceeding $10 Million

Some of the projects expected to experience token unlocks above $10 million in January include:

- Hyperliquid (HYPE) – January 6:

46 million HYPE tokens will enter circulation. The total value is around $308 million, representing 3.61% of the circulating supply. - Official Trump (TRUMP) – January 18:

50 million TRUMP tokens will be unlocked, worth approximately $245 million, equal to 95% of the circulating supply. - Bitget Token (BGB) – January 26:

140 million BGB tokens will be released into the market. Valued at around $488 million, this corresponds to a 5% increase in circulating supply. - Plume (PLUME) – January 21:

36 billion PLUME tokens will be unlocked, representing a very high 39.75% of the circulating supply.

Projects With Medium-Scale Token Unlocks

In January, projects such as Arbitrum (ARB), Starknet (STRK), LayerZero (ZRO), Aptos (APT), Jupiter (JUP), and Ethena (ENA) will also experience smaller but potentially market-relevant token unlocks. In these cases, the supply increase typically ranges between 1% and 6%. While token unlocks do not always result in sharp price declines, they do tend to increase short-term volatility. Investors are generally advised to be more cautious, particularly with projects facing high unlock-to-circulating-supply ratios.

“High-ratio token unlocks can create price pressure. However, a project’s long-term roadmap and the intended use of the unlocked tokens will be key determining factors.”

Assessment

The approximately $2 billion in token unlocks expected in January 2026 is seen as a critical test for the altcoin market. Projects like ONDO, with exceptionally high unlock ratios relative to circulating supply, will be closely monitored for potential selling pressure. At the same time, overall market conditions, investor risk appetite, and how teams manage the newly unlocked tokens will ultimately determine the price impact of this supply increase.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.