Nearly $6 billion worth of Bitcoin and Ethereum options are expiring today, adding pressure to already fragile crypto markets. Bitcoin hovers around $109,000, while traders boost short-term bearish positioning amid rising macro and political uncertainty. More than $1.15 billion has flowed into short-dated put options as investors brace for further downside.

Options Market Turns Sharply Bearish

Data from Deribit shows total open interest in Bitcoin options at 43,905 BTC, representing a notional value above $4.79 billion. The put-to-call ratio stands at 0.83, signaling stronger demand for downside protection.

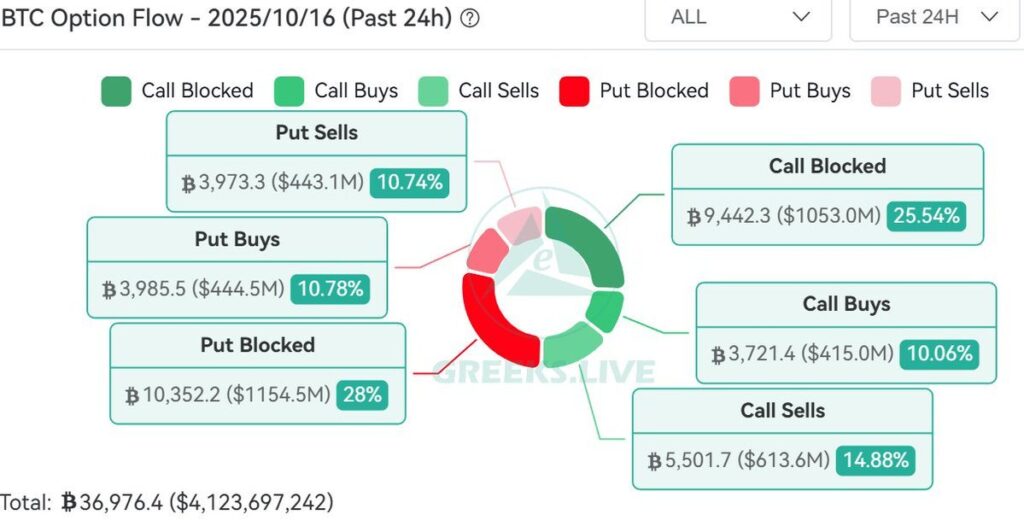

The max pain point — the strike level where most options expire worthless — sits near $116,000, suggesting traders expect limited short-term upside. According to Greeks.Live, short-term out-of-the-money (OTM) puts now account for roughly 28% of total options volume, reflecting the market’s strongest defensive stance since the October 11 pullback.

The options skew has turned deeply negative, highlighting aggressive hedging activity by market makers and liquidity providers. The shift underscores a growing sense of caution across digital asset markets as political volatility, tariff fears, and ETF discounts weigh on risk appetite.

Ethereum Under Pressure After Selini Capital Loss

Ethereum trades near $3,921, hovering below its max pain level of $4,100. Open interest stands at 251,884 ETH, with a put-to-call ratio of 0.81, mirroring Bitcoin’s defensive positioning.

Market sentiment weakened further following reports that Selini Capital suffered a $50 million loss tied to an unwind of a failed basis trade. The fund’s distress has shaken confidence in the derivatives market, with traders citing concerns over IBIT’s discount and limited catalysts for a near-term rebound.

Amid growing uncertainty, some participants are cautiously selling puts near perceived bottoms—a contrarian strategy aiming to profit from potential rebounds. However, Asian session flows remain predominantly bearish, reflecting sustained selling pressure.

Key Levels and Market Outlook

Analysts are watching $93,500 as a potential bottom and $100,000 as a short-term recovery zone for Bitcoin. Despite minor relief rallies, the broader narrative remains defensive, with traders prioritizing hedging and risk management over bullish exposure.

With options skew deeply negative across maturities and macro sentiment deteriorating, the next decisive move in crypto could still lean to the downside. Unless political turbulence eases or Selini’s liquidity issues stabilize, volatility is likely to persist into the coming weeks.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.