Ethereum is experiencing a notable divergence in whale behavior as January 2026 draws to a close. Rather than moving in a unified direction, large holders appear split between accumulation and distribution strategies. While some whales are steadily adding ETH during price weakness, others are transferring sizable holdings to exchanges, introducing potential selling pressure. This opposing activity reflects a clear power struggle beneath the surface of the market.

Ethereum Price Under Sustained Pressure

Ethereum has struggled to maintain momentum in recent weeks. Over the past seven days, ETH has fallen by more than 10%, wiping out all gains recorded earlier in the year. At the time of writing, Ethereum is trading near $2,913, marking a year-to-date decline of roughly 5%.

This price weakness has unfolded amid broader market uncertainty, creating conditions where whale decisions carry increased influence over short-term price dynamics.

Accumulation Signals From Large Holders

On-chain data indicates that several large investors are treating the recent pullback as a buying opportunity. One notable OTC-linked wallet, identified as 0xFB7, acquired 20,000 ETH in a single move, representing an investment of approximately $56 million. Over the past five days, the same address has accumulated a total of 70,013 ETH, worth more than $200 million.

This accumulation trend extends beyond a single wallet. Recently, whales collectively added over 350,000 ETH in just one day. At the same time, Ethereum balances held on centralized exchanges continue to decline, suggesting that a portion of this supply is being moved into long-term storage rather than positioned for immediate sale.

Rotation and Distribution Add Complexity

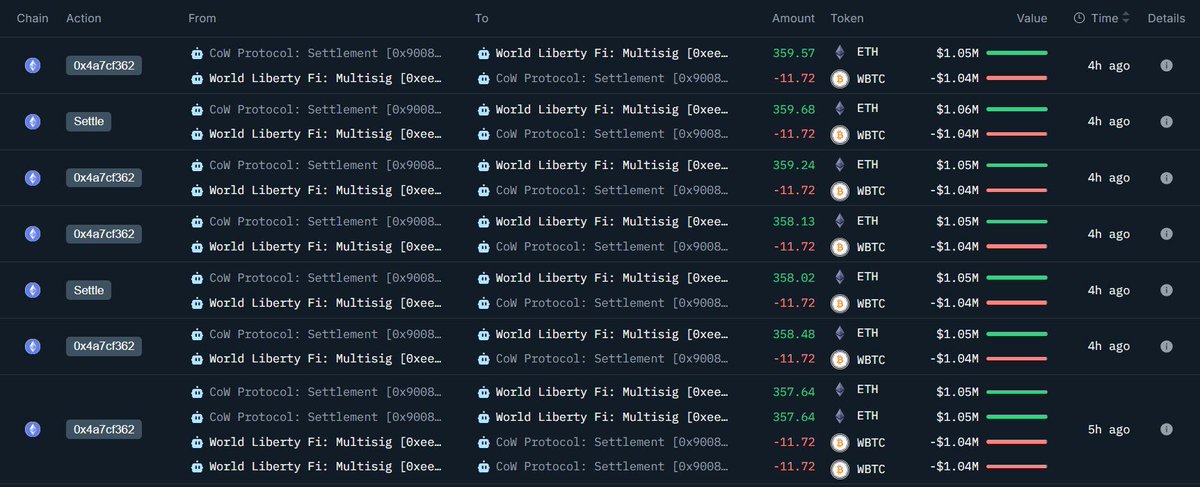

While accumulation remains evident, not all whale activity supports a bullish narrative. Some large investors are actively reshaping their portfolios. The DeFi project World Liberty Financial shifted part of its exposure from Bitcoin to Ethereum, swapping 93.77 WBTC for 2,868 ETH. Another whale followed a similar rotation, selling 120 BTC to acquire 3,623 ETH.

Conversely, an early Ethereum holder reactivated after nearly nine years of inactivity, transferring 50,000 ETH to the Gemini exchange. Although the wallet still retains 85,000 ETH, such a large exchange deposit often raises concerns about potential profit-taking or portfolio rebalancing.

Network Fundamentals Remain Strong

Despite mixed whale behavior and price consolidation, Ethereum’s network metrics paint a more constructive picture. The seven-day average of active Ethereum addresses has reached a record high of 718,000. This divergence between stagnant price action and rising network participation has historically preceded upward price movements.

Growth in Layer-2 usage, ongoing DeFi activity, and expanding user engagement continue to reinforce Ethereum’s long-term fundamentals. While whale activity remains divided, the underlying network data suggests that Ethereum’s broader value proposition remains intact.

This content is not investment advice. Cryptocurrencies involve significant risk, and investment decisions should be based on individual research.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.