As the week draws to a close, crypto markets have entered a volatile phase. Bitcoin briefly dipped below the $116,373 support level last night, but quickly recovered and returned to the consolidation zone. Many analysts believe this dip was largely a manipulative move, and the price bouncing back into its prior range has offered renewed optimism for investors.

Bitcoin Key Levels

-

Support: $116,373

-

Resistance: $119,313

Currently trading around $117,511, Bitcoin is showing short-term bullish signals. The upcoming release of key macroeconomic data and developments related to ETFs may support a move toward the $119,313 resistance level.

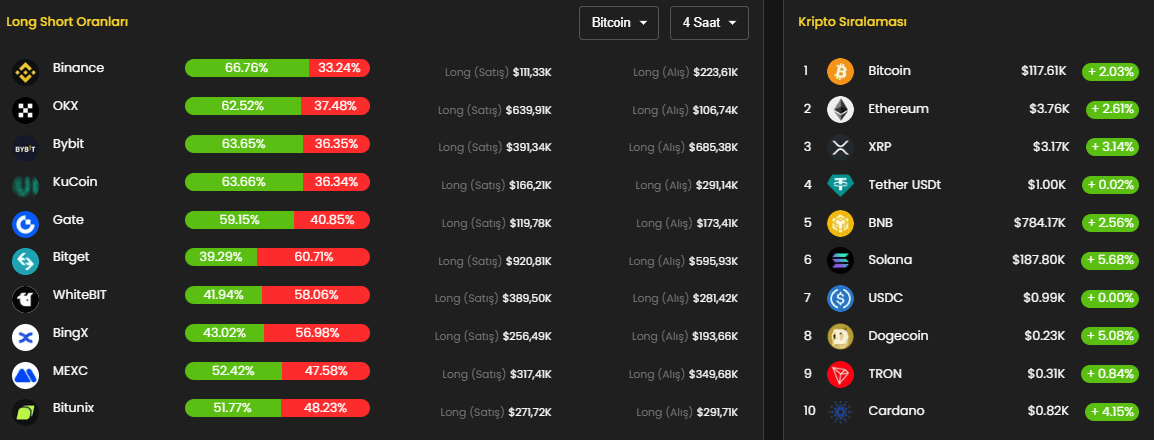

Long Positions Dominate the Market

Looking at long/short ratios across major exchanges, it’s clear that long positions are dominant. This reflects traders’ expectations for a short-term upward move. However, as always, caution is advised when engaging in high-leverage trades.

Ethereum and Altcoins Rebound

Ethereum rose by 1.68% in the last 24 hours to reach $3,753, marking a 5.40% weekly gain. This upward momentum has also spread to the broader altcoin market. Following yesterday’s sharp pullback, many strong altcoins quickly recovered and are now pushing back toward key resistance levels.

This content is for informational purposes only and does not constitute investment advice. Cryptocurrency markets involve significant risk, and you should always do your own research before making any investment decisions.

Feel free to share your thoughts on the topic in the comments. Additionally, you can follow us on Telegram, YouTube, and Twitter for more real-time news and updates.