The crypto markets saw another major milestone with massive spot ETF investments. On Thursday, Bitcoin and Ether-based funds attracted significant inflows. This marked the second-largest daily net inflow since the launch of these funds.

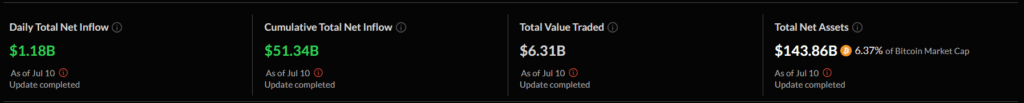

According to Farside Investors, U.S. spot Bitcoin ETFs saw total inflows of $1.17 billion on Thursday. The largest share came from BlackRock’s iShares Bitcoin Trust ETF (IBIT), which led the pack with $448 million in net inflows.

Fidelity’s Wise Origin Bitcoin Fund followed closely, attracting $324 million on the same day. The strong momentum came just as Bitcoin surged past $113,800, setting a new all-time high. Moreover, the rally continued into Friday.

These inflows ranked second only to the $1.37 billion recorded on November 7, 2024, after Donald Trump won the U.S. presidential election.

BlackRock’s Ether ETF Sets New Daily Inflow Record

Ether-based ETFs saw total net inflows of $383.1 million on Thursday, marking the second-largest daily intake in their history.

The bulk of these investments went into BlackRock’s iShares Ethereum Trust ETF (ETHA). With $300.9 million in net inflows, ETHA set a new record for the highest daily entry ever recorded for an Ether ETF.

Meanwhile, investor interest extended beyond price movements. According to Galaxy Research, U.S.-based Bitcoin ETFs have purchased a total of $28.22 billion worth of BTC in 2025 so far. In contrast, Bitcoin miners produced only $7.85 billion in new supply during the same period. Bitcoin demand has exceeded new issuance, creating potential scarcity in the market.

Investor Demand Grows Despite Platform Barriers

Nate Geraci, President of NovaDius Wealth Management, highlighted a key point in a post on Friday. He noted that traditional financial advisors remain cautious.

“Major platforms like Vanguard still restrict access to these ETFs, yet investors are finding ways,” Geraci wrote, emphasizing the scale of the inflows.

On the Ethereum side, supply metrics also show key signals. According to Ultra Sound Money, ETH net issuance hit 2,110 ETH in the last 24 hours, equivalent to roughly $6.33 million.

But the $383.1 million that flowed into Ether ETFs far exceeded that number, again raising concerns about supply-demand imbalances.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.