According to Glassnode data, miner revenues are declining, while futures trading volume has peaked at $122 billion per day.

BTC is only 6% away from its all-time high of $111,700. Despite this surge, the network shows remarkable calmness, with a noticeable drop in transaction counts.

Bitcoin’s daily transactions, which reached 734,000 in 2023 and 2024, have decreased to between 320,000 and 500,000 daily since early 2025. The main reason for this decline is the reduction in non-monetary transactions related to Taproot and OP_RETURN. Monetary transactions have remained stable, with value transfers steady, while data-carrying transactions have nearly ceased.

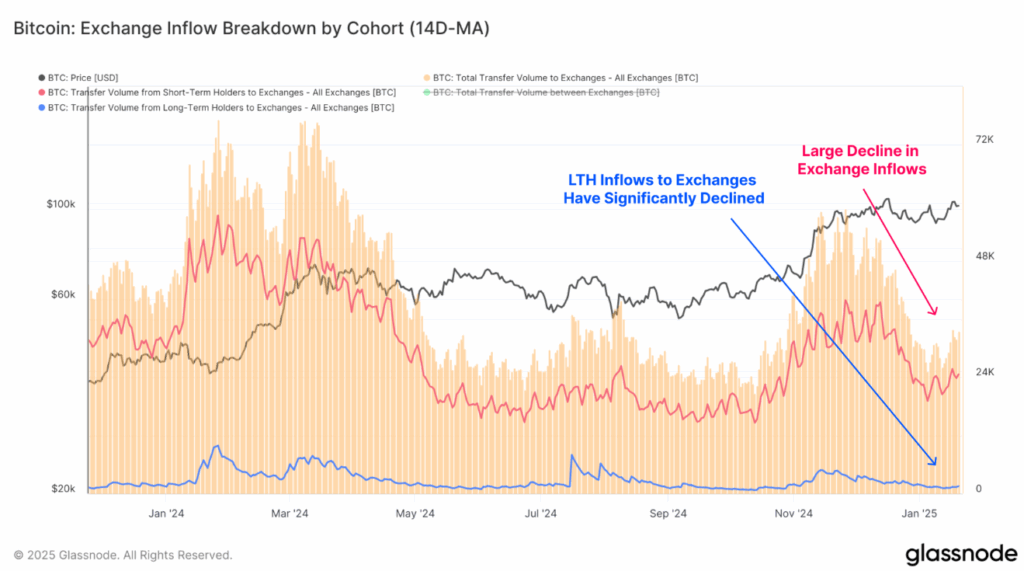

Big Investors Gain More Influence

Despite the drop in transaction counts, transaction volumes remain high. Daily average transaction volume is around $7.5 billion, with the average value per transaction reaching $36,200. This indicates fewer but larger transactions on the network.

Supporting this trend, transactions over $100,000 now account for 89% of the network volume, while those between $0-$100,000 have fallen to 11%. These figures clearly show large investors dominating on-chain activities.

Explosion of Off-Chain Market Volumes

Spot and derivatives markets play a critical role in BTC’s current dynamics. Centralized exchanges see an average daily spot volume of $10 billion. Futures trading volume reached $57 billion daily last year and hit a record $122 billion at peak.

Options markets have also grown, with daily average volumes reaching $2.4 billion and some days hitting $5 billion. All these figures reveal off-chain market activity is 7 to 16 times larger than on-chain volume.

