Amid a high-volatility environment, ACX fell more than 10% on Friday following sweeping allegations of DAO governance misuse and insider trading ahead of its Binance listing.

Sharp ACX Price Drop

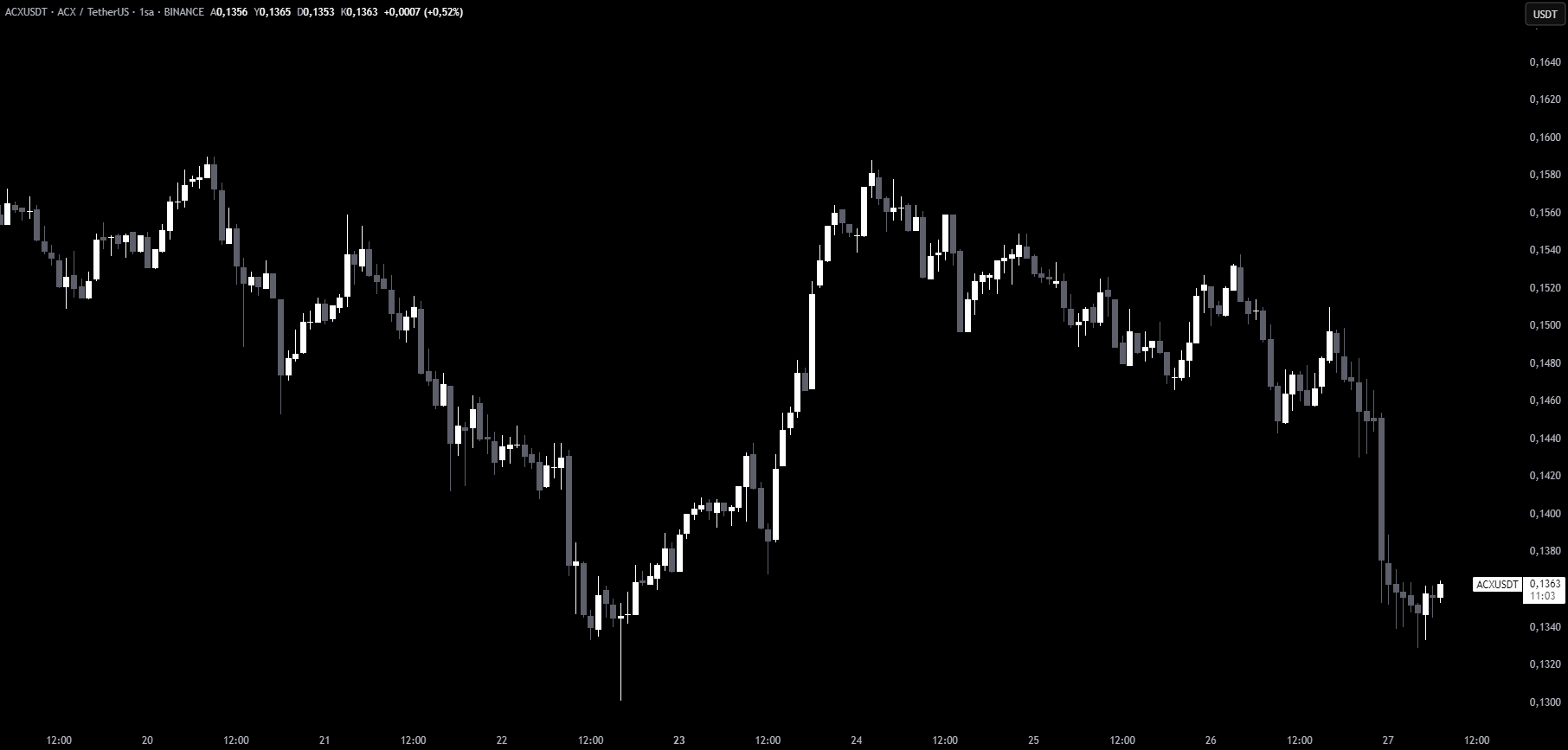

ACX plunged from approximately $0.151 to $0.134 after allegations surfaced. At the time of writing, ACX is down 12.5% in the last 24 hours and 41% over the past month.

DAO Misconduct Allegations

Ogle, the pseudonymous founder of Glue, claimed the Across Protocol team used community treasury tokens—worth roughly $23 million—for their private entity. He further alleged the use of secret wallets tied to Risk Labs’ CEO Hart Lambur and others to push through opaque proposals.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Across Protocol Fires Back

Hart Lambur swiftly dismissed the claims as entirely false. He clarified that Risk Labs, a Cayman-based non-profit, used treasury grants for protocol advancement—not private gain. Lambur emphasized transparency in governance, stating token grants remain untouched and housed in multisig wallets. He also insisted that neither he nor the team had insider knowledge regarding the Binance listing, which they learned from a tweet.

These allegations shine a spotlight on the need for stronger transparency and governance within DAOs. Token voting practices and treasury management continue to be critical concerns for crypto investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.