Crypto markets are facing a critical moment today as over $5 billion worth of Bitcoin (BTC) and Ethereum (ETH) options reach expiry. This high-value expiry is expected to trigger notable price swings, especially during European trading hours.

Bitcoin’s max pain level stands at $108,000, while Ethereum’s is at $2,600. These price levels could act as gravitational zones as contracts settle. However, any price drop may be temporary, as markets often stabilize quickly after large expiries.

BTC and ETH Options Show Balanced Market Sentiment

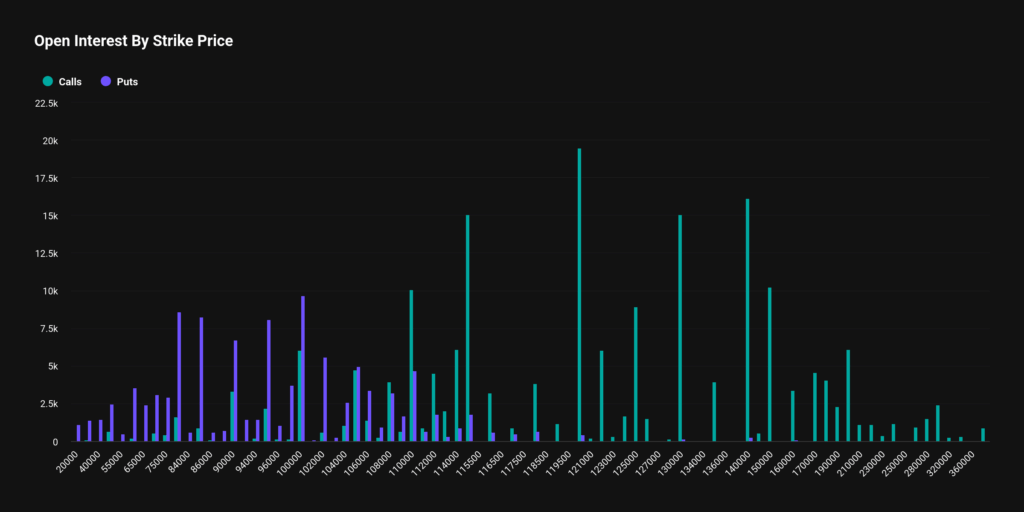

Data from Deribit reveals that Bitcoin options expiring today hold a notional value of $4.3 billion, with 36,970 contracts open. The Put/Call ratio (PCR) stands at 1.06, indicating slightly more sell positions than buy ones.

Ethereum options set to expire are worth $712.35 million, covering 239,926 contracts. ETH also shows a Put/Call ratio of 1.11, which reflects a cautious but not overly bearish market stance.

For context, last week’s expiry on July 4 totaled $3.6 billion, with 27,384 BTC and 237,274 ETH contracts. Today’s figures mark a significant increase in notional value for both assets. Notably, both weeks shared Put/Call ratios above 1, showing that investors remain hedged or unsure about short-term market direction.

Leverage Spikes as Risk Appetite Grows

Analysts at Greeks.live report a lack of consensus on direction, with traders relying heavily on news-driven setups. The platform noted extremely risky trades, including 500x leveraged positions, being opened near current price levels.

“Traders are taking massive risks with high-confidence setups,” Greeks.live noted. These strategies may offer outsized returns but also expose investors to sudden, steep losses.

As of this writing, Bitcoin is trading at $118,823, having set a new all-time high (ATH). Meanwhile, Ethereum stands at $3000, after a strong 7% intraday gain. Both are well above their respective max pain points.

While a pullback toward these pain levels is possible as expiry approaches, a complete drop to $108K or $2,600 is unlikely. Still, short-term volatility could impact both retail and institutional strategies.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.