Bitcoin fell below $100,000 today, hitting an intraday low of $98,944. Investors reacted with shock. Many are asking, “How much is Bitcoin now, and why did it drop?” The decline follows a $730 billion drop in the US stock market, the prolonged federal government shutdown, and investors pulling back from risky assets. The crypto market is experiencing panic and heavy selling pressure.

Bitcoin and Ethereum Critical Levels

Corporate data shows that K33 Research reports the average cost basis of spot Bitcoin (BTC) ETFs in the US at roughly $89,613, about 11% below the current price. Investors view this as a critical technical support zone. (Sources: Bloomberg, K33 Research) BTC dropped to $98,944 during intraday trading, losing over 7% in 24 hours. This move tests key technical support levels.

Ethereum (ETH) fell about 14% to $3,089, marking its lowest level in four months. This highlights the volatility in the crypto market and investors’ withdrawal from risky assets.

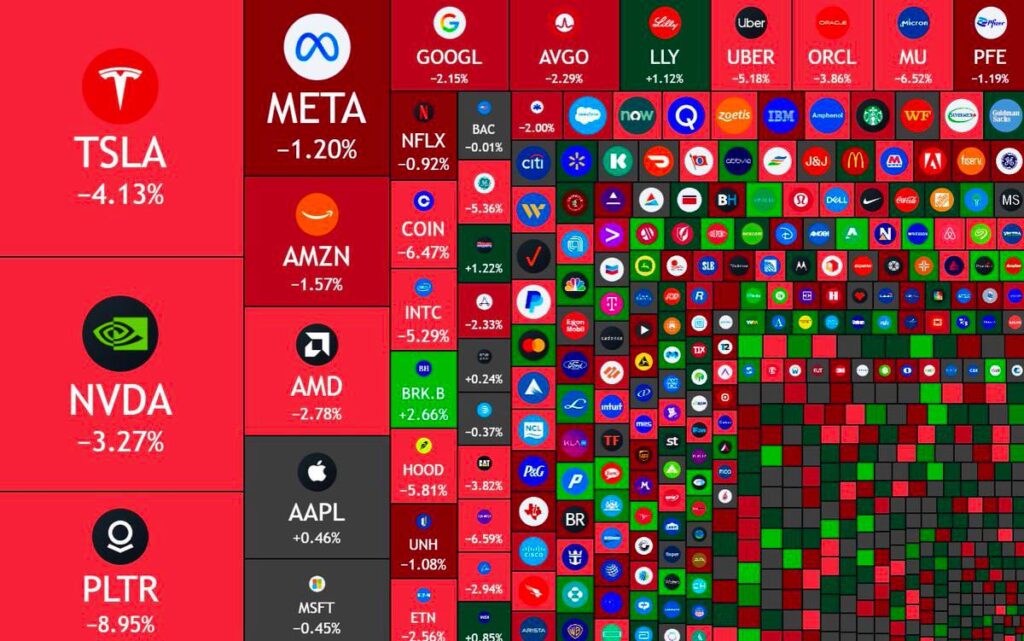

Historic Drop in the US Stock Market

The US equity market lost roughly $730 billion in total market value today. The S&P 500 and Nasdaq saw sharp declines. The federal government shutdown, which began on October 1, has created market uncertainty. Combined with liquidity concerns and investor anxiety, this intensified selling pressure in both stocks and crypto markets.

Bitcoin and Altcoin Market Overview

According to CoinMarketCap, the global crypto market started at $4.3 trillion on October 6, dropped to $3.9 trillion around October 10–12, and fell again to $3.35 trillion by November 1. The 24-hour trading volume reached $280.73 billion.

The Fear & Greed Index reads 27, indicating “Fear.” The Altcoin Season Index shows 25/100, with Bitcoin dominating altcoins. The CoinMarketCap 20 Index at 210.95 mirrors the general market trend, showing that major cryptocurrencies are moving in line with the overall market decline.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates