a16z Crypto, one of the most influential investment firms in the cryptocurrency world, has shared its striking forecasts for 2026. The company’s comprehensive analysis reveals that the crypto sector is entering a new era in which it will move beyond being merely an investment vehicle and become deeply integrated with finance, the internet, and legal systems.

a16z Crypto: Crypto Is Shifting Toward an Infrastructure-Centric Model

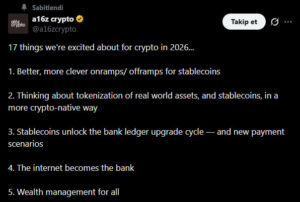

a16z Crypto’s 17-point report titled “Crypto Industry Trend Outlook” for 2026 emphasizes that the sector is undergoing a fundamental transformation. According to the report, crypto projects will no longer focus solely on generating transactions, as they have in the past. Instead, they will assume the role of an infrastructure layer that enables the transition to broader application ecosystems. This approach aims to make crypto one of the core building blocks of the internet and financial systems. a16z argues that this transformation will become clearer and more visible by 2026.

One of the key highlights of the report is stablecoins. According to a16z Crypto, stablecoins will significantly modernize banking ledgers and payment infrastructures by making fiat on- and off-ramp processes more efficient. This development is expected to pave the way for faster, lower-cost, and more transparent financial transactions for both individual users and institutional players.

a16z Crypto also predicts a new phase in the tokenization of real-world assets (RWAs). According to the report, this process will gradually evolve into a more “natively crypto” structure. Stablecoins are expected to become one of the critical infrastructure components of this new financial architecture. This transformation could enable traditional assets to be represented more effectively on the blockchain and become more accessible on a global scale.

Privacy, Artificial Intelligence, and New Paradigms

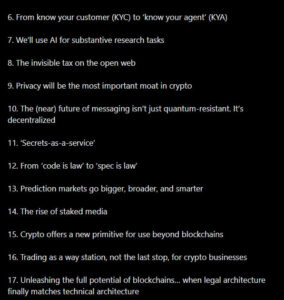

a16z Crypto positions privacy as one of the most important long-term competitive advantages of the crypto ecosystem. The report notes that new concepts such as decentralized and quantum-resistant communication solutions and “Privacy as a Service” will come to the forefront.

In addition, artificial intelligence is expected to be widely used not only in commercial applications but also in advanced research and analytical scenarios. Within this framework, the current “Know Your Customer (KYC)” approach is anticipated to evolve toward a “Know Your Agent (KYA)” model.

A Notable Statement from a16z Crypto

The report includes the following assessment:

“Crypto is moving beyond being a tool for financial transactions and is becoming the core infrastructure of the internet and financial systems. Once legal architecture aligns with technical architecture, the true potential of blockchain technology will be unlocked.”

According to a16z Crypto, 2026 will be a critical turning point for the cryptocurrency sector. Developments across many areas—from stablecoins and tokenization to privacy solutions and AI integration—are expected to support the long-term growth of crypto. With this transformation, cryptocurrencies may move beyond being purely financial instruments and become foundational infrastructure for the internet and the financial world.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.