The crypto market has been showing strong momentum recently, especially with the latest developments in Ethereum and Bitcoin ETFs. Data reveals that while Ethereum ETFs recorded strong inflows, Bitcoin ETFs displayed a more mixed outlook.

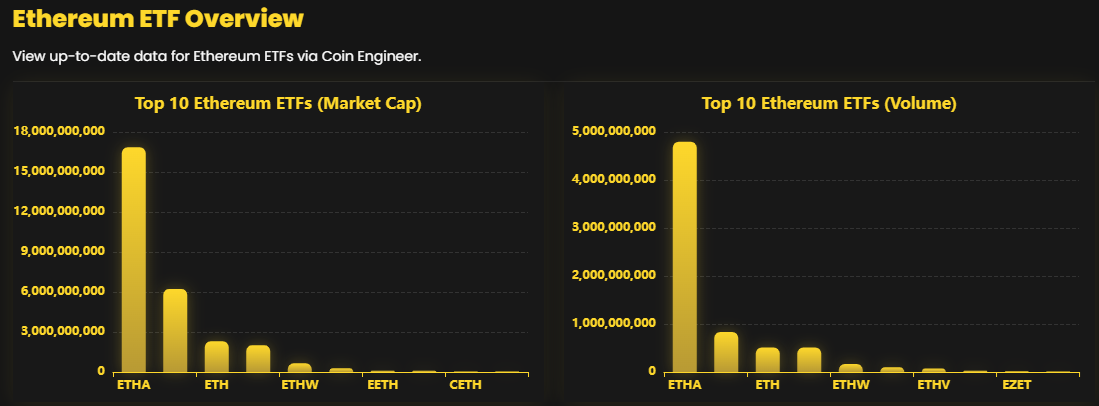

Ethereum ETFs See Strong Inflows

On the Ethereum side, ETHV, CETH, QETH, ETHE (+45.90m), ETH (+22.70m), ETHA (+109.40m), ETHW (+36.60m), FETH (+117.90m) and EZET (+5.50m) recorded a total inflow of +337.70 million dollars. This clearly indicates that institutional and retail interest in Ethereum ETFs remains strong.

Boosted by this momentum, Ethereum price reached a historic milestone last night, hitting a new ATH (all-time high) of $4,880. This record highlights investors’ growing confidence in ETH and the direct impact of ETF inflows on the market.

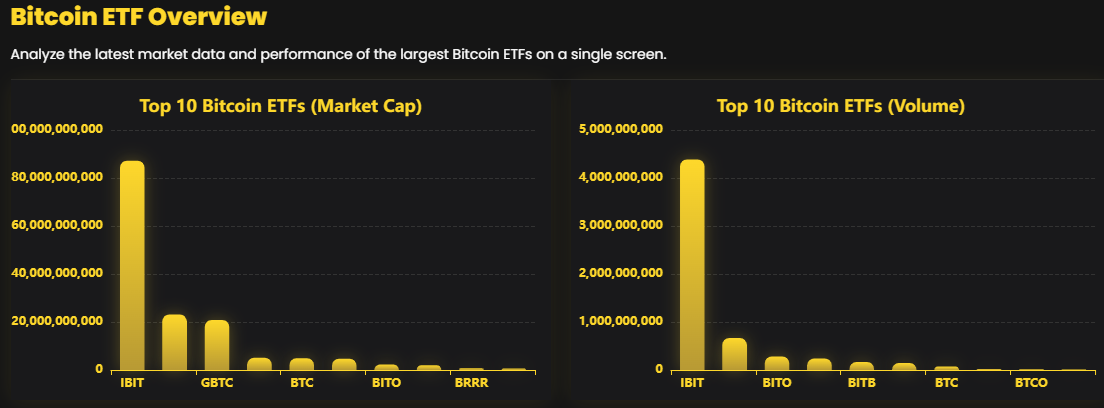

Click here to follow Bitcoin and Ethereum ETFs and other On-Chain data in real time.

Bitcoin ETFs Show a Mixed Picture

The situation looks different for Bitcoin. No inflows were observed for BTCO, BTC, BTCW and BRRR, while GBTC (+6.40m), FBTC (+50.90m), ARKB (+65.70m), BITB (+12.70m), HODL (+26.40m) and EZBC (+13.50m) added up to a total of -23.20 million dollars.

Despite this imbalance, Bitcoin price surged to around $177,000, supported by the overall positive market sentiment. Still, the ETF data shows that investors remain more cautious on the BTC side.

Macro Impact: Powell’s Remarks

During yesterday’s Jackson Hole meeting, Fed Chair Jerome Powell delivered relatively positive remarks that played a major role in fueling the rally. His references to potential “controlled easing steps” boosted demand for risk assets, further supporting momentum in both Ethereum and Bitcoin.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.