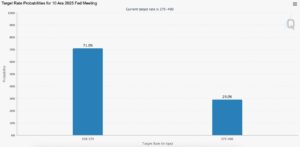

Global markets continue to intensify their focus on the Federal Reserve’s meeting scheduled for December 10, 2025, with expectations rising around a potential interest rate cut. Market pricing now shows a 71% probability that the U.S. Federal Reserve (FED) will lower interest rates by 25 basis points at the December meeting — a figure boosted by increasingly dovish signals and uncertainty surrounding recent data flow.

According to data provided by the CME FedWatch tool, the target rate range could be lowered to 350–375 basis points, while the likelihood of keeping the current policy range of 375–400 basis points stands at 29%.

This article may also catch your attention: Bitcoin (BTC) Recovery Gains Strength: Will the Uptrend Continue?

Factors Strengthening Expectations

Statements made by New York Fed President John Williams indicate that short-term adjustments to interest rates may be possible, further boosting market expectations of a rate cut.

Data flow disruptions in the United States are creating uncertainty in the FED’s decision-making process. Although recent minutes suggest differing views within the Fed regarding a potential rate cut, the overall sentiment points toward a policy easing at the final meeting of the year.

A higher probability of a rate cut has positively reflected on Bitcoin and altcoin markets, increasing appetite for risk assets. However, market participants remain cautious in light of possible surprises from the Federal Reserve.

For the latest breaking crypto news, click here