The NFT market delivered an unexpected momentum shift in the opening weeks of the year. According to CryptoSlam data, total NFT sales volume jumped by %37 compared to the previous week, but the real change came from Bitcoin. At a time when the market was widely considered stagnant, the timing of this surge signals a notable structural break.

Weekly NFT sales climbed from $65.58 million to $88.29 million. This rise was not limited to volume alone. The number of buyers increased by %22.90 to 342,044, while sellers grew by %24.17 to 242,004. Total transactions also expanded by %10.54, reaching 937,495. The data suggests a broader participation recovery rather than isolated activity.

As Capital Shifts Toward Bitcoin, Market Balance Changes

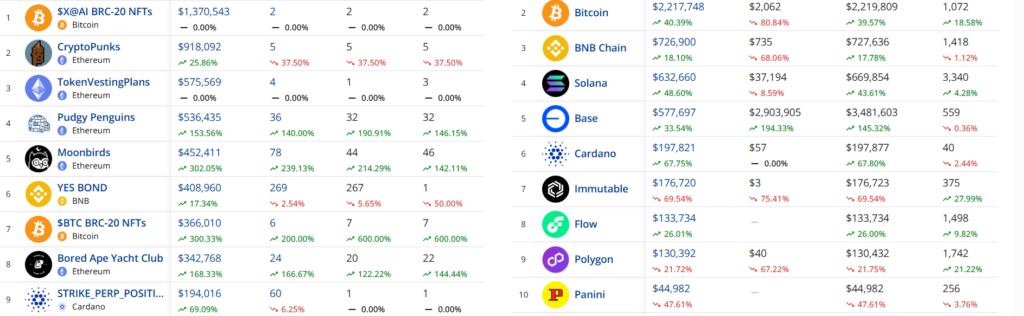

The most striking development of the week was Bitcoin overtaking Ethereum in NFT sales volume. Bitcoin-based NFT transactions reached $29.95 million, marking a sharp %144.41 increase week over week. Buyer participation on the network also rose by %25.29, indicating that the move was not driven by a single outlier alone.

Ethereum continued to grow, with sales volume rising by %39.08 to $27.57 million. However, this increase lagged behind Bitcoin’s acceleration. From a timing perspective, the divergence points to a short-term shift in risk preference among NFT participants.

$X@AI BRC-20 NFTs Redefined the Weekly Narrative

Bitcoin-based $X@AI BRC-20 NFTs became the dominant force behind the surge. The collection generated $23.14 million in weekly sales, reflecting an extraordinary %1,099.81 increase. Yet this figure masks a highly concentrated structure.

Only 12 transactions occurred, involving 12 buyers and 12 sellers. A single sale worth $17.13 million, completed four days ago, stood out as the largest NFT transaction of the week. This concentration raises questions about whether the spike reflects sustainable demand or a temporary liquidity event.

Established Collections Hold Ground but Lose Momentum

DMarket on the Mythos chain ranked second with $6.04 million in volume. Despite strong buyer and transaction counts, its growth pace remained limited. On BNB Chain, YES BOND climbed to $2.72 million, securing a top-three position, though activity was driven by just two sellers.

Ethereum-based CryptoPunks recorded $2.69 million in sales, while Pudgy Penguins returned to the top five with a %52 increase. In contrast, Polygon’s Courtyard collection fell sharply, posting a %56 decline and losing momentum.

Why It Matters

At first glance, the weekly jump suggests a renewed NFT market recovery. However, the distribution of activity tells a more cautious story. Bitcoin’s dominance was largely fueled by a small number of high-value trades, pointing to selective capital deployment rather than a broad-based bull phase.

Whether this concentration evolves into sustained demand or fades as a short-lived spike will become clearer in the coming weeks. For now, volume has risen—but the market’s true direction remains unresolved.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.