Today, more than $6 billion worth of Bitcoin and Ethereum options expired, increasing volatility risks in the cryptocurrency market heading into the weekend.

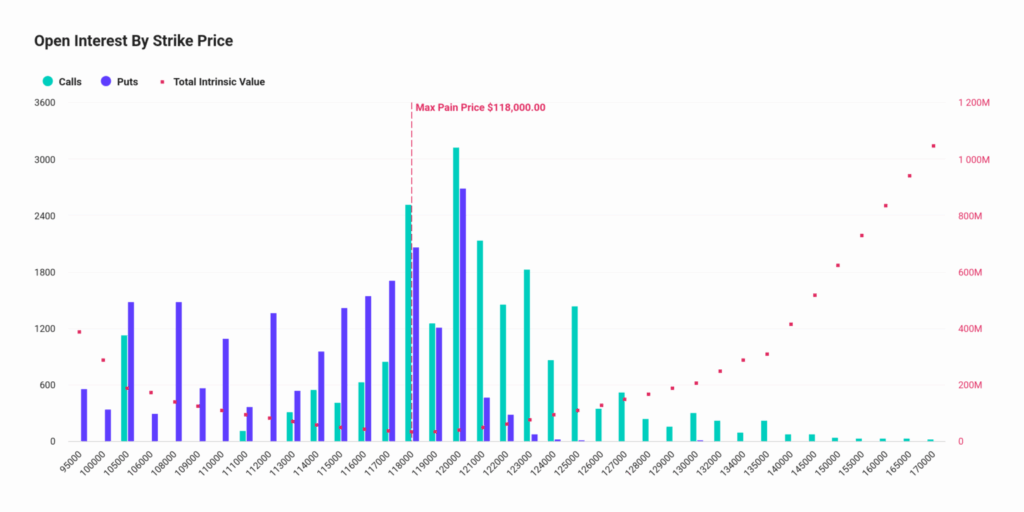

According to Deribit data, Bitcoin’s maximum pain point was set at $117,000. At the time of writing, BTC traded at $118,995. The put-call ratio for expiring Bitcoin options stood at 0.90, indicating more call positions than puts — a bullish signal. The nominal value of Bitcoin options reached $4.78 billion, with 40,185 open contracts.

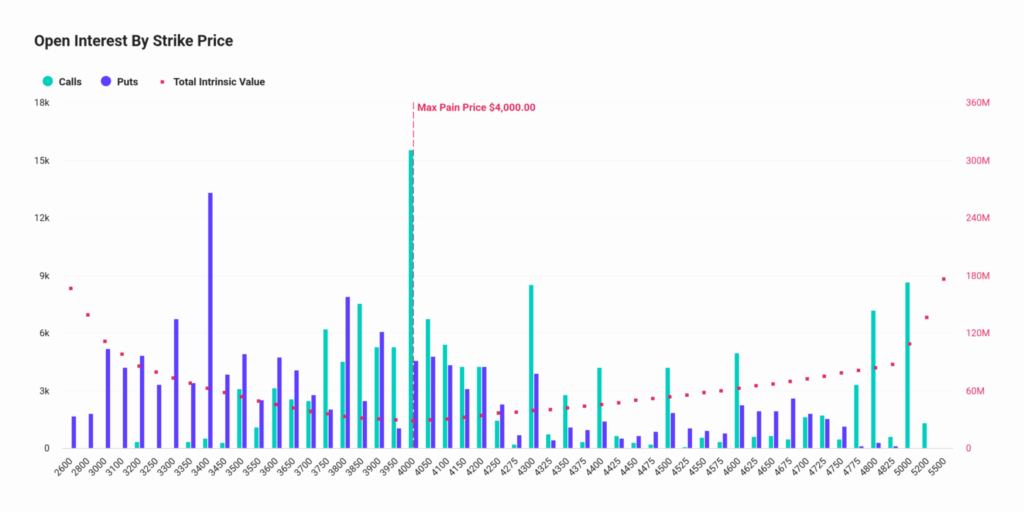

On the Ethereum side, the maximum pain point was $4,000, with ETH trading at $4,629. The put-call ratio came in at 1.02, showing a slight tilt toward put positions. Ethereum options had a nominal value of $1.33 billion and 287,946 open contracts.

Record-Breaking Options Volume, Diverging Market

Last week, $5 billion worth of options expired. This week, the figure exceeded $6 billion. Data from Greeks.live shows that the expiry followed a macro-driven market correction. PPI inflation hit 3.7%, the highest since March 2022, while core CPI rose above 3%. Despite this, implied volatility in the options market remained largely unchanged.

Deribit set a new daily record with $10.9 billion in trading volume, signaling sustained investor interest. Some analysts warned that Bitcoin could peak near $122,000 and Ethereum close to $4,700. Heavy open interest and record volumes increase the likelihood of prices moving toward maximum pain levels.

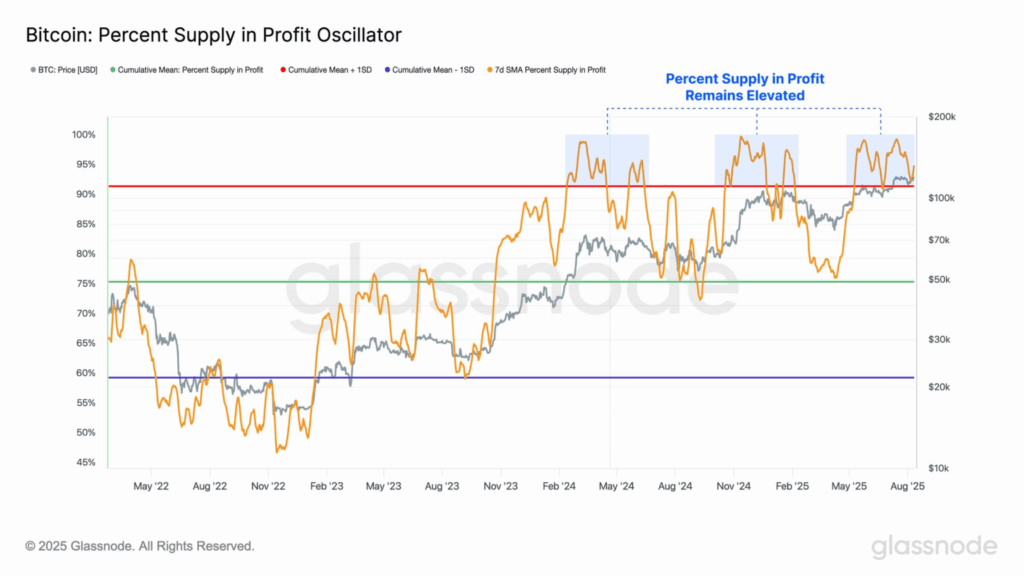

Glassnode data revealed that when Bitcoin reached a new all-time high, the profitable BTC supply surged to 99%. This figure was around 95% before the July correction and has never dropped below the cumulative average of 92% plus one standard deviation.

Over the weekend, price action will determine whether bullish momentum continues or profit-taking triggers a pullback.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.