Arthur Hayes, co-founder of BitMEX, made headlines after initiating a major crypto asset sale during a sharp market downturn. Hayes offloaded Ethereum (ETH), Ethena (ENA), and PEPE tokens, with the total transaction amount exceeding $13.35 million.

According to Lookonchain data, the selloff included 2,373 ETH worth $8.32 million, 7.76 million ENA worth $4.62 million, and 38.86 billion PEPE tokens valued at around $414,700. The move came shortly after Bitcoin’s price dropped to $112,731 within 24 hours, signaling that Hayes anticipated the dip in advance.

Meanwhile, Julio Moreno, Head of Research at CryptoQuant, stated that Bitcoin has entered the third major profit-taking phase in its current bull cycle. Historically, such phases often mark a correction period that precedes a renewed upward trend.

Arthur Hayes(@CryptoHayes) sold 2,373 $ETH($8.32M), 7.76M $ENA($4.62M) and 38.86B $PEPE($414.7K) in the past 6 hours.https://t.co/1HymJRPhcj pic.twitter.com/MoJNKUjJaQ

— Lookonchain (@lookonchain) August 2, 2025

Strategic Pullback or Simple Profit-Taking?

Hayes’ decision appears at odds with his previous bullish outlook. He had predicted Ethereum would eventually reach $10,000, while consistently advocating for rapid altcoin adoption. The recent divestment could suggest a more cautious repositioning rather than a complete shift in sentiment.

Interestingly, just weeks prior, Hayes had acquired ENA tokens worth $1.5 million at lower prices. This indicates he remains active in early-stage projects, maintaining a broader long-term crypto investment strategy. Despite the selloff, his confidence in the market’s growth potential seems intact.

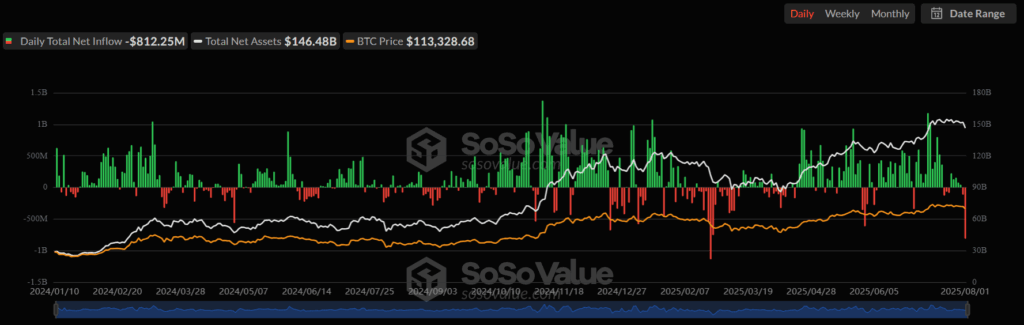

In addition, it’s not just Arthur Hayes adjusting positions. Institutional players are also retreating. Spot Bitcoin ETFs witnessed $812 million in net outflows—the second-largest single-day withdrawal on record. Fidelity’s FBTC fund led the exodus with a $331 million pullback.

Spot Ethereum ETFs also reported notable outflows, reflecting broader investor caution. This trend suggests risk appetite is decreasing and that investors are bracing for further market volatility.

Global Headwinds Build as Hayes Waits on the Sidelines

Hayes’ recent sell decisions might also reflect macroeconomic factors rather than crypto-specific concerns. The White House has announced new tariffs targeting over 60 countries, set to take effect on August 7. The U.S. Federal Reserve warns this could drive inflation higher. Hayes had previously cautioned investors about geopolitical shocks creating heightened volatility.

Thus, his selloff—particularly in ETH and PEPE—may not signal a bearish reversal, but rather a temporary repositioning. Hayes appears to be stepping back from short-term turbulence while staying invested in the long-term potential of select altcoins.

This approach reinforces a fundamental principle in investing: risk management remains critical, even in bullish markets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.