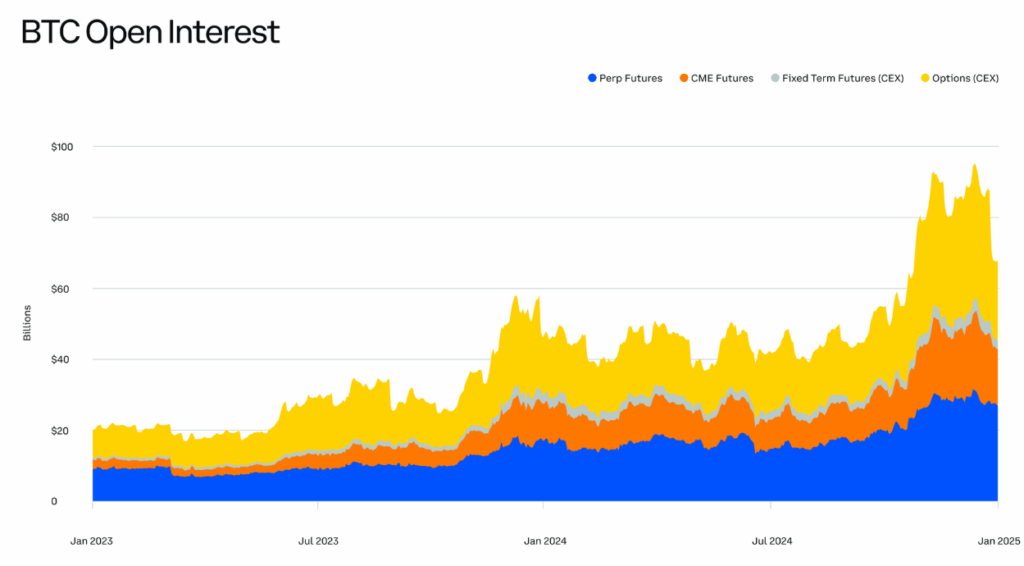

Leverage Increases, Risk Rises

Leverage levels in derivatives markets are rising. Total open interest stands at around $96.2 billion. Especially since the approval of spot Bitcoin ETFs in early 2024, leverage has increased further, bringing higher risk of sudden price swings. Open interest in futures surged from $7.7 billion to $52.8 billion, while options rose from $3.2 billion to $43.4 billion, pushing total derivatives open interest to $114 billion. This shows clear growth and rising investor interest in derivatives.

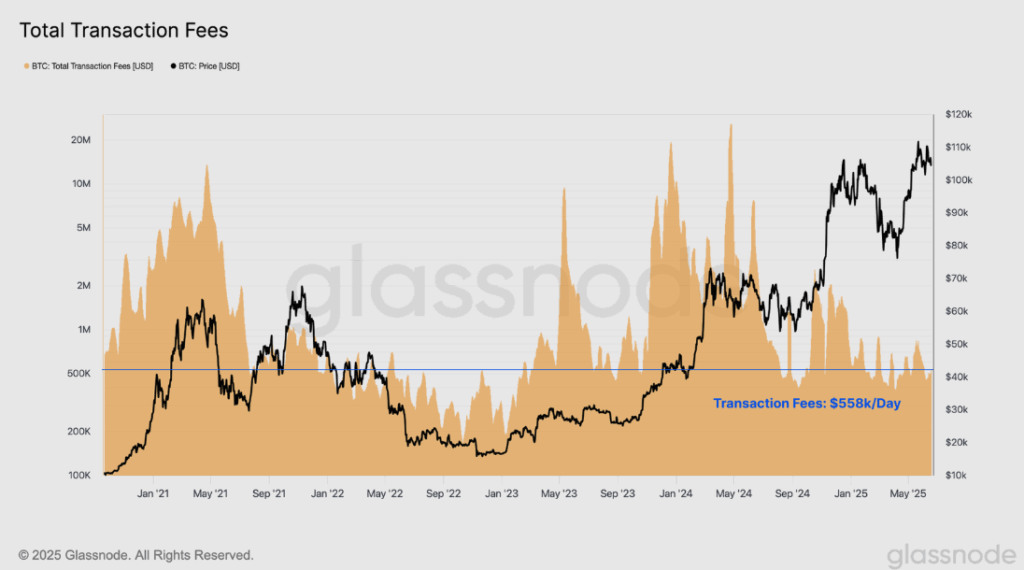

Meanwhile, miners’ income from transaction fees has dropped significantly, averaging only $558,000 daily in the last month. This decline indicates a notable decrease in block space demand, mirroring the general drop in transaction counts.

One notable development is the preference for stablecoin-collateralized positions over crypto-collateralized ones, signaling more cautious and sustainable risk management by investors.