Decentralized derivatives exchange Aster is preparing for its upcoming token airdrop and weighing how best to structure the distribution. During a recent livestream, CEO Leonard revealed that the team is seriously considering the use of vesting schedules for recipients.

Why Vesting? Reducing Selling Pressure

According to Leonard, introducing vesting could prevent recipients from immediately selling large amounts of tokens, a scenario that might otherwise place heavy pressure on ASTER’s price. By doing so, Aster aims to protect the interests of both existing token holders and new community members:

“We reserve the right to move forward with this option. A final decision will be made and announced within the next two to three days,” Leonard said.

In the crypto world, vesting is a widely adopted practice. It helps maintain stability by locking tokens for a certain period and gradually releasing them, ensuring a healthier market environment.

320 Million Tokens Set for Season 2

Aster has allocated more than half of its total token supply to community airdrops. For Season 2, the platform confirmed that 320 million ASTER tokens, valued at around $600 million, will be distributed to participants.

During the livestream, Leonard explained that the team is carefully assessing whether the release of around 4% of the token supply could trigger unwanted selling activity. He emphasized that the protection of long-term holders is just as important as rewarding airdrop participants.

The Season 2 points accumulation period will officially close on October 5 at 11:59 pm UTC, with Leonard confirming that all details will be finalized and shared before the snapshot is taken.

Record-Breaking Trading Volume

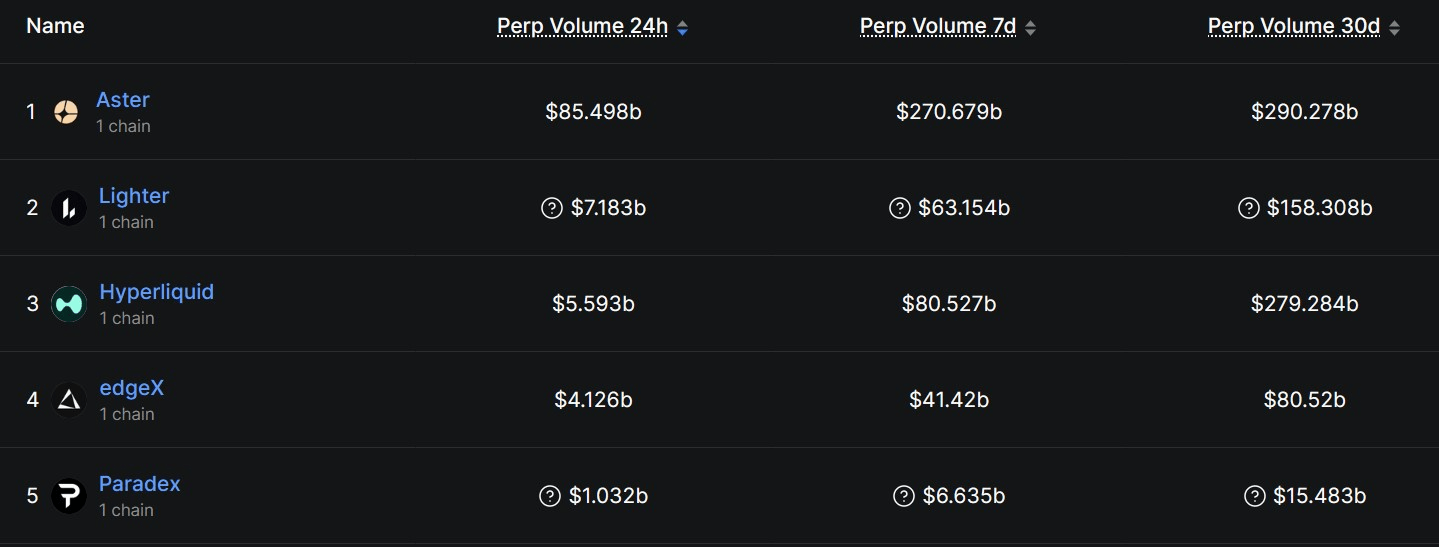

Ahead of the airdrop, Aster’s trading activity has surged dramatically. Data shows that the platform’s daily perpetual DEX volume recently climbed to $85 billion, more than 12 times higher than its closest competitor, Lighter, on the same day.

While these numbers highlight impressive adoption, some community members remain cautious. The key question is whether such high volumes can be sustained once the current incentives are reduced or phased out.

What is Aster DEX? How to Use It?

You can join our Telegram channel to not miss the news and stay informed about the crypto world.