Bitcoin (BTC) has recently captured renewed attention. As of May 21, Bitcoin reached an all-time high of $111,860. This rise occurred in a calm and stable environment. Remarkably, despite hitting record prices, investors are not engaging in heavy profit-taking.

Why Is Bitcoin Not Facing Selling Pressure?

Glassnode analyzed this situation and pointed out that despite 100% supply profitability, investors remain cautious about selling their Bitcoin holdings. According to the platform, the total profit-taking volume at prices above $111,000 was around $1 billion. This figure is less than half of the $2.1 billion recorded when BTC first crossed $100,000 last December.

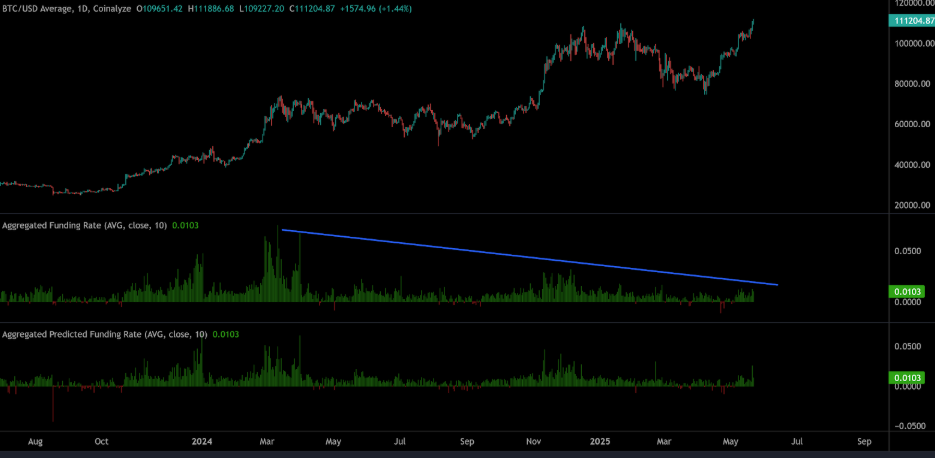

Funding rates indicate that Bitcoin’s current rally is healthy and organic. These rates were six times higher in Q1 and three times higher in Q4 of last year. The current low rates suggest minimal speculative activity in the futures market.

This means the rally is driven by real purchases in the spot market rather than leveraged trading. As a result, the risk of sudden and sharp corrections is reduced, offering a safer environment for investors.

Glassnode stated:

“Despite higher prices, profit realization was much more limited.”

This data shows that current investors remain patient and focused on the long term. At the same time, it supports the view that Bitcoin still holds strong upside potential. Analysts say Bitcoin’s rise is fueled by spot buying rather than leveraged positions, with futures funding rates remaining low, indicating restrained risk-taking and more organic price moves.

On the liquidity side, there is a noticeable increase in stablecoin supply. Moreover, the global M2 money supply growth points to a large cash reserve ready to be deployed in the market. All these factors support the idea that Bitcoin can continue rising.

Additionally, global liquidity trends continue to provide support for BTC. The global M2 money supply, which measures the total money circulating in major economies, grew by 5% in Q1 2025. This growth was influenced by monetary policy easing in the US, European Union, and Japan.

NOT INVESTMENT ADVICE

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.