A sharp sell-off led by Bitcoin is unfolding in the cryptocurrency market. Rising macroeconomic uncertainties, steep losses in U.S. equities, and turmoil in the Japanese bond market have triggered a strong global risk-off mood. As investors move away from risky assets, the crypto market has also come under heavy selling pressure. As a result of these factors, Bitcoin fell below the $89,000 level, increasing short-term concerns.

Sharp Declines in Bitcoin and Ethereum

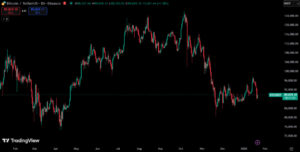

According to market data, Bitcoin dropped 4.2% over the last 24 hours, falling to as low as $88,746. The sharp pullback from around $92,500 earlier in the day clearly highlights the strength of the selling pressure. Rising volatility was accompanied by higher trading volumes, signaling that panic selling had also come into play.

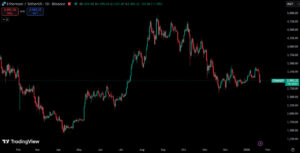

Ethereum (ETH) posted an even steeper move, losing 7.3% to fall to around $2,953. Bitcoin’s decline spread broadly across the altcoin market. Alongside Ethereum, major cryptocurrencies such as BNB, XRP, and Solana (SOL) fell between 4% and 7% during the day. Analysts say this picture shows a growing risk-off sentiment among investors, with selling not limited to isolated assets.

U.S. Stocks and Crypto-Related Shares Also Under Pressure

The sell-off in the crypto market mirrored sharp losses in U.S. equities. The S&P 500 and Nasdaq Composite closed down more than 2%, while the Dow Jones Industrial Average fell 1.76%. According to CNBC, this session marked the worst performance for all three major U.S. indices since October, underscoring the widespread exit from risk assets across global markets.

The selling wave directly impacted crypto-related stocks as well. Shares of crypto exchange Coinbase fell 5.6%, while stablecoin issuer Circle dropped 7.5%. Strategy, one of the largest corporate holders of Bitcoin, saw its shares decline 7.8%, and BitMine Immersion—known for its Ethereum treasury—fell 9.4%. Analysts note that these sharp drops once again highlight the strong correlation between the crypto ecosystem and traditional financial markets.

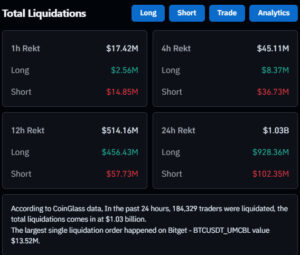

Liquidations Exceed $1 Billion

The sudden market downturn also triggered a massive wave of liquidations in derivatives markets. According to Coinglass data, approximately $1.03 billion in positions were liquidated over the past 24 hours, with around $929 million coming from long positions. Highly leveraged trades led to cascading liquidations amid the sharp price movements.

Vincent Liu, CIO of Kronos Research, commented on the drop:

“A risk-off macro environment and the unwinding of leveraged positions caused cascading liquidations. This put pressure on all risk assets, including crypto.”

Analysts point to sharp moves in the Japanese bond market as a key driver of the sell-off. Heavy bond selling pushed long-term Japanese government bond yields to some of their fastest increases in decades. According to Reuters, the 10-year Japanese bond yield rose by about 19 basis points over two days, while the 30-year yield recorded its sharpest daily jump since 2003.

Peter Chung, Head of Research at Presto Research, summarized the situation as follows:

“Last night, the ‘sell America’ trade kicked in. Stocks, bonds, the dollar, and Bitcoin fell, while gold rose. Panic spread from Japan.”

Macro Developments Weigh on Risk Appetite

Another major factor intensifying selling pressure is renewed trade tensions between the United States and the European Union. U.S. President Donald Trump’s renewed rhetoric on tariffs against Europe, combined with geopolitical statements, has strengthened perceptions of global uncertainty. These developments have prompted investors to adopt a more cautious stance toward risky assets.

At the same time, gold and silver prices hitting consecutive record highs indicate a growing shift toward safe-haven assets. According to experts, rising demand for precious metals shows that investors are seeking protection in an uncertain macro environment, reinforcing a global risk-off trend.

Key Bitcoin Levels Under Watch

Andri Fauzan Adziima, Head of Research at Bitrue, stated that investors are closely monitoring the $87,000–$88,000 range as a critical support zone for Bitcoin. A downside break below this area could open the door to a deeper pullback toward $85,000.

According to Adziima, investors will be closely watching:

- Macroeconomic data

- Signals from the Federal Reserve

- Geopolitical developments

- Leverage levels in derivatives markets

- ETF flows and institutional capital movements

Assessment

Bitcoin’s drop below $89,000 highlights just how strong the risk-off sentiment has become in global markets. Sharp declines in U.S. stocks, volatility in the Japanese bond market, and rising geopolitical uncertainty continue to weigh on the crypto market. While high volatility is expected to persist in the short term, investors are advised to closely monitor key support levels and macroeconomic developments.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.