Binance CEO Richard Teng recently commented that Bitcoin’s (BTC) recent decline is not solely a crypto-specific phenomenon. According to Teng, the drop is largely driven by broader market deleveraging and risk-off behavior, with Bitcoin’s volatility now aligning with that of many major asset classes.

Since hitting all-time highs in early October, Bitcoin has dropped nearly 35%, trading around $82,000. The total cryptocurrency market capitalization has also fallen from $4.28 trillion to $2.84 trillion, reflecting a roughly 33% decrease. Despite this pullback, Teng emphasized that Bitcoin still trades at more than double the levels seen at the beginning of 2024, highlighting the sector’s overall growth.

Market Consolidation Seen as Healthy

Teng views the current decline as a natural and healthy consolidation for the market. Profit-taking by investors and a temporary pause in price action can help stabilize the ecosystem. “Any form of consolidation allows the industry to regroup and build on stronger foundations,” Teng stated, underlining the long-term benefits of temporary corrections.

Bitcoin Volatility Compared to Traditional Assets

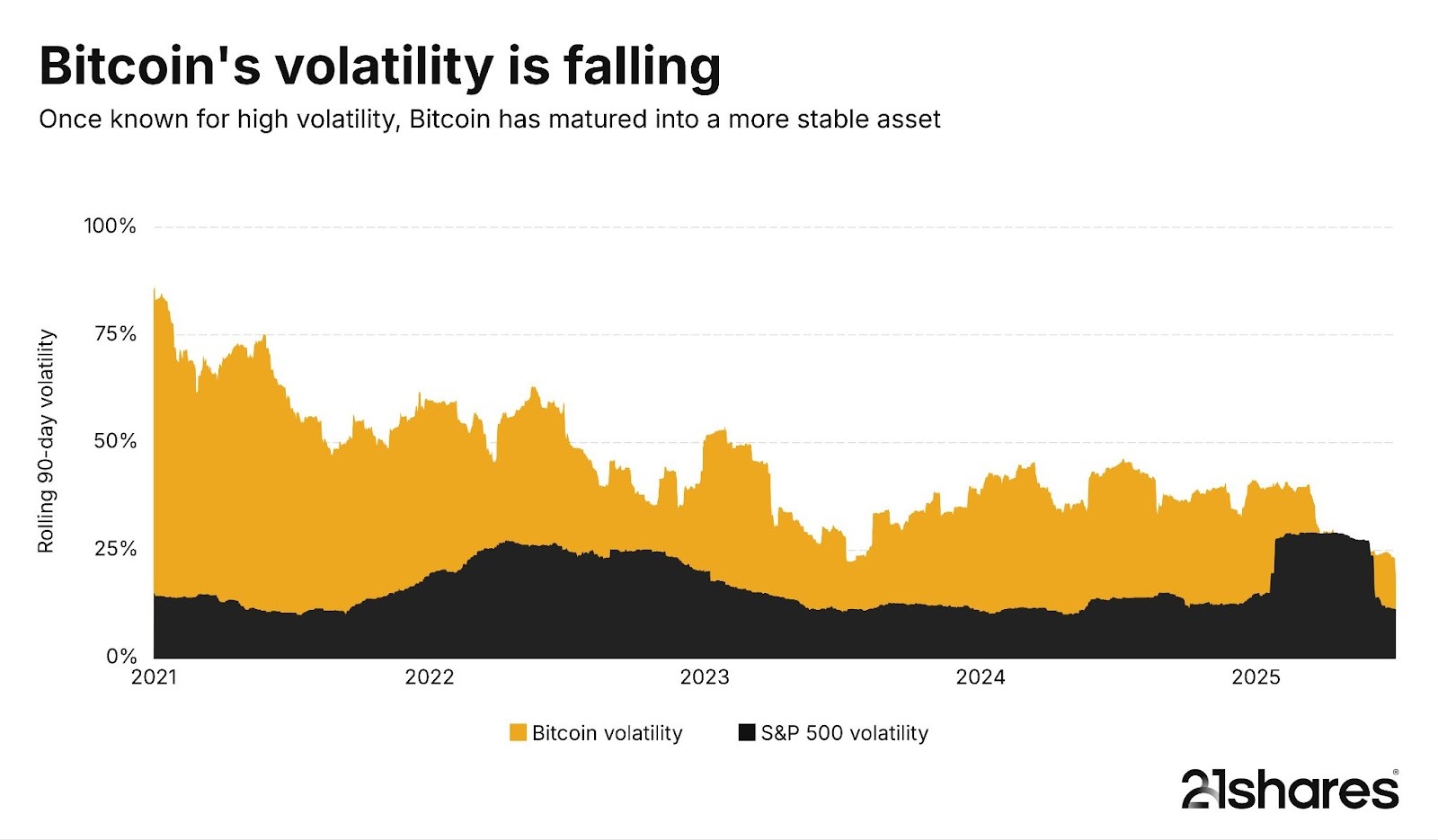

Contrary to the popular perception that Bitcoin is exceptionally volatile, Teng notes that its recent swings are comparable to movements in other major asset classes. In 2025, the 60-day BTC-USD volatility has ranged between 1% and 2.44% over short periods. This reflects a downward trend in Bitcoin’s historically extreme volatility, aided by growing adoption and increasing liquidity. While Bitcoin’s annualized volatility reached 181% in 2013, it has dropped to around 23% this year.

Interestingly, the S&P 500 briefly exceeded Bitcoin’s volatility during periods of extraordinary market turbulence in 2025. On average, however, the S&P 500 maintains volatility around 15%, while Bitcoin continues to show annualized volatility above 50%. Certain tech stocks, including Tesla (65%), AMD (73%), and Palantir (63%), demonstrate even higher volatility, though these are considered outliers in traditional finance.

Implications for Investors

Teng’s perspective suggests that Bitcoin’s recent decline is part of a broader, market-wide risk adjustment rather than a sector-specific crisis. Consolidation periods provide an opportunity for the cryptocurrency market to strengthen its foundations and allow investors to adapt to prevailing conditions. While Bitcoin remains volatile, historical trends indicate that its swings are gradually becoming more manageable as the market matures.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.