The Bank for International Settlements (BIS) has warned that the rapid expansion of cryptocurrencies and decentralized finance (DeFi) may increase financial instability and deepen the wealth gap.

A System Reaching Critical Mass

In its April 15, 2025 report, BIS noted that crypto and DeFi have reached “critical mass” in terms of capital and users, posing growing regulatory and economic concerns.

Stablecoins, in particular, have become essential to crypto value transfers. However, the report argues they need stricter rules to guarantee dollar redemptions during market stress.

Urging Stronger Regulation

BIS supports efforts like the STABLE Act passed in the U.S. House Financial Services Committee, which aims to enhance transparency and consumer protection in the stablecoin sector.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

The GENIUS Act, also mentioned, seeks to enforce collateral requirements and Anti-Money Laundering compliance among stablecoin issuers.

Rich Get Richer?

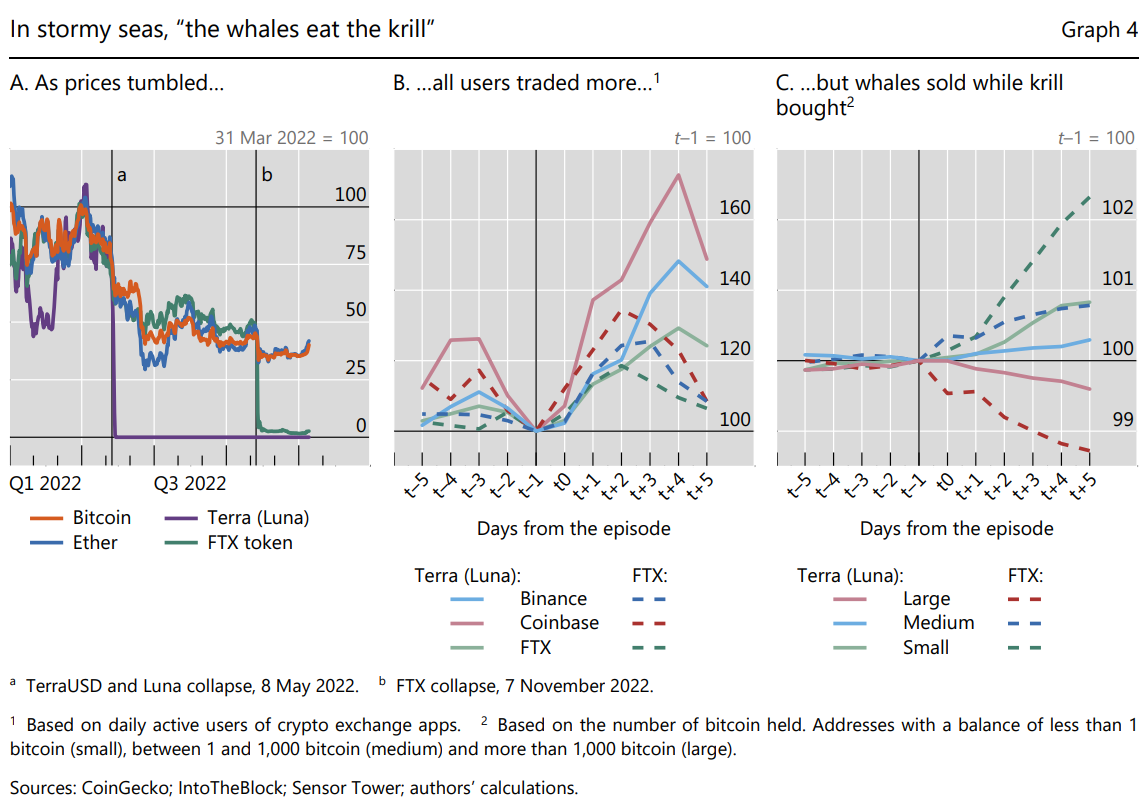

Citing events like the 2022 FTX collapse, BIS warned that crypto often functions as a wealth transfer mechanism from small investors to large holders (“whales”).

“Retail users were buying while whales were selling — this is not financial inclusion, it’s reverse redistribution,” the report said.

Though similar in economic function to TradFi, DeFi’s unique traits — like smart contracts and modular design — require proactive, specialized regulation to avoid systemic risks.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.