The crypto market is experiencing a major derivatives event today as roughly $4 billion worth of Bitcoin (BTC) and Ethereum (ETH) options reach expiry. Both assets are trading below their maximum pain levels, which indicates potential losses for many call option holders. However, investors continue to maintain their positions, reflecting cautious optimism amid volatile market conditions.

Bitcoin Options Show Strong Call Bias

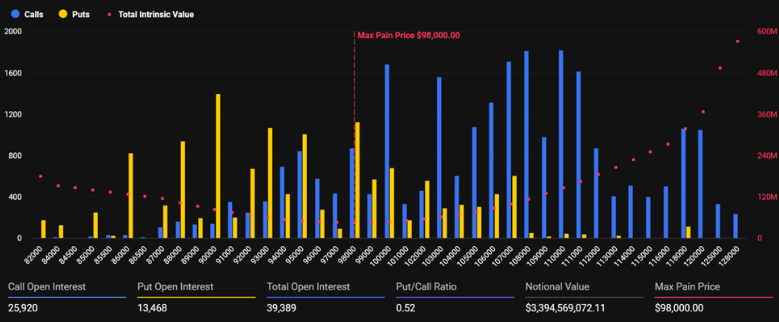

Bitcoin was trading at $84,195 at the time of writing, marking an 8.02% drop over the past 24 hours. As the expiry approaches, 39,389 BTC contracts worth $3.39 billion will mature, mostly consisting of call options. According to Deribit data, there are 25,920 call contracts versus 13,468 put contracts, giving a put-call ratio of 0.52. This shows that investors hold nearly twice as many bullish positions despite recent declines.

The maximum pain price for Bitcoin stands at $98,000, approximately 14% above the current trading level. Maximum pain refers to the strike price where most options would expire worthless, maximizing losses for holders. After reaching a peak of $126,080 on October 6, 2025, Bitcoin entered a corrective phase, coinciding with broader market weakness.

Ethereum Investors Focus on Upper Strike Calls

Ethereum has also declined, trading at $2,737 after a 6.98% drop over the last 24 hours. Today’s expiry covers 185,730 ETH contracts valued at $524 million, with 108,166 call and 77,564 put options. The put-call ratio of 0.72 indicates slightly weaker bullish sentiment compared to Bitcoin but still confirms continued preference for calls.

Investors are focused on strike levels around $2,900 and $3,100 for the December 2025 expiry. Ethereum’s maximum pain is $3,200, roughly 13% above the current price, implying that many options may expire worthless. However, the continued call positioning confirms that bullish sentiment remains intact.

Market Signals Reflect Cautious Optimism

The derivatives market structure reveals nuanced investor sentiment as expiry approaches. Despite recent declines, investors maintain significant call exposure and do not increase put protection. Deribit analysts noted, “Flows are biased toward calls at higher strikes while downside protection remains weak. Positioning does not indicate major risk avoidance, but investors remain cautious after the recent sharp decline.”

This suggests that the market views the recent drop as a routine correction rather than the start of a prolonged bear phase. High open interest, strong call bias, and low protection could allow short-term call holders to benefit if prices recover toward maximum pain levels. Conversely, further declines could increase losses for bullish positions and create additional selling pressure.

Key Takeaways:

-

Approximately $4 billion in BTC and ETH options expire today

-

Bitcoin call options maintain dominance despite recent drops

-

Ethereum holds call positions at upper strike levels

-

Maximum pain levels suggest potential losses for many option holders

-

Market continues to reflect cautious bullish sentiment

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.