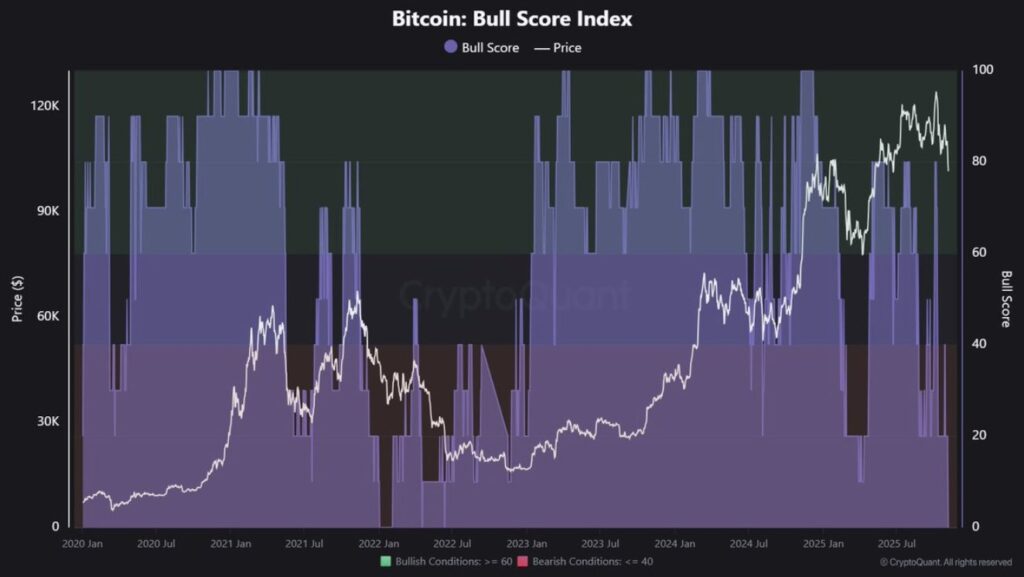

Bitcoin (BTC) Bull Score Index has dropped to zero for the first time since June 2022, signaling a sharp cooling in market momentum. Analysts say this does not necessarily indicate the start of a bear market, but rather a fatigue phase within an extended bull cycle.

Critical Bitcoin Support Levels Under Pressure

Bitcoin has fallen below the $100,000 level, moving closer to key support zones closely monitored by traders. The 365-day moving average, on-chain realized price bands and network valuation price are now seen as major reference points. If the price stays below these levels, selling pressure could intensify.

On-Chain Indicators Turn Bearish

According to CryptoQuant, all 10 major on-chain indicators—including MVRV, ETF inflows, stablecoin liquidity, demand growth and trader margins—are currently trending below their baseline. ETF and institutional inflows have slowed, long-term holders (LTH) continue selling and stablecoin liquidity is tightening.

Key metrics to watch include:

-

365-Day Moving Average (MA): Around $102K, major support.

-

Traders’ On-chain Realized Price: Lower band at $72K, indicating short-term downside potential.

-

Network Valuation Price (Metcalfe 2×): Support sits near $91K.

-

Bull Score Index: Fell to 0, signaling extremely weak bullish strength.

These levels are being closely monitored to assess market momentum and possible correction risks.

Analyst Outlook: Pause, Not Panic

CryptoQuant analysts argue this decline is more likely the exhaustion phase of a prolonged bull market rather than the start of a new bear cycle. However, they warn that if Bitcoin fails to recover above the 365-day MA soon, a deeper correction could follow.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.