As we head into 2026, SocialFi (decentralized social media) projects—once promoted with huge expectations and bold promises in the crypto market—have almost completely disappeared from the scene. These projects aimed to combine social interaction with direct economic value for users. While they initially attracted strong interest, most failed to build a sustainable model. A comprehensive analysis published by Our Crypto Talk clearly shows that the SocialFi ecosystem—once marketed as one of the hottest trends of 2023–2024—has effectively collapsed and failed to leave a lasting impact on the industry.

Why Did SocialFi Collapse?

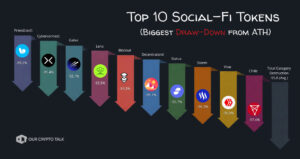

According to the analysis, most SocialFi platforms were either abandoned, acquired, or rendered functionally irrelevant. The majority of tokens associated with these projects lost more than 90% of their value, with some suffering declines of up to 99%. Formerly popular altcoins such as FRIEND, DEGEN, CYBER, RLY, and DESO stand out among the failed projects.

Our Crypto Talk emphasizes that participation in the SocialFi ecosystem was driven not by genuine community demand, but largely by speculative capital, bot-driven reward farming, and short-term trading activity. Once incentives faded, users quietly abandoned the platforms. This dynamic is described in the analysis as a clear illustration of the disconnect between actual usage and financial activity.

A Vision That Failed in Practice

In theory, SocialFi offered a highly appealing vision: direct value transfer instead of ad-based models, user-owned social graphs instead of centralized platforms, and content creators earning revenue without intermediaries. It positioned itself as a strong alternative to Web2 social media. In practice, however, social interaction increasingly became a balance-sheet metric, while conversations and posts were reduced to commercial instruments.

Our Crypto Talk summarizes the outcome with a striking statement:

“Hundreds of millions of dollars were raised, tokens dropped by 99%, feeds went quiet, and communities disappeared without even saying goodbye.”

A Notable Critique from Vitalik Buterin

One of the most significant criticisms highlighted in the analysis came not from market commentators, but from Vitalik Buterin, co-founder of Ethereum. In his remarks in early 2026, Buterin stressed that sustaining social networks does not come from producing more tokens. Instead, he called for a return to censorship-resistant, genuinely decentralized social networks that do not distort user behavior with financial incentives.

Final Assessment

The collapse of SocialFi clearly demonstrates a long-debated issue in the crypto world: the assumption that money inherently improves social interaction often backfires. Financial incentives reshaped behavior, and behavior reshaped community culture. The result was not merely insufficient earnings for users, but the erosion of the human nature of social interaction itself. For this reason, SocialFi lost its sustainability not due to technical shortcomings, but because of flawed design choices and misaligned incentives.