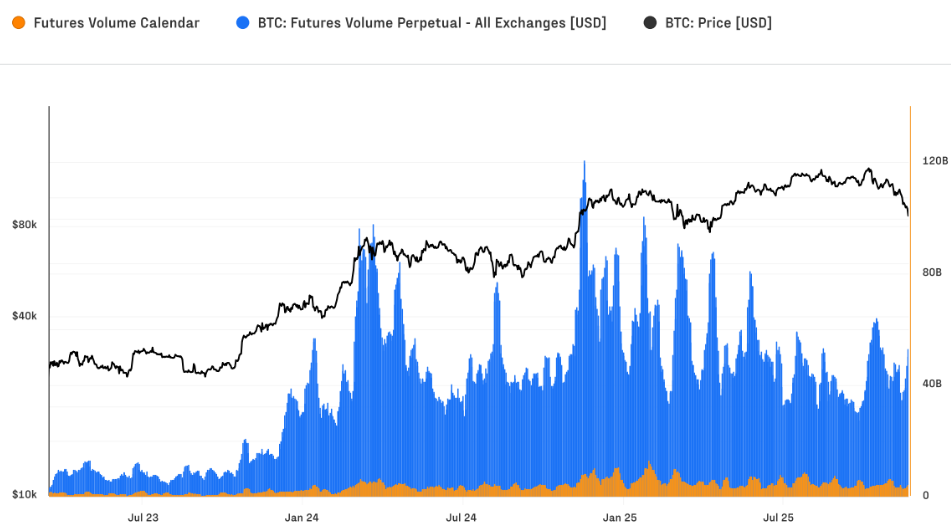

Bitcoin leveraged positions have surged, causing daily liquidations to nearly triple this cycle. According to Glassnode and Fasanara, open positions and trading volume in the futures market are rising, increasing investor exposure to risk. This trend indicates that the cryptocurrency market is now shaped more heavily by derivative instruments.

Leveraged Positions Trigger Record Liquidations

The report shows that daily futures liquidations have risen significantly compared to the previous cycle. Long positions, which averaged $28 million and short positions $15 million in the prior cycle, have climbed to $68 million and $45 million respectively in the current cycle.

During a sharp mid-October downturn, more than $640 million of long positions were liquidated within an hour. Bitcoin fell from $121,000 to $102,000, and open interest dropped from $49.5 billion to $38.8 billion, marking one of the fastest deleveraging events in Bitcoin history.

Futures vs. Spot Market Dynamics

Open interest in futures hit a record $67.9 billion, while daily trading volume reached $68.9 billion in mid-October, with perpetual contracts accounting for over 90% of activity. Spot market volumes also doubled from the previous cycle, ranging between $8 billion and $22 billion daily. Hourly spot volume peaked at $7.3 billion, showing that traders were buying the dip rather than panicking.

Glassnode notes that since the launch of US spot ETFs in early 2024, Bitcoin’s price discovery has shifted toward the cash market, with leverage increasingly concentrated in futures. This shift has helped Bitcoin’s market dominance rise from 38.7% in late 2022 to 58.3% today.

Institutional Investors and Bitcoin’s Network Power

The report highlights Bitcoin’s growing role as a settlement network rivaling Visa and Mastercard. In the past 90 days, the Bitcoin network processed $6.9 trillion in transfers. Institutional holdings are increasing, with approximately 6.7 million BTC held in ETFs, corporate treasuries, and centralized/decentralized vaults. Since early 2024, ETFs alone have absorbed 1.5 million BTC.

Key Bitcoin Metrics:

-

Daily futures liquidation: Long $68M, Short $45M

-

Futures open interest: $67.9B

-

Spot trading volume: $8–22B

-

Mid-October hourly spot peak: $7.3B

-

Bitcoin market dominance: 58.3%

-

90-day network transfer volume: $6.9T

-

BTC held by institutions: 6.7M

The combination of rising leverage and institutional interest is reshaping trading behavior and market cycles. These figures reflect a more mature and structurally robust cryptocurrency market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.