The debate over the ultimate store of value intensified throughout 2025 as gold clearly outpaced Bitcoin. Over the course of the year, the Bitcoin–gold ratio dropped by nearly 50%, highlighting a significant shift in relative performance between the two assets. While Bitcoin continued to attract attention and maintain elevated price levels, gold dominated capital flows under the prevailing macroeconomic conditions.

This divergence reflects a changing investment landscape rather than a collapse in Bitcoin demand.

Where Does the Bitcoin–Gold Ratio Stand?

At the end of 2024, purchasing one Bitcoin required roughly 40 ounces of gold. By the final quarter of 2025, that figure had declined to approximately 20 ounces. The compression of this ratio illustrates how rapidly gold appreciated relative to Bitcoin during the year.

Importantly, this move does not suggest that Bitcoin lost its relevance as a store of value. Instead, 2025 introduced a pricing regime in which gold benefited disproportionately from macro-driven demand.

Why Gold Outperformed in 2025

Gold delivered a standout performance in 2025, rising 63% year-to-date and surpassing $4,000 per ounce in the fourth quarter. What made this rally unusual was its timing: it unfolded while monetary policy remained restrictive for most of the year.

The US Federal Reserve kept interest rates elevated and implemented its first rate cut only in September. Under normal circumstances, such conditions would weigh on non-yielding assets. However, gold defied this pattern, signaling a structural shift in demand dynamics.

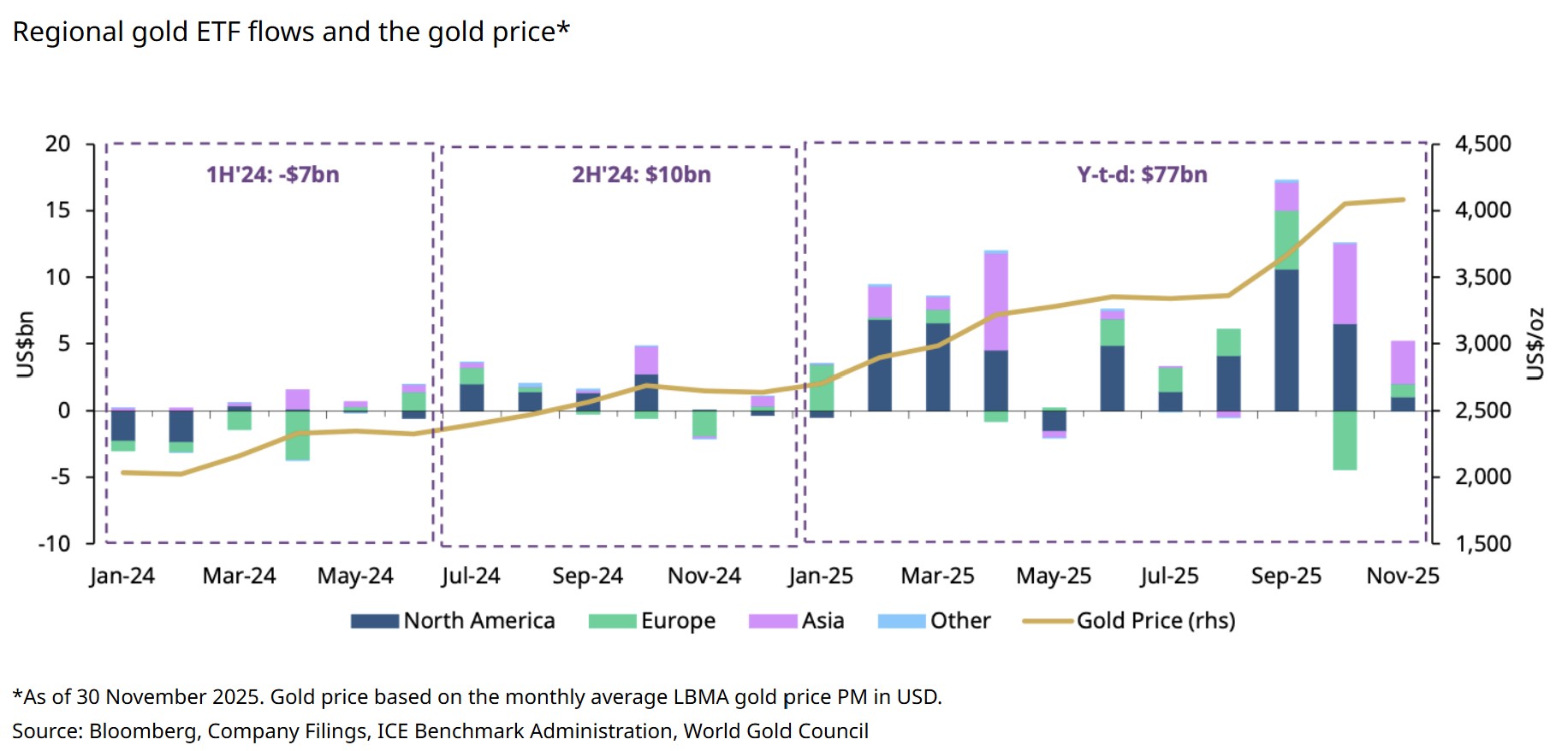

Central banks played a decisive role. Through October, official sector purchases totaled 254 tonnes, with the National Bank of Poland contributing 83 tonnes. At the same time, global gold ETFs recorded inflows of 397 tonnes in the first half of 2025, pushing total ETF holdings to a record 3,932 tonnes by November.

Rising geopolitical uncertainty further strengthened gold’s appeal. The VIX averaged 18.2 in 2025, while geopolitical risk indexes increased by 34% year-over-year, reinforcing gold’s role as a defensive asset.

Why Bitcoin Lagged on a Relative Basis

Bitcoin posted solid absolute gains in 2025, reaching six-figure price levels. However, momentum weakened during the second half of the year. Spot Bitcoin ETF assets under management rose from $120 billion in January to $152 billion in July, before declining to $112 billion over the following five months.

On-chain data also pointed to distribution. Long-term holders realized substantial profits throughout the year, with cumulative sales exceeding 500,000 BTC. In October alone, approximately 300,000 BTC changed hands, marking one of the most significant selling phases of the cycle.

A Cyclical Shift, Not a Structural Breakdown

The sharp decline in the Bitcoin–gold ratio reflects a temporary divergence driven by tight financial conditions, elevated uncertainty, and strong institutional demand for gold. Rather than undermining Bitcoin’s long-term narrative, the 2025 performance gap highlights how different macro environments can favor different store-of-value assets at different points in the cycle.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.