Digital asset manager Grayscale has highlighted that Bitcoin lagged behind other cryptocurrencies during the third quarter of 2025, describing the period as a unique form of “altcoin season” that stands apart from previous cycles.

Comparing Bitcoin, Ether, and Other Market Segments

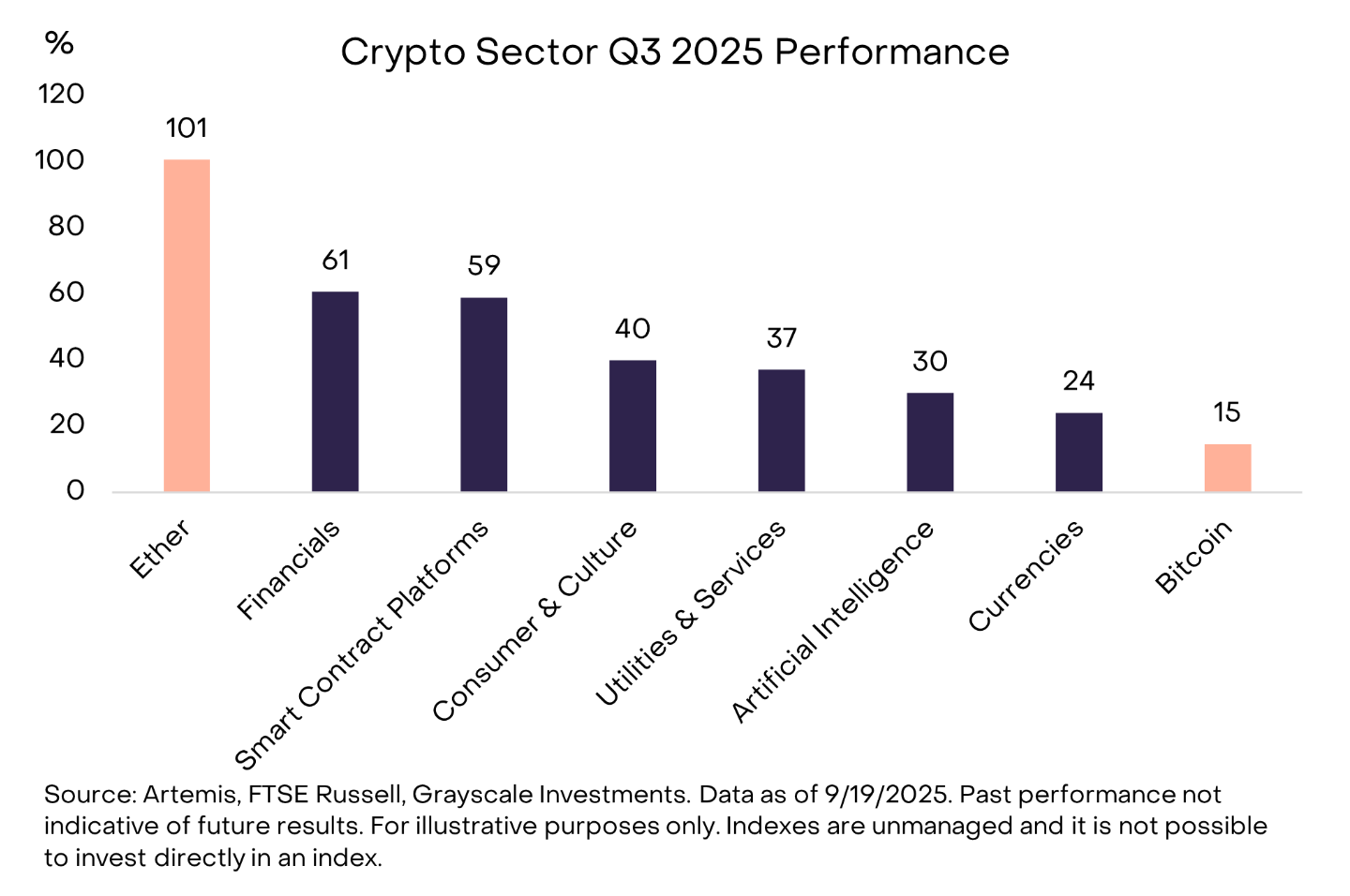

According to Grayscale’s latest report, Q3 delivered positive returns across major crypto sectors, including Bitcoin, Ether, AI-focused projects, and smart contract ecosystems. Yet, in terms of performance, Bitcoin trailed its peers.

Smart contract platforms particularly benefited from the passage of a stablecoin bill in the United States in July, while AI-related projects, Bitcoin, and other digital currencies did not gain the same level of momentum.

A Distinct Type of Alt Season

The report suggested that Bitcoin’s underperformance, combined with the strength shown by other sectors, makes Q3 resemble an “altcoin season.” However, it emphasized that this version of alt season was different from previous ones, where Bitcoin’s dominance typically dropped in a more traditional pattern.

Expanding Treasuries and Stablecoin Adoption

Another key takeaway from the report was the diversification of crypto treasuries. More organizations are adding a variety of tokens to their balance sheets. In the U.S., stablecoin adoption has been accelerating, while trading volumes on centralized exchanges have also climbed.

Grayscale noted that pending legislation in Congress on digital asset market structures could further influence market behavior as the year progresses into Q4.

Bitcoin’s Strong Rally but Relative Weakness

Despite a major rally that saw Bitcoin surpass $120,000 in August, its growth lagged when compared to other digital assets.

Research indicated that both Bitcoin and altcoins trailed behind gold and equities in terms of setting new all-time highs. One contributing factor was the outflow of stablecoins from exchanges, which dampened liquidity.

Optimism Surrounding Crypto ETFs

As a leader in digital asset investment products, Grayscale continues to play a pivotal role in the exchange-traded funds (ETF) market. The firm highlighted that the U.S. Securities and Exchange Commission’s (SEC) recent approval of new listing standards for crypto ETFs could help drive market growth in Q4.

The regulator’s green light for a multi-asset ETF — offering exposure to BTC, ETH, XRP, Solana, and Cardano — has also boosted investor sentiment, adding to the positive outlook.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.