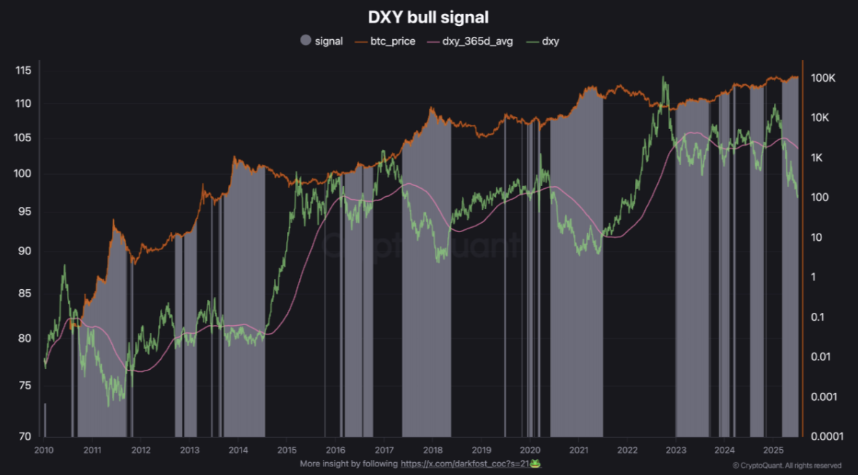

The US Dollar Index (DXY) has dropped to its weakest level in the last 21 years. It is now trading more than 6.5 points below its annual and 200-day moving averages. This indicates a significant depreciation of the dollar in recent months. Meanwhile, Bitcoin (BTC) is receiving bullish signals in response to this weakness.

Historical Weakness in DXY and Its Impact on Bitcoin

On July 1, 2025, the DXY fell to 96.377, a level not seen in over three years. According to CryptoQuant data, Bitcoin maintains an inverse correlation with the US Dollar Index. The DXY remaining below its 200-day moving average often creates upward momentum for BTC.

Darkfost highlights that despite US debt reaching an all-time high, the dollar fails to show strength. He notes this as the largest deviation in the last 21 years. However, such weakness tends to benefit risk assets like Bitcoin.

Historical data confirms that such periods have been highly favorable for BTC. Currently, DXY’s decline may set the stage for a new Bitcoin rally, although the price has not yet responded.

Historically, Bitcoin moves inversely to the dollar index. As the dollar weakens, investors tend to shift to alternative assets. This leads to changes in portfolio allocations, increasing demand for Bitcoin.

Current Correlation Status Between Bitcoin and DXY

So far, Bitcoin has not fully responded to the dollar’s historical weakness. However, chart patterns show that periods where DXY stays below its annual average are generally favorable for BTC, signaling potential for a future rally.

TradingView data shows that DXY has lost more than 10% of its value since the beginning of the year. Darkfost emphasizes that investors are turning away from the dollar as a safe haven and shifting capital toward risk assets.

“Looking at historical data, it becomes clear that such periods have been highly favorable to BTC. We are currently in a phase where the weakness of the DXY could fuel a new rise in BTC but the price didn’t react yet.”

Bitcoin’s inverse correlation with the dollar stands out as a critical element in the market. This trend continues as part of the broader risk-on asset narrative. As the dollar weakens, investors increasingly consider Bitcoin for their portfolios.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